Washington Post 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In May 2012, the ED issued a preliminary report containing several

findings that required Kaplan University to conduct additional file

reviews and submit additional data. In January 2013, Kaplan

submitted a response to the ED’s data request. In December 2013,

the ED issued its Final Program Review Report determining that

Kaplan University was required to repay a nominal sum.

The Company does not expect the open program reviews to have a

material impact on KHE; however, the results of open program

reviews and their impact on Kaplan’s operations are uncertain.

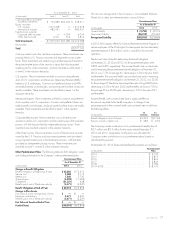

The 90/10 Rule. Under regulations referred to as the 90/10 rule,

a KHE school would lose its eligibility to participate in Title IV

programs for a period of at least two fiscal years if the institution

derives more than 90% of its receipts from Title IV programs, as

calculated on a cash basis in accordance with the Higher

Education Act and applicable ED regulations, in each of two

consecutive fiscal years. An institution with Title IV receipts

exceeding 90% for a single fiscal year would be placed on

provisional certification and may be subject to other enforcement

measures. The 90/10 rule calculations are performed for each

OPEID unit. The largest OPEID reporting unit in KHE in terms of

revenue is Kaplan University, which accounted for approximately

69% of the Title IV funds received by the division in 2013. In

2013, Kaplan University derived less than 81% of its receipts from

the Title IV programs, and other OPEID units derived between 69%

and 89% of their receipts from Title IV programs. In 2012, Kaplan

University derived less than 80% of its receipts from Title IV

programs, and other OPEID units derived between 71% and 88%

of their receipts from Title IV programs.

A majority of KHE students are enrolled in certificate and associate’s

degree programs. Revenue from certificate and associate’s degree

programs is composed of a higher percentage of Title IV funds than

is the case for revenue from KHE’s bachelor’s and other degree

programs. KHE is taking various measures to reduce the percentage

of its receipts attributable to Title IV funds, including modifying

student payment options; emphasizing direct-pay and employer-

paid education programs; encouraging students to carefully

evaluate the amount of their Title IV borrowing; eliminating some

programs; cash-matching; and developing and offering additional

non-Title IV-eligible certificate preparation, professional development

and continuing education programs, some of which programs were

acquired by certain KHE campuses in 2013 from other Kaplan

businesses. Kaplan has taken steps to ensure that revenue from

programs acquired by a KHE campus is eligible to be counted in

that campus’ 90/10 calculation. However, there can be no

guarantee that the ED will not challenge the inclusion of revenue

from any recently acquired program in KHE’s 90/10 calculations

or will not issue an interpretation of the 90/10 rule that would

exclude such revenue from the calculation. Absent the adoption of

the changes mentioned above, and if current trends continue,

management estimates that in 2014, three of the KHE Campuses’

OPEID units, representing approximately 1.7% of KHE’s 2013

revenues, could have a 90/10 ratio over 90%. As noted above,

Kaplan is taking steps to address compliance with the 90/10 rule;

however, there can be no guarantee that these measures will be

adequate to prevent the 90/10 ratio at some of the schools from

exceeding 90% in the future.

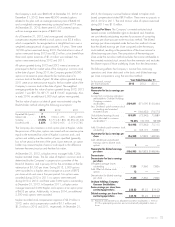

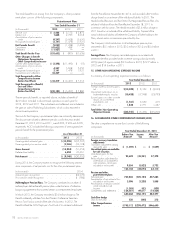

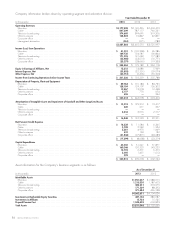

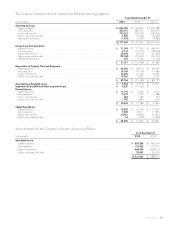

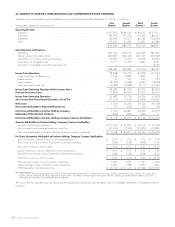

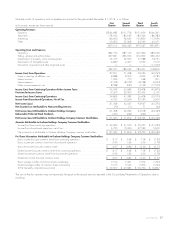

19. BUSINESS SEGMENTS

Basis of Presentation. The Company’s organizational structure is

based on a number of factors that management uses to evaluate,

view and run its business operations, which include, but are not

limited to, customers, the nature of products and services and use of

resources. The business segments disclosed in the Consolidated

Financial Statements are based on this organizational structure and

information reviewed by the Company’s management to evaluate

the business segment results. The Company has six reportable

segments: KHE, KTP, Kaplan International, cable, television

broadcasting and other businesses.

The Company evaluates segment performance based on operating

income before amortization of intangible assets and impairment of

goodwill and other long-lived assets. The accounting policies at the

segments are the same as described in Note 2. In computing

income from operations by segment, the effects of equity in earnings

(losses) of affiliates, interest income, interest expense, other non-

operating income and expense items and income taxes are not

included. Intersegment sales are not material.

Identifiable assets by segment are those assets used in the

Company’s operations in each business segment. The Prepaid

Pension cost is not included in identifiable assets by segment.

Investments in marketable equity securities are discussed in Note 4.

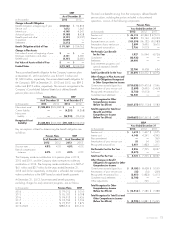

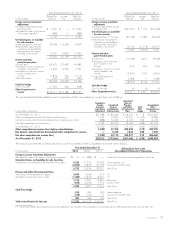

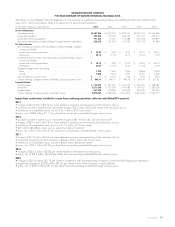

Education. Education products and services are provided by Kaplan,

Inc. KHE includes Kaplan’s postsecondary education businesses, made

up of fixed-facility colleges, as well as online postsecondary and

career programs. KHE also includes the domestic professional training

businesses. KTP includes Kaplan’s standardized test preparation

programs. Kaplan International includes professional training and

postsecondary education businesses outside the United States, as well

as English-language programs.

Kaplan’s Colloquy business moved from Kaplan International to

Kaplan Corporate effective January 1, 2013. Segment operating

results of the education division have been restated to reflect this

change.

Kaplan sold Kidum in August 2012, EduNeering in April 2012,

KLT in February 2012, KCS in October 2011 and KVE in July

2011; therefore, the education division’s operating results exclude

these businesses.

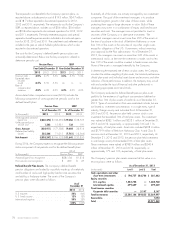

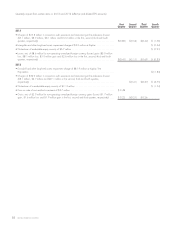

In response to student demand levels, Kaplan has formulated and

implemented restructuring plans at its various businesses that have

resulted in significant costs in the past three years, with the objective

of establishing lower cost levels in future periods. Across all Kaplan

businesses, restructuring costs of $36.4 million, $45.2 million and

$28.9 million were recorded in 2013, 2012 and 2011,

respectively, as follows:

Year Ended December 31

(in thousands) 2013 2012 2011

Accelerated depreciation ..... $16,856 $17,230 $ 3,965

Lease obligation losses ....... 9,351 9,794 7,570

Severance ................ 6,289 14,349 17,205

Accelerated amortization of

intangible assets .......... —2,595 —

Other ................... 3,862 1,274 205

$36,358 $45,242 $28,945

82 GRAHAM HOLDINGS COMPANY