Washington Post 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

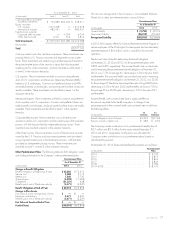

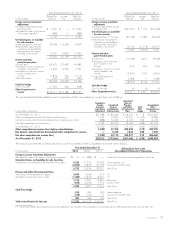

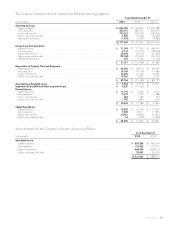

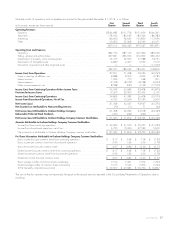

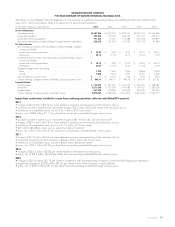

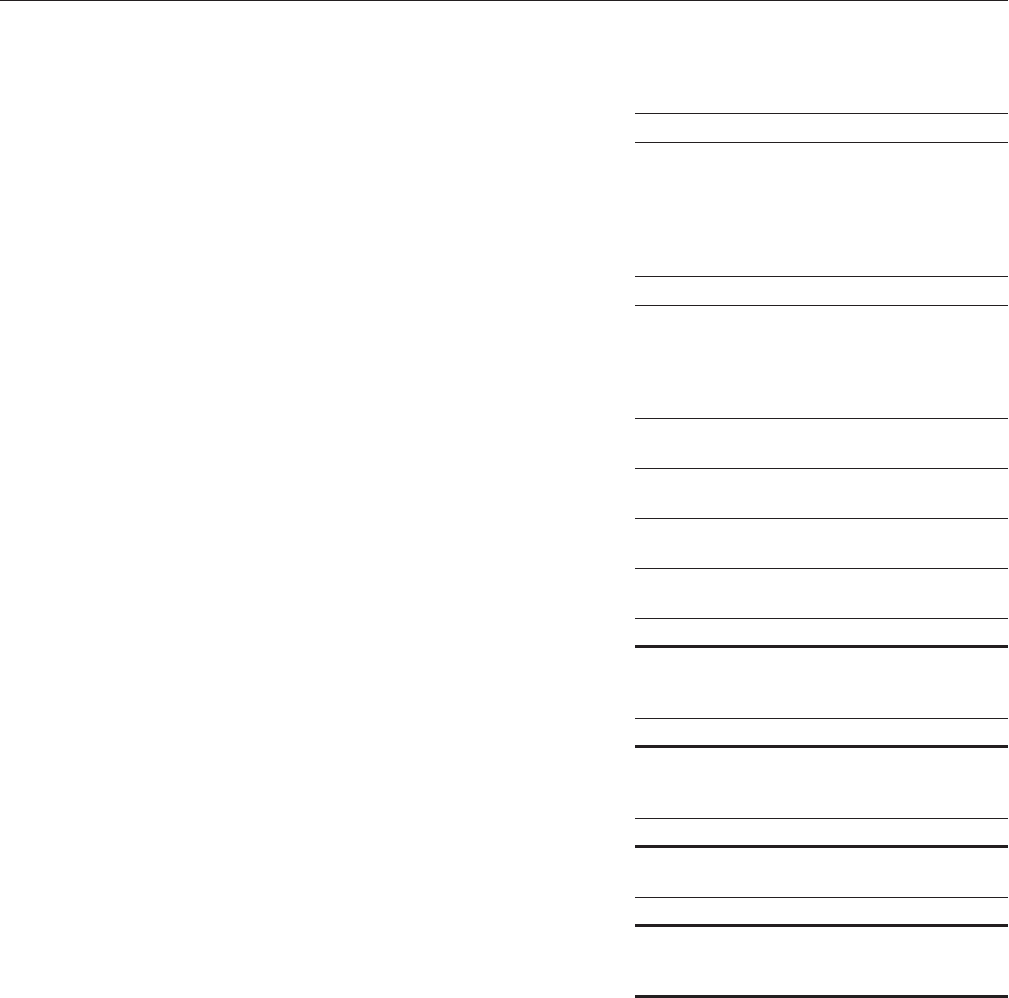

Quarterly results of operations and comprehensive income for the year ended December 31, 2012, is as follows:

