Washington Post 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2011, the Company completed five business acquisitions.

Kaplan acquired three businesses in its Kaplan International division,

one business in its KHE division and one business in its Kaplan

Ventures division. These included the May 2011 acquisitions of

Franklyn Scholar and Carrick Education Group, national providers

of vocational training and higher education in Australia, and the

June 2011 acquisition of Structuralia, a provider of e-learning for

the engineering and infrastructure sector in Spain. The purchase

price allocations for these acquisitions mostly comprised goodwill,

other intangible assets and property, plant and equipment.

Dispositions. On October 1, 2013, the Company completed the

sale of its Publishing Subsidiaries that together conducted most of the

Company’s publishing business and related services, including

publishing The Washington Post, Express, The Gazette Newspapers,

Southern Maryland Newspapers, Greater Washington Publishing,

Fairfax County Times and El Tiempo Latino and related websites.

Slate magazine, TheRoot.com and Foreign Policy were not part of

the transaction and remain with the Company, as do the Trove and

SocialCode businesses, the Company’s interest in Classified Ventures

and certain real estate assets, including the headquarters building

in downtown Washington, DC. In March 2013, the Company

completed the sale of The Herald, a daily and Sunday newspaper

headquartered in Everett, WA. The Herald was previously reported in

the newspaper publishing division.

The Company divested its interest in Avenue100 Media Solutions in

July 2012, which was previously reported in other businesses.

Kaplan completed the sales of Kidum in August 2012, EduNeering

in April 2012, and KLT in February 2012, which were part of the

Kaplan Ventures division.

Kaplan completed the sales of KVE in July 2011 and KCS in

October 2011, which were part of Kaplan Ventures and KHE,

respectively.

Consequently, the Company’s income from continuing operations

excludes results from these businesses, which have been reclassified

to discontinued operations (see Note 3).

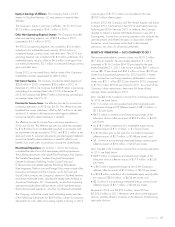

Capital Expenditures. During 2013, the Company’s capital expen-

ditures totaled $224.1 million. The Company’s capital expenditures

for businesses included in continuing operations for 2013, 2012

and 2011 are disclosed in Note 19 to the Consolidated Financial

Statements. The Company estimates that its capital expenditures will

be in the range of $240 million to $265 million in 2014.

Investments in Marketable Equity Securities. At December 31,

2013, the fair value of the Company’s investments in marketable

equity securities was $487.2 million, which includes $444.2

million in Berkshire Hathaway Inc. Class A and B common stock

and $43.0 million in the common stock of three publicly traded

companies.

At December 31, 2013 and 2012, the unrealized gain related to

the Company’s Berkshire stock investment totaled $286.9 million

and $177.6 million, respectively.

At the end of 2013 and 2012, the Company’s investment in

Strayer Education, Inc. had been in an unrealized loss position for

about six months. The Company evaluated this investment for other-

than-temporary impairment based on various factors, including the

duration and severity of the unrealized loss, the reason for the

decline in value, the potential recovery period and the Company’s

ability and intent to hold the investment. Based on this evaluation,

the Company concluded that the unrealized loss was other-than-

temporary and recorded a $10.4 million and $18.0 million write-

down of the investment in 2013 and 2012, respectively.

At the end of the first quarter of 2011, the Company’s investment in

Corinthian Colleges, Inc. had been in an unrealized loss position

for over six months. The Company evaluated this investment for

other-than-temporary impairment based on various factors, including

the duration and severity of the unrealized loss, the reason for the

decline in value, the potential recovery period and the Company’s

ability and intent to hold the investment. Based on this evaluation,

the Company concluded that the unrealized loss was other-than-

temporary and recorded a $30.7 million write-down of the

investment. The investment continued to decline, and in the third

quarter of 2011, the Company recorded an additional $23.1

million write-down of the investment.

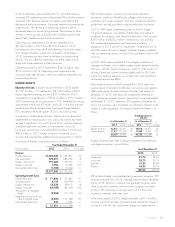

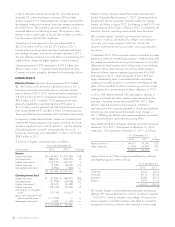

Common Stock Repurchases and Dividend Rate. During 2013,

2012 and 2011, the Company purchased a total of 33,024,

301,231 and 644,948 shares, respectively, of its Class B

common stock at a cost of approximately $17.7 million, $103.2

million and $248.1 million, respectively. In September 2011, the

Board of Directors increased the authorization to repurchase a total

of 750,000 shares of Class B common stock. The Company did

not announce a ceiling price or a time limit for the purchases. The

authorization included 43,573 shares that remained under the

previous authorization. At December 31, 2013, the Company had

remaining authorization from the Board of Directors to purchase up

to 159,219 shares of Class B common stock. The annual dividend

rate for 2014 was increased to $10.20 per share, up from $9.80

in 2012. In December 2012, the Company declared and paid an

accelerated cash dividend totaling $9.80 per share of outstanding

common stock, in lieu of regular quarterly dividends that the

Company otherwise would have declared and paid in calendar

year 2013.

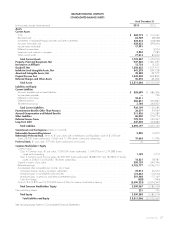

Liquidity. During 2013, the Company’s borrowings decreased by

$245.9 million and the Company’s cash and cash equivalents

increased by $57.3 million.

At December 31, 2013, the Company has $569.7 million in

cash and cash equivalents, compared to $512.4 million at

December 31, 2012. Restricted cash at December 31, 2013,

totaled $83.8 million, compared to $28.5 million at December 31,

2012. As of December 31, 2013 and 2012, the Company had

money market investments of $431.8 million and $432.7 million,

respectively, that are classified as cash, cash equivalents and rest-

ricted cash in the Company’s Consolidated Financial Statements.

At December 31, 2013, the Company has approximately $15.6

million in cash and cash equivalents in countries outside the U.S.,

which is not immediately available for use in operations or for

distribution.

At December 31, 2013 and 2012, the Company had borrowings

outstanding of $450.8 million and $696.7 million, respectively.

2013 FORM 10-K 47