Washington Post 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

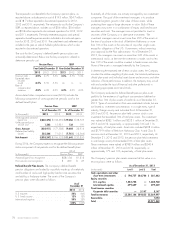

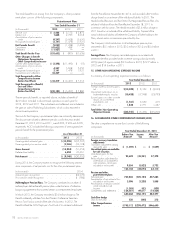

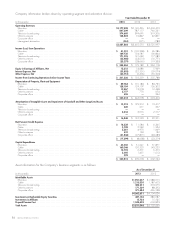

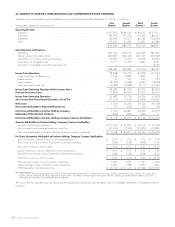

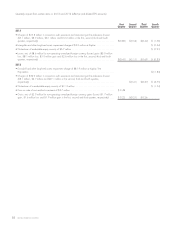

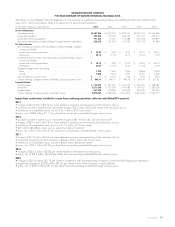

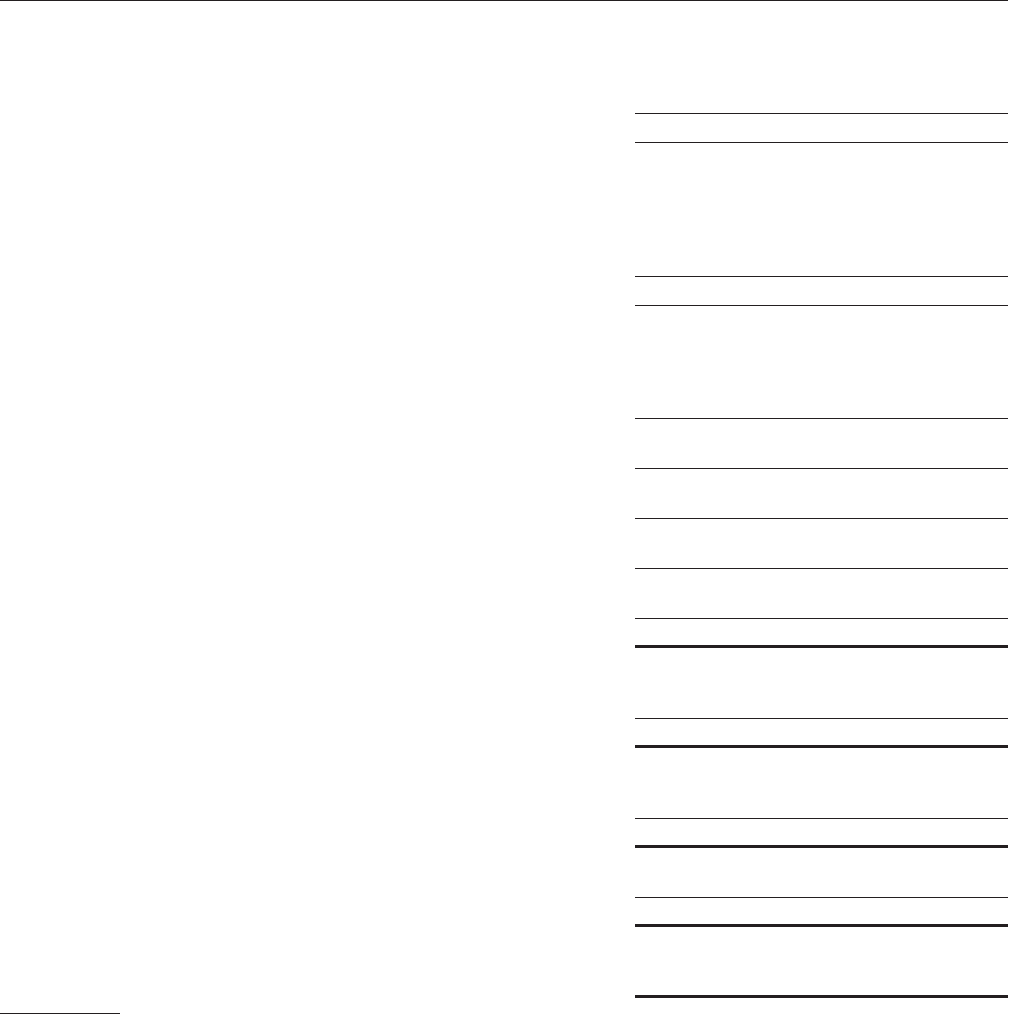

20. SUMMARY OF QUARTERLY OPERATING RESULTS AND COMPREHENSIVE INCOME (UNAUDITED)

Quarterly results of operations and comprehensive income for the year ended December 31, 2013, is as follows:

