Washington Post 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

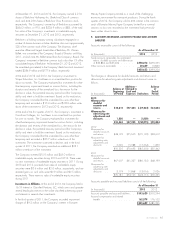

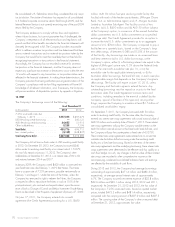

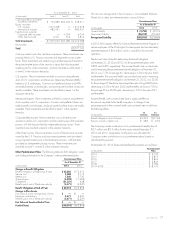

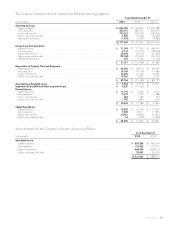

SERP

As of December 31

(in thousands) 2013 2012

Change in Benefit Obligation

Benefit obligation at beginning of year .... $104,062 $ 92,863

Service cost ........................ 1,612 1,467

Interest cost ........................ 4,148 4,241

Actuarial (gain) loss .................. (9,180) 8,428

Benefits paid and other ............... (4,101) (2,937)

Curtailment ........................ (2,059) —

Settlement ......................... (3,313) —

Benefit Obligation at End of Year ....... $ 91,169 $ 104,062

Change in Plan Assets

Fair value of assets at beginning of year . . . $—$—

Employer contributions and other ......... 4,101 3,681

Benefits paid ....................... (4,101) (3,681)

Fair Value of Assets at End of Year ...... $—$—

Funded Status ...................... $ (91,169) $(104,062)

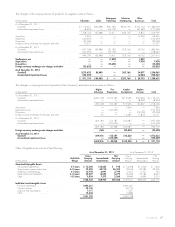

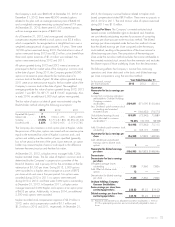

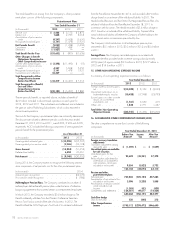

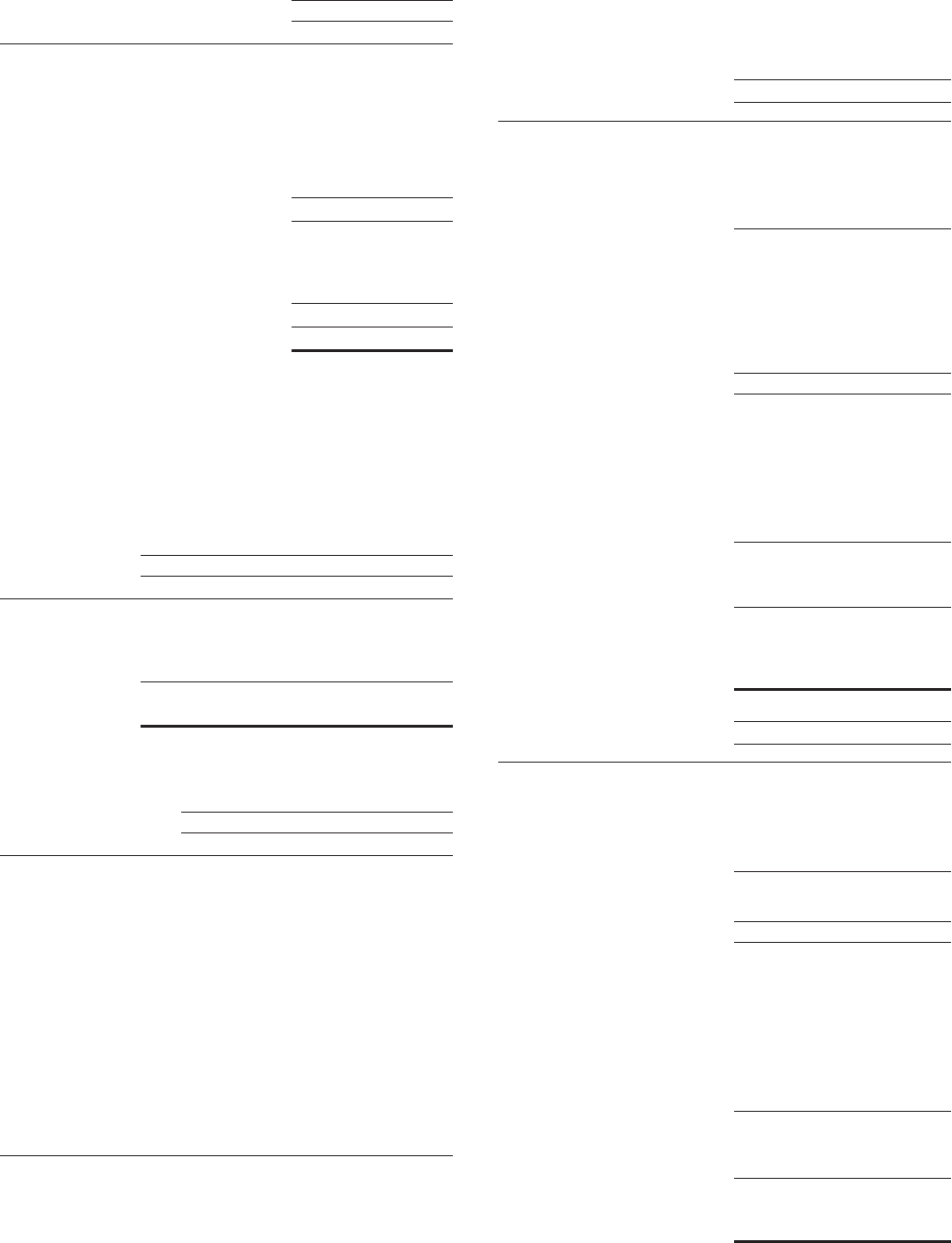

The accumulated benefit obligation for the Company’s pension plans

at December 31, 2013 and 2012, was $1,091.1 million and

$1,349.2 million, respectively. The accumulated benefit obligation for

the Company’s SERP at December 31, 2013 and 2012, was $89.3

million and $97.6 million, respectively. The amounts recognized in the

Company’s Consolidated Balance Sheets for its defined benefit

pension plans are as follows:

Pension Plans SERP

As of December 31 As of December 31

(in thousands) 2013 2012 2013 2012

Noncurrent asset . . $1,245,505 $604,823 $—$—

Current liability .... ——(4,251) (4,368)

Noncurrent

liability ........ ——(86,918) (99,694)

Recognized Asset

(Liability) ...... $1,245,505 $604,823 $(91,169) $(104,062)

Key assumptions utilized for determining the benefit obligation are

as follows:

Pension Plans SERP

As of December 31 As of December 31

2013 2012 2013 2012

Discount rate .......... 4.8% 4.0% 4.8% 4.0%

Rate of compensation

increase ............ 4.0% 4.0% 4.0% 4.0%

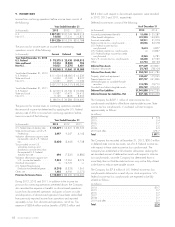

The Company made no contributions to its pension plans in 2013,

2012 and 2011, and the Company does not expect to make any

contributions in 2014. The Company made contributions to its SERP of

$4.1 million and $3.7 million for the years ended December 31,

2013 and 2012, respectively. As the plan is unfunded, the Company

makes contributions to the SERP based on actual benefit payments.

At December 31, 2013, future estimated benefit payments,

excluding charges for early retirement programs, are as follows:

(in thousands) Pension Plans SERP

2014 .......................... $ 79,012 $ 5,010

2015 .......................... $ 76,105 $ 5,098

2016 .......................... $ 74,913 $ 5,426

2017 .......................... $ 74,794 $ 5,592

2018 .......................... $ 75,357 $ 5,879

2019–2023 .................... $385,612 $31,610

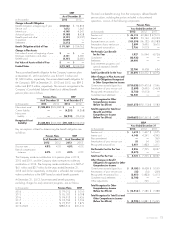

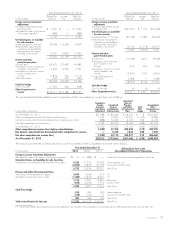

The total cost (benefit) arising from the Company’s defined benefit

pension plans, including the portion included in discontinued

operations, consists of the following components:

Pension Plans

Year Ended December 31

(in thousands) 2013 2012 2011

Service cost .................. $ 46,115 40,344 $ 27,619

Interest cost .................. 55,821 59,124 60,033

Expected return on assets ........ (105,574) (96,132) (95,983)

Amortizationofpriorservicecost .....

2,809 3,695 3,605

Recognized actuarial loss ........ 2,756 9,013 —

Net Periodic Cost (Benefit)

for the Year ................ 1,927 16,044 (4,726)

Curtailment .................. (43,930) ——

Settlement ................... 39,995 ——

Early retirement programs and

special separation benefit

expense ................... 22,700 8,508 634

Total Cost (Benefit) for the Year ... $ 20,692 $ 24,552 $ (4,092)

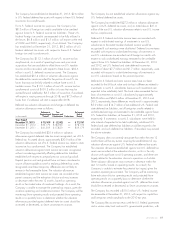

Other Changes in Plan Assets and

Benefit Obligations Recognized

in Other Comprehensive Income

Current year actuarial (gain) loss . . . $(750,328) $(79,405) $ 7,046

Amortization of prior service cost . . . (2,809) (3,695) (1,463)

Recognized net actuarial loss ..... (2,756) (9,013) —

Curtailmentandsettlement........ 94,520 ——

Total Recognized in Other

Comprehensive Income

(Before Tax Effects) .......... $(661,373) $(92,113) $ 5,583

Total Recognized in Total Cost

(Benefit) and Other

Comprehensive Income

(Before Tax Effects) .......... $(640,681) $(67,561) $ 1,491

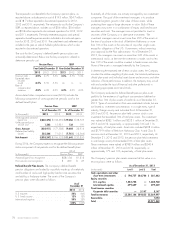

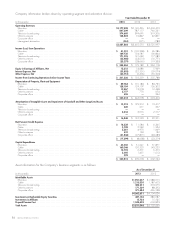

SERP

Year Ended December 31

(in thousands) 2013 2012 2011

Service cost .................. $ 1,612 $ 1,467 $ 1,655

Interest cost .................. 4,148 4,241 4,342

Plan amendment ............... ——369

Amortization of prior service cost . . . 55 54 260

Recognized actuarial loss ........ 2,481 1,833 1,411

Net Periodic Cost for the Year .... 8,296 7,595 8,037

Settlement ................... (2,575) ——

Total Cost for the Year .......... $ 5,721 $ 7,595 $ 8,037

Other Changes in Benefit

Obligations Recognized in Other

Comprehensive Income

Current year actuarial (gain) loss . . . $ (9,180) $ 8,428 $ 9,059

Amortization of prior service cost . . . (55) (54) (260)

Recognized net actuarial loss ..... (2,481) (1,833) (1,411)

Curtailmentandsettlement........ (2,798) ——

Other adjustments .............. —745 —

Total Recognized in Other

Comprehensive Income

(Before Tax Effects) .......... $ (14,514) $ 7,286 $ 7,388

Total Recognized in Total Cost and

Other Comprehensive Income

(Before Tax Effects) .......... $ (8,793) $ 14,881 $ 15,425

2013 FORM 10-K 75