(in thousands, except per share amount) First

Quarter Second

Quarter Third

Quarter Fourth

Quarter

Operating Revenues

Education .......................................................... $546,685 $551,774 $551,696 $546,341

Subscriber .......................................................... 178,022 182,639 185,326 186,383

Advertising .......................................................... 82,600 94,649 105,855 117,696

Other ............................................................. 20,305 25,368 34,760 45,471

827,612 854,430 877,637 895,891

Operating Costs and Expenses

Operating .......................................................... 382,106 387,167 407,364 389,620

Selling, general and administrative ........................................ 347,841 335,054 314,359 336,262

Depreciation of property, plant and equipment ............................... 56,165 56,594 57,588 73,731

Amortization of intangible assets .......................................... 3,839 4,407 5,090 7,610

Impairment of goodwill and other long-lived assets ............................. ———111,593

789,951 783,222 784,401 918,816

Income (Loss) from Operations ............................................ 37,661 71,208 93,236 (22,925)

Equity in earnings of affiliates, net ......................................... 3,888 3,314 4,099 2,785

Interest income ....................................................... 1,069 775 648 901

Interest expense ...................................................... (9,163) (8,979) (8,738) (9,064)

Other income (expense), net ............................................. 8,588 (635) 4,163 (17,572)

Income (Loss) from Continuing Operations Before Income Taxes ................... 42,043 65,683 93,408 (45,875)

Provision for Income Taxes ............................................... 17,200 23,900 37,000 5,100

Income (Loss) from Continuing Operations ................................... 24,843 41,783 56,408 (50,975)

Income from Discontinued Operations, Net of Tax .............................. 6,725 10,264 37,539 5,600

Net Income (Loss) ...................................................... 31,568 52,047 93,947 (45,375)

Net (Income) Loss Attributable to Noncontrolling Interests ........................ (70) (11) 71 (64)

Net Income (Loss) Attributable to Graham Holdings Company ..................... 31,498 52,036 94,018 (45,439)

Redeemable Preferred Stock Dividends ...................................... (451) (222) (222) —

Net Income (Loss) Attributable to Graham Holdings Company Common Stockholders . . . $ 31,047 $ 51,814 $ 93,796 $ (45,439)

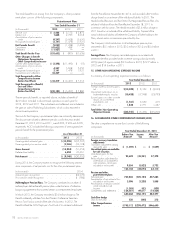

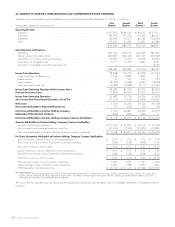

Amounts Attributable to Graham Holdings Company Common Stockholders

Income (loss) from continuing operations .................................... $ 24,322 $ 41,550 $ 56,257 $ (51,039)

Income from discontinued operations, net of tax ............................... 6,725 10,264 37,539 5,600

Net income (loss) attributable to Graham Holdings Company common stockholders ..... $ 31,047 $ 51,814 $ 93,796 $ (45,439)

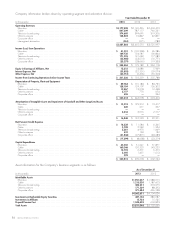

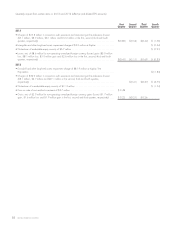

Per Share Information Attributable to Graham Holdings Company Common Stockholders

Basic income (loss) per common share from continuing operations .................. $ 3.17 $ 5.48 $ 7.58 $ (7.35)

Basic income per common share from discontinued operations .................... 0.90 1.36 5.06 0.78

Basic net income (loss) per common share ................................... $ 4.07 $ 6.84 $ 12.64 $ (6.57)

Diluted income (loss) per common share from continuing operations ................ $ 3.17 $ 5.48 $ 7.58 $ (7.35)

Diluted income per common share from discontinued operations ................... 0.90 1.36 5.06 0.78

Diluted net income (loss) per common share .................................. $ 4.07 $ 6.84 $ 12.64 $ (6.57)

Basic average number of common shares outstanding .......................... 7,514 7,431 7,272 7,223

Diluted average number of common shares outstanding ......................... 7,615 7,545 7,376 7,223

2012 Quarterly comprehensive income ..................................... $ 59,907 $ 47,085 $ 95,760 $ 16,857

The sum of the four quarters may not necessarily be equal to the annual amounts reported in the Consolidated Statements of Operations due to

rounding.

2013 FORM 10-K 87