(in thousands, except per share amounts) First

Quarter Second

Quarter Third

Quarter(1) Fourth

Quarter

Operating Revenues

Education .......................................................... $527,815 $548,230 $546,452 $555,011

Subscriber .......................................................... 186,790 192,273 190,302 186,297

Advertising .......................................................... 82,994 96,670 84,444 102,208

Other ............................................................. 39,241 52,423 51,331 45,383

836,840 889,596 872,529 888,899

Operating Costs and Expenses

Operating .......................................................... 381,965 400,515 400,939 381,492

Selling, general and administrative ........................................ 337,865 323,182 331,247 335,028

Depreciation of property, plant and equipment ............................... 59,895 57,816 55,633 59,874

Amortization of intangible assets .......................................... 3,717 3,313 2,837 3,731

Impairment of intangibles and other long-lived assets ........................... ———3,250

783,442 784,826 790,656 783,375

Income from Operations 53,398 104,770 81,873 105,524

Equity in earnings of affiliates, net ......................................... 3,418 3,868 5,892 37

Interest income ....................................................... 510 522 642 590

Interest expense ...................................................... (8,960) (9,048) (9,221) (8,838)

Other (expense) income, net ............................................. (4,083) (12,858) 8,110 (14,920)

Income from Continuing Operations Before Income Taxes ........................ 44,283 87,254 87,296 82,393

Provision for Income Taxes ............................................... 17,800 34,500 31,000 26,700

Income from Continuing Operations ........................................ 26,483 52,754 56,296 55,693

(Loss) Income from Discontinued Operations, Net of Tax ......................... (21,224) (7,620) (25,872) 100,835

Net Income ........................................................... 5,259 45,134 30,424 156,528

Net Income Attributable to Noncontrolling Interests ............................. (97) (253) (75) (55)

Net Income Attributable to Graham Holdings Company ......................... 5,162 44,881 30,349 156,473

Redeemable Preferred Stock Dividends ...................................... (444) (206) (205) —

Net Income Attributable to Graham Holdings Company Common Stockholders ........ $ 4,718 $ 44,675 $ 30,144 $156,473

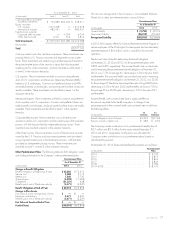

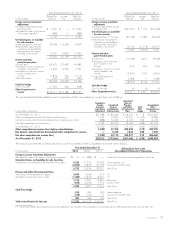

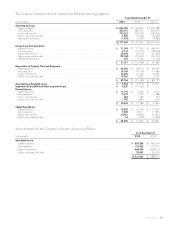

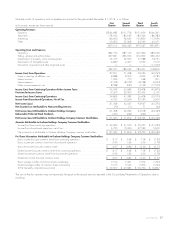

Amounts Attributable to Graham Holdings Company Common Stockholders

Income from continuing operations ........................................ $ 25,942 $ 52,295 $ 56,016 $ 55,638

(Loss) income from discontinued operations, net of tax .......................... (21,224) (7,620) (25,872) 100,835

Net income attributable to Graham Holdings Company common stockholders ......... $ 4,718 $ 44,675 $ 30,144 $156,473

Per Share Information Attributable to Graham Holdings Company Common Stockholders

Basic income per common share from continuing operations ...................... $ 3.50 $ 7.05 $ 7.55 $ 7.54

Basic (loss) income per common share from discontinued operations ................ (2.86) (1.03) (3.48) 13.66

Basic net income per common share ....................................... $ 0.64 $ 6.02 $ 4.07 $ 21.20

Diluted income per common share from continuing operations ..................... $ 3.50 $ 7.05 $ 7.53 $ 7.52

Diluted (loss) income per common share from discontinued operations ............... (2.86) (1.03) (3.48) 13.62

Diluted net income per common share ...................................... $ 0.64 $ 6.02 $ 4.05 $ 21.14

Basic average number of common shares outstanding .......................... 7,227 7,229 7,231 7,266

Diluted average number of common shares outstanding ......................... 7,266 7,283 7,337 7,347

2013 Quarterly comprehensive income ..................................... $ 29,129 $ 61,125 $ 37,533 $555,695

(1) Other revenue and operating expenses of $29.9 million from the third quarter of 2013 have been revised to correctly present revenue on a net basis for certain third

quarter contracts that were previously reported on a gross basis. The amounts did not impact net income, and the Company concluded that the amounts were not

material to the Company’s consolidated financial statements.

The sum of the four quarters may not necessarily be equal to the annual amounts reported in the Consolidated Statements of Operations due to

rounding.

86 GRAHAM HOLDINGS COMPANY