Washington Post 2013 Annual Report Download - page 78

Download and view the complete annual report

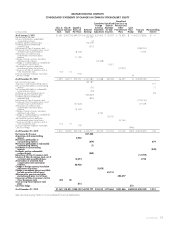

Please find page 78 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GRAHAM HOLDINGS COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION AND NATURE OF OPERATIONS

Graham Holdings Company (the Company), formerly The

Washington Post Company, is a diversified education and media

company. The Company’s Kaplan subsidiary provides a wide

variety of educational services, both domestically and outside the

United States. The Company’s media operations comprise the

ownership and operation of cable systems and television broad-

casting (through the ownership and operation of six television

broadcast stations).

On October 1, 2013, the Company completed the sale of most of

its newspaper publishing businesses, including The Washington

Post. The operating results of these businesses have been presented

in income (loss) from discontinued operations, net of tax, for all

periods presented.

Education—Kaplan, Inc. provides an extensive range of educational

services for students and professionals. Kaplan’s various businesses

comprise three categories: Higher Education, Test Preparation and

Kaplan International.

Media—The Company’s diversified media operations comprise

cable operations, television broadcasting, and several websites and

print publications.

Cable. Cable ONE provides cable services that include video,

high-speed data and telephone service in the midwestern, western

and southern states of the United States.

Television broadcasting. The Company owns six VHF television

stations located in Houston, TX; Detroit, MI; Miami, FL; Orlando, FL;

San Antonio, TX; and Jacksonville, FL. Other than the Company’s

Jacksonville station, WJXT, the Company’s television stations are

affiliated with one of the major national networks.

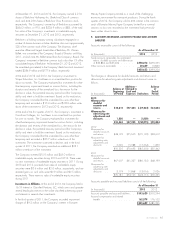

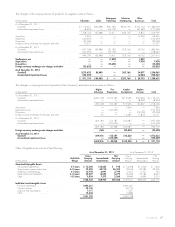

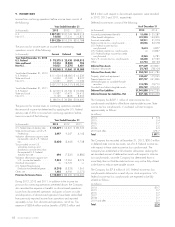

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Principles of Consolidation. The

accompanying Consolidated Financial Statements have been

prepared in accordance with generally accepted accounting

principles (GAAP) in the United States and include the assets,

liabilities, results of operations and cash flows of the Company and

its majority-owned and controlled subsidiaries. All significant

intercompany accounts and transactions have been eliminated in

consolidation.

Reclassifications. Certain amounts in previously issued financial

statements have been reclassified to conform with the 2013

presentation, which includes the reclassification of the results of

operations of certain businesses as discontinued operations for all

periods presented.

Use of Estimates. The preparation of financial statements in

conformity with GAAP requires management to make estimates and

judgments that affect the amounts reported in the financial

statements. Management bases its estimates and assumptions on

historical experience and on various other factors that are believed

to be reasonable under the circumstances. Due to the inherent

uncertainty involved in making estimates, actual results reported in

future periods may be affected by changes in those estimates. On

an ongoing basis, the Company evaluates its estimates and

assumptions.

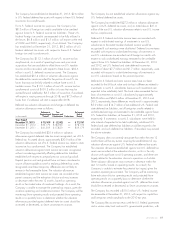

Business Combinations. The purchase price of an acquisition is

allocated to the assets acquired, including intangible assets, and

liabilities assumed, based on their respective fair values at the

acquisition date. Acquisition-related costs are expensed as incurred.

The excess of the cost of an acquired entity over the net of the

amounts assigned to the assets acquired and liabilities assumed is

recognized as goodwill. The net assets and results of operations of

an acquired entity are included in the Company’s Consolidated

Financial Statements from the acquisition date.

Cash and Cash Equivalents. Cash and cash equivalents consist of

cash on hand, short-term investments with original maturities of three

months or less and investments in money market funds with

weighted average maturities of three months or less.

Restricted Cash. Restricted cash represents amounts held for

students that were received from U.S. Federal and state govern-

ments under various aid grant and loan programs, such as Title

IV of the U.S. Federal Higher Education Act of 1965 (Higher

Education Act), as amended, that the Company is required to

maintain pursuant to U.S. Department of Education (ED) and

other regulations. Restricted cash also includes (i) certain funds

that the Company may be required to return if a student who

receives Title IV program funds withdraws from a program and

(ii) funds required to be held by non-U.S. higher education

institutions for prepaid tuition.

Concentration of Credit Risk. Cash and cash equivalents are

maintained with several financial institutions domestically and

internationally. Deposits held with banks may exceed the amount of

insurance provided on such deposits. Generally, these deposits may

be redeemed upon demand and are maintained with financial

institutions with investment-grade credit ratings. The Company

routinely assesses the financial strength of significant customers, and

this assessment, combined with the large number and geographical

diversity of its customers, limits the Company’s concentration of risk

with respect to trade accounts receivable.

Allowance for Doubtful Accounts. Accounts receivable have been

reduced by an allowance for amounts that may be uncollectible in

the future. This estimated allowance is based primarily on the aging

category, historical trends and management’s evaluation of the

financial condition of the customer.

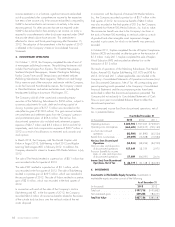

Investments in Marketable Equity Securities. The Company’s

investments in marketable equity securities are classified as

available-for-sale and, therefore, are recorded at fair value in the

Consolidated Financial Statements, with the change in fair value

during the period excluded from earnings and recorded net of

income taxes as a separate component of other comprehensive

income. If the fair value of a marketable equity security declines

below its cost basis and the decline is considered other than

60 GRAHAM HOLDINGS COMPANY