Washington Post 2013 Annual Report Download - page 101

Download and view the complete annual report

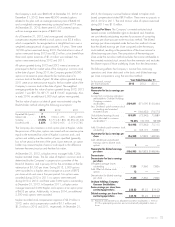

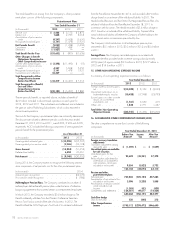

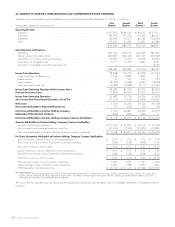

Please find page 101 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.KHE incurred restructuring costs of $19.5 million, $23.4 million

and $13.2 million in 2013, 2012 and 2011, respectively,

primarily from accelerated depreciation and severance and lease

obligations. In 2013 and 2012, these costs were incurred in

connection with a plan announced in September 2012 for KHE to

close or consolidate operations at 13 ground campuses, along with

plans to consolidate facilities and reduce workforce at its online

programs. The 2011 costs were primarily severance costs from

workforce reduction programs.

Kaplan International incurred restructuring costs of $5.8 million,

$16.4 million and $1.0 million in 2013, 2012 and 2011,

respectively. These restructuring costs were largely in Australia,

where Kaplan is consolidating and restructuring its businesses, and

included lease obligations, accelerated depreciation and severance

charges.

In 2010, KTP began implementing a plan to reorganize its business

consistent with the migration of students to Kaplan’s online and

hybrid test preparation offerings, reducing the number of leased test

preparation centers. In 2011, implementation of the plan was

completed and $12.5 million in lease and severance obligations

and accelerated depreciation was recorded.

Total accrued restructuring costs at Kaplan were $17.6 million at

the end of each of 2013 and 2012.

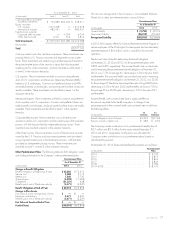

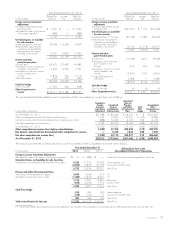

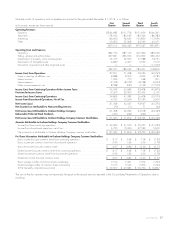

In the second quarter of 2012, Kaplan International results

benefited from a favorable $3.9 million out of period expense

adjustment related to certain items in 2011 and 2010. With

respect to this out of period expense adjustment, the Company has

concluded that it was not material to the Company’s financial

position or results of operations for 2013, 2012 and 2011 and the

related interim periods, based on its consideration of quantitative

and qualitative factors.

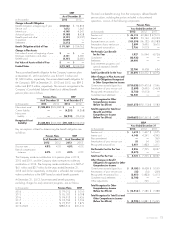

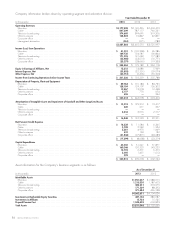

Cable. Cable operations consist of cable systems offering video,

Internet, phone and other services to subscribers in midwestern,

western and southern states. The principal source of revenue is

monthly subscription fees charged for services.

Television Broadcasting. Television broadcasting operations are

conducted through six VHF television stations serving the Detroit,

Houston, Miami, San Antonio, Orlando and Jacksonville television

markets. All stations are network-affiliated (except for WJXT in

Jacksonville), with revenues derived primarily from sales of

advertising time.

Other Businesses. Other businesses includes the results of SocialCode,

a marketing solutions provider helping companies with marketing on

social-media platforms; Celtic Healthcare, a provider of home health

and hospice services in the northeastern and mid-Atlantic regions,

acquired by the Company in November 2012; Forney, a global

supplier of products and systems that control and monitor combustion

processes in electric utility and industrial applications, acquired by the

Company in August 2013; and Trove, a digital team focused on

emerging technologies and new product development. Also included

are The Slate Group and FP Group, previously included as part of the

Company’s newspaper publishing division, which publish online and

print magazines and websites.

Corporate Office. Corporate office includes the expenses of the

Company’s corporate office and a net pension credit.

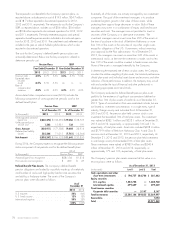

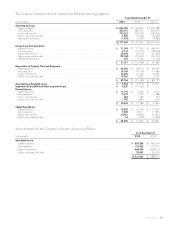

Geographical Information. The Company’s non-U.S. revenues in

2013, 2012 and 2011 totaled approximately $672 million,

$644 million and $594 million, respectively, primarily from

Kaplan’s operations outside the U.S. The Company’s long-lived

assets in non-U.S. countries (excluding goodwill and other

intangible assets), totaled approximately $66 million and $58

million at December 31, 2013 and 2012, respectively.

2013 FORM 10-K 83