Washington Post 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.temporary, the Company will record a write-down, which is

included in earnings. The Company uses the average cost method

to determine the basis of the securities sold or reclassified out of

other comprehensive income.

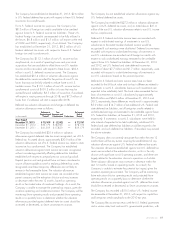

Fair Value Measurements. Fair value measurements are determined

based on the assumptions that a market participant would use in

pricing an asset or liability based on a three-tiered hierarchy that

draws a distinction between market participant assumptions based on

(i) observable inputs, such as quoted prices in active markets (Level 1);

(ii) inputs other than quoted prices in active markets that are

observable either directly or indirectly (Level 2); and (iii) unobservable

inputs that require the Company to use present value and other

valuation techniques in the determination of fair value (Level 3).

Financial assets and liabilities are classified in their entirety based on

the lowest level of input that is significant to the fair value measure.

The Company’s assessment of the significance of a particular input to

the fair value measurements requires judgment and may affect the

valuation of the assets and liabilities being measured and their

placement within the fair value hierarchy.

For assets that are measured using quoted prices in active markets,

the total fair value is the published market price per unit multiplied

by the number of units held, without consideration of transaction

costs. Assets and liabilities that are measured using significant other

observable inputs are primarily valued by reference to quoted prices

of similar assets or liabilities in active markets, adjusted for any

terms specific to that asset or liability.

The Company measures certain assets—including goodwill;

intangible assets; property, plant and equipment; cost and equity-

method investments—at fair value on a nonrecurring basis when

they are deemed to be impaired. The fair value of these assets is

determined with valuation techniques using the best information

available and may include quoted market prices, market

comparables and discounted cash flow models.

Fair Value of Financial Instruments. The carrying amounts reported

in the Company’s Consolidated Financial Statements for cash and

cash equivalents, restricted cash, accounts receivable, accounts

payable and accrued liabilities, the current portion of deferred

revenue and the current portion of debt approximate fair value

because of the short-term nature of these financial instruments. The

fair value of long-term debt is determined based on a number

of observable inputs, including the current market activity of the

Company’s publicly traded notes, trends in investor demands and

market values of comparable publicly traded debt. The fair value of

the interest rate hedge is determined based on a number of

observable inputs, including time to maturity and market interest

rates.

Inventories and Contracts in Progress. Inventories and contracts in

progress are stated at the lower of cost or realizable values and are

based on the first-in, first-out (FIFO) method.

Property, Plant and Equipment. Property, plant and equipment is

recorded at cost and includes interest capitalized in connection with

major long-term construction projects. Replacements and major

improvements are capitalized; maintenance and repairs are

expensed as incurred. Depreciation is calculated using the straight-

line method over the estimated useful lives of the property, plant and

equipment: 3 to 20 years for machinery and equipment; 20 to 50

years for buildings. The costs of leasehold improvements are

amortized over the lesser of their useful lives or the terms of the

respective leases.

The cable division capitalizes costs associated with the construction

of cable transmission and distribution facilities and new cable

service installations. Costs include all direct labor and materials, as

well as certain indirect costs. The cost of subsequent disconnects

and reconnects are expensed as they are incurred.

Evaluation of Long-Lived Assets. The recoverability of long-lived

assets and finite-lived intangible assets is assessed whenever adverse

events or changes in circumstances indicate that recorded values may

not be recoverable. A long-lived asset is considered to not be

recoverable when the undiscounted estimated future cash flows are

less than the asset’s recorded value. An impairment charge is

measured based on estimated fair market value, determined primarily

using estimated future cash flows on a discounted basis. Losses on

long-lived assets to be disposed of are determined in a similar

manner, but the fair market value would be reduced for estimated

costs to dispose.

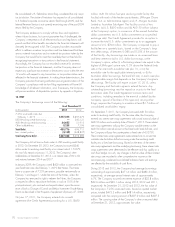

Goodwill and Other Intangible Assets. Goodwill is the excess of

purchase price over the fair value of identified net assets of businesses

acquired. The Company’s intangible assets with an indefinite life are

principally from franchise agreements at its cable division, as the

Company expects its cable franchise agreements to provide the

Company with substantial benefit for a period that extends beyond

the foreseeable horizon, and the Company’s cable division

historically has obtained renewals and extensions of such agreements

for nominal costs and without any material modifications to the

agreements. Amortized intangible assets are primarily student and

customer relationships and trade names and trademarks, with

amortization periods up to 10 years.

The Company reviews goodwill and indefinite-lived intangible

assets at least annually, as of November 30, for possible

impairment. Goodwill and indefinite-lived intangible assets are

reviewed for possible impairment between annual tests if an event

occurs or circumstances change that would more likely than not

reduce the fair value of the reporting unit or indefinite-lived

intangible asset below its carrying value. The Company tests its

goodwill at the reporting unit level, which is an operating segment

or one level below an operating segment. In reviewing the carrying

value of indefinite-lived intangible assets at the cable division, the

Company aggregates its cable systems on a regional basis. The

Company initially assesses qualitative factors to determine if it is

necessary to perform the two-step goodwill impairment review or

indefinite-lived intangible asset quantitative impairment review. The

Company reviews the goodwill for impairment using the two-step

process and the indefinite-lived intangible assets using the

quantitative process if, based on its assessment of the qualitative

factors, it determines that it is more likely than not that the fair value

of a reporting unit or indefinite-lived intangible asset is less than its

carrying value, or if it decides to bypass the qualitative assessment.

The Company reviews the carrying value of goodwill and indefinite-

lived intangible assets utilizing a discounted cash flow model, and,

2013 FORM 10-K 61