Washington Post 2013 Annual Report Download - page 61

Download and view the complete annual report

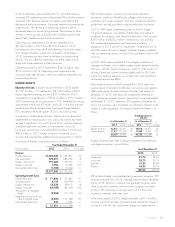

Please find page 61 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Equity in Earnings of Affiliates. The Company holds a 16.5%

interest in Classified Ventures, LLC and interests in several other

affiliates.

The Company’s equity in earnings of affiliates, net, for 2013 was

$13.2 million, compared to $14.1 million in 2012.

Other Non-Operating (Expense) Income. The Company recorded

other non-operating expense, net, of $23.8 million in 2013,

compared to $5.5 million in 2012.

The 2013 non-operating expense, net, included a $10.4 million

write-down of a marketable equity security, $13.4 million in

unrealized foreign currency losses and other items. The 2012 non-

operating expense, net, included an $18.0 million write-down of a

marketable equity security, offset by $6.6 million in net gains from

cost method investments, $3.1 million in unrealized foreign currency

gains and other items.

During 2013, on an overall basis, the fair value of the Company’s

marketable securities appreciated by $96.3 million.

Net Interest Expense. The Company incurred net interest expense of

$33.8 million in 2013, compared to $32.6 million in 2012. At

December 31, 2013, the Company had $450.8 million in borrowings

outstanding at an average interest rate of 7.0%; at December 31,

2012, the Company had $696.7 million in borrowings outstanding at

an average interest rate of 5.1%.

Provision for Income Taxes. The effective tax rate for income from

continuing operations in 2013 was 36.5%. This effective tax rate

benefited from lower state taxes, offset by $4.6 million in net state

and non-U.S. valuation allowances provided against deferred

income tax benefits where realization is doubtful.

The effective tax rate for income from continuing operations in

2012 was 53.6%. This effective tax rate was adversely impacted

by $12.8 million from nondeductible goodwill in connection with

an impairment charge recorded in 2012, and $12.5 million in net

state and non-U.S. valuation allowances provided against deferred

income tax benefits where realization is doubtful, offset by tax

benefits from lower rates in jurisdictions outside the United States.

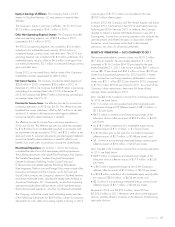

Discontinued Operations. On October 1, 2013, the Company

completed the sale of most of its newspaper publishing businesses.

The publishing businesses sold include The Washington Post, Express,

The Gazette Newspapers, Southern Maryland Newspapers,

Greater Washington Publishing, Fairfax County Times and

El Tiempo Latino and related websites (Publishing Subsidiaries).

Slate magazine, TheRoot.com and Foreign Policy were not part of the

transaction and remain with the Company, as do the Trove and

SocialCode businesses, the Company’s interest in Classified Ventures

and certain real estate assets, including the headquarters building in

downtown Washington, DC. Consequently, income from continuing

operations excludes these sold businesses, which have been reclass-

ified to discontinued operations, net of tax, for all periods presented.

The Company sold all the issued and outstanding equity securities

of the Publishing Subsidiaries for $250 million, subject to customary

adjustments for cash, debt and working capital at closing. In 2013,

a pre-tax gain of $157.5 million was recorded on the sale

($100.0 million after-tax gain).

In March 2013, the Company sold The Herald. Kaplan sold Kidum

in August 2012, EduNeering in April 2012 and Kaplan Learning

Technologies (KLT) in February 2012. In addition, the Company

divested its interest in Avenue100 Media Solutions in July 2012.

Consequently, income from continuing operations also excludes the

operating results and related net gains on disposition of these

businesses, which have been reclassified to discontinued

operations, net of tax, for all periods presented.

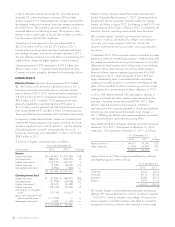

RESULTS OF OPERATIONS — 2012 COMPARED TO 2011

Net income attributable to common shares was $131.2 million

($17.39 per share) for the year ended December 31, 2012,

compared to $116.2 million ($14.70 per share) for the year

ended December 31, 2011. Net income includes $60.1 million in

income ($8.17 per share) and $34.2 million in losses ($4.33 per

share) from discontinued operations for 2012 and 2011 respec-

tively. Income from continuing operations attributable to common

shares was $71.1 million ($9.22 per share) for 2012, compared

to $150.5 million ($19.03 per share) for 2011. As a result of the

Company’s share repurchases, there were 6% fewer diluted

average shares outstanding in 2012.

Items included in the Company’s income from continuing operations

for 2012 are listed below:

• $111.6 million noncash goodwill and other long-lived assets

impairment charge at KTP (after-tax impact of $81.9 million, or

$11.33 per share);

• $45.2 million in severance and restructuring charges at the

education division (after-tax impact of $32.9 million, or $4.53

per share);

• an $18.0 million write-down of a marketable equity security

(after-tax impact of $11.2 million, or $1.54 per share);

• a $5.8 million gain on the sale of a cost method investment

(after-tax impact of $3.7 million, or $0.48 per share); and

• $3.1 million in non-operating unrealized foreign currency gains

(after-tax impact of $2.0 million, or $0.27 per share).

Items included in the Company’s income from continuing operations

for 2011 are listed below:

• $28.9 million in severance and restructuring charges at the

education division (after-tax impact of $17.9 million, or $2.26

per share);

• a $9.2 million impairment charge at one of the Company’s

affiliates (after-tax impact of $5.7 million, or $0.72 per share);

• a $53.8 million write-down of a marketable equity security (after-

tax impact of $34.6 million, or $4.34 per share); and

• $3.3 million in non-operating unrealized foreign currency losses

(after-tax impact of $2.1 million, or $0.26 per share).

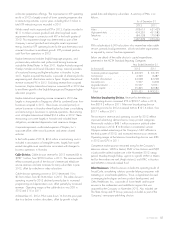

Revenue for 2012 was $3,455.6 million, down 2% from

$3,526.0 million in 2011. Revenues were down at the education

division, partially offset by increases at the television broadcasting

and cable divisions.

2013 FORM 10-K 43