Washington Post 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

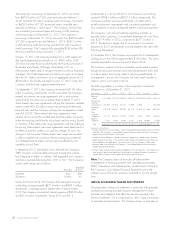

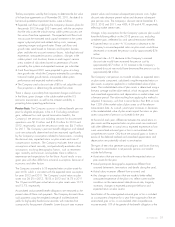

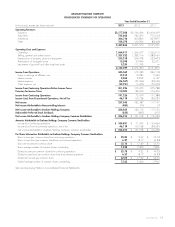

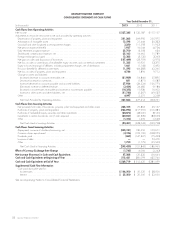

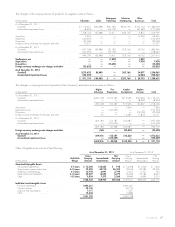

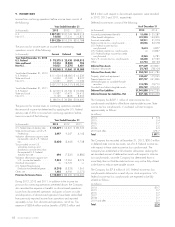

GRAHAM HOLDINGS COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31,

(in thousands) 2013 2012 2011

Cash Flows from Operating Activities

Net Income ..................................................................... $ 237,345 $ 132,187 $ 117,157

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation of property, plant and equipment .......................................... 251,262 269,992 255,975

Amortization of intangible assets .................................................... 13,598 21,444 30,333

Goodwill and other long-lived asset impairment charges ................................... 3,250 111,593 11,923

Net pension expense (benefit) ...................................................... 1,927 16,044 (4,726)

Early retirement program expense ................................................... 22,700 8,508 634

Stock-based compensation expense, net .............................................. 25,163 14,662 11,789

Foreign exchange loss (gain) ....................................................... 13,382 (3,132) 3,263

Net gain on sales and disposition of businesses ......................................... (157,449) (23,759) (2,975)

Net loss on sales or write-downs of marketable equity securities and cost method investments ........ 11,325 10,925 53,375

Equity in losses (earnings) of affiliates, including impairment charges, net of distributions ............ 1,661 (1,148) 5,492

Provision (benefit) for deferred income taxes ............................................ 11,595 (64,383) 42,265

Net loss on sales of property, plant and equipment ...................................... 4,746 1,896 9,712

Change in assets and liabilities:

(Increase) decrease in accounts receivable, net ........................................ (81,989) (14,846) 27,895

Decrease (increase) in inventories .................................................. 851 (1,871) (1,587)

Increase (decrease) in accounts payable and accrued liabilities ............................ 37,926 (34,224) (126,771)

(Decrease) increase in deferred revenue ............................................. (3,434) 24,482 (9,186)

(Increase) in income taxes receivable and increase in income taxes payable .................. (18,352) 11,936 16,002

Increase in other assets and other liabilities, net ....................................... (51,740) (5,367) (49,537)

Other ........................................................................ 4,097 2,275 2,258

Net Cash Provided by Operating Activities ........................................... 327,864 477,214 393,291

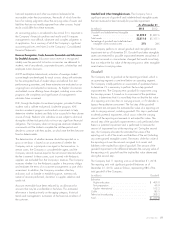

Cash Flows from Investing Activities

Net proceeds from sales of businesses, property, plant and equipment and other assets ............ 248,105 76,863 49,157

Purchases of property, plant and equipment ............................................ (224,093) (217,995) (216,381)

Purchases of marketable equity securities and other investments .............................. (28,073) (48,031) (8,165)

Investments in certain businesses, net of cash acquired .................................... (20,027) (40,339) (83,699)

Other ........................................................................ (1,313) 1,459 (1,640)

Net Cash Used in Investing Activities ............................................... (25,401) (228,043) (260,728)

Cash Flows from Financing Activities

(Repayment) issuance of short-term borrowing, net ........................................ (240,121) 130,450 109,671

Common shares repurchased ...................................................... (4,196) (103,196) (248,055)

Dividends paid ................................................................. (863) (147,327) (75,493)

Issuance of debt ................................................................ ——52,476

Other ........................................................................ 1,750 (1,772) (25,560)

Net Cash Used in Financing Activities .............................................. (243,430) (121,845) (186,961)

Effect of Currency Exchange Rate Change ........................................... (1,745) 4,006 (2,243)

Net Increase (Decrease) in Cash and Cash Equivalents .................................. 57,288 131,332 (56,641)

Cash and Cash Equivalents at Beginning of Year ...................................... 512,431 381,099 437,740

Cash and Cash Equivalents at End of Year ........................................... $ 569,719 $ 512,431 $ 381,099

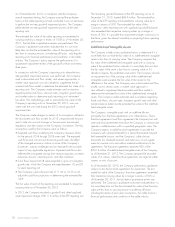

Supplemental Cash Flow Information

Cash paid during the year for:

Income taxes ................................................................ $ 144,500 $ 50,531 $ 38,500

Interest ..................................................................... $ 35,500 $ 35,500 $ 32,650

See accompanying Notes to Consolidated Financial Statements.

58 GRAHAM HOLDINGS COMPANY