Washington Post 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

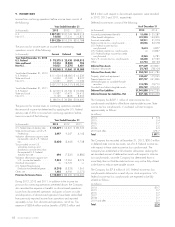

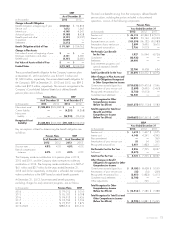

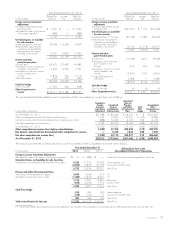

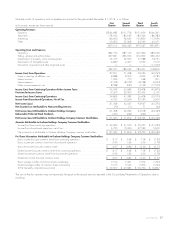

The total (benefit) cost arising from the Company’s other postretire-

ment plans consists of the following components:

Postretirement Plans

Year Ended December 31

(in thousands) 2013 2012 2011

Service cost ................ $ 2,488 $ 3,113 $ 2,872

Interest cost ................ 1,848 2,735 3,063

Amortization of prior service

credit ................... (4,247) (5,608) (5,650)

Recognized actuarial gain ..... (2,141) (1,478) (1,921)

Net Periodic Benefit ......... (2,052) (1,238) (1,636)

Curtailment ................ (41,623) 438 —

Settlement ................. (11,927) ——

Total Benefit for the Year ..... $(55,602) $ (800) $(1,636)

Other Changes in Benefit

Obligations Recognized in

Other Comprehensive Income

Current year actuarial gain .... $ (3,298) $(11,493) $ (55)

Amortization of prior service

credit ................... 4,247 5,608 5,650

Recognized actuarial gain ..... 2,141 1,478 1,921

Curtailment and settlement ..... 32,329 ——

Total Recognized in Other

Comprehensive Income

(Before Tax Effects) ........ $ 35,419 $ (4,407) $ 7,516

Total Recognized in (Benefit)

Cost and Other

Comprehensive Income

(Before Tax Effect) ......... $(20,183) $ (5,207) $ 5,880

The net periodic benefit, as reported above, includes a benefit of

$2.9 million included in discontinued operations in each year for

2013, 2012 and 2011. The curtailment and settlement are included in

the gain on sale of Publishing Subsidiaries, which is also reported in

discontinued operations.

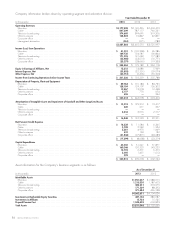

The costs for the Company’s postretirement plans are actuarially determined.

The discount rates utilized to determine periodic cost for the years ended

December 31, 2013, 2012 and 2011, were 3.30%, 3.90% and 4.60%,

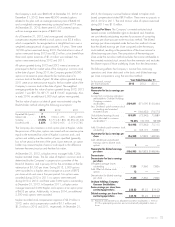

respectively. AOCI included the following components of unrecognized net

periodic benefit for the postretirement plans:

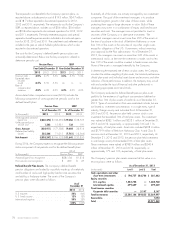

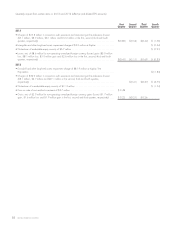

As of December 31

(in thousands) 2013 2012

Unrecognized actuarial gain ........... $ (13,928) $(25,525)

Unrecognized prior service credit ........ (2,306) (26,128)

Gross Amount (16,234) (51,653)

Deferred tax liability .................. 6,494 20,661

Net Amount ........................ $ (9,740) $(30,992)

During 2014, the Company expects to recognize the following amortiz-

ation components of net periodic cost for the other postretirement plans:

(in thousands) 2014

Actuarial gain recognition ......................... $(2,076)

Prior service credit recognition ...................... $ (783)

Multiemployer Pension Plans. The Company contributed to a number of

multiemployer defined benefit pension plans under the terms of collective-

bargaining agreements that covered certain union-represented employees.

In March 2013, the Company recorded a $0.4 million charge as The

Herald unilaterally withdrew from the Western Conference Teamsters

Pension Trust Fund as a result of the sale of its business. In 2012, The

Herald notified the GCIU Employer’s Trust Fund of its unilateral withdrawal

from the Plan effective November 30, 2012, and recorded a $0.9 million

charge based on an estimate of the withdrawal liability. In 2011, The

Herald notified the union and the CWA/ITU Negotiated Pension Plan of its

unilateral withdrawal from the Plan effective December 18, 2011. In

connection with this action, The Herald recorded a $2.4 million charge in

2011 based on an estimate of the withdrawal liability. Payment of the

actual withdrawal liability will relieve the Company of further liability to the

Plans, absent certain circumstances prescribed by law.

The Company’s total contributions to all multiemployer pension plans

amounted to $0.1 million in 2013, $0.2 million in 2012 and $0.4 million

in 2011.

Savings Plans. The Company recorded expense associated with

retirement benefits provided under incentive savings plans (primarily

401(k) plans) of approximately $9.0 million in 2013, $12.7 million in

2012 and $14.6 million in 2011.

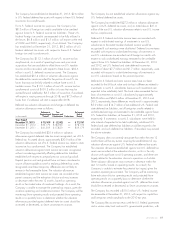

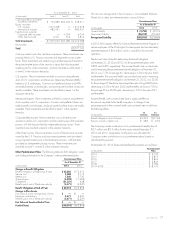

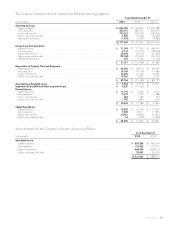

15. OTHER NON-OPERATING (EXPENSE) INCOME

A summary of non-operating (expense) income is as follows:

Year Ended December 31

(in thousands) 2013 2012 2011

Foreign currency (losses) gains,

net ................... $(13,382) $ 3,132 $ (3,263)

Impairment write-down on a

marketable equity security . . (10,438) (17,998) (53,793)

(Losses) gains on sales or write-

downs of cost method

investments, net .......... (1,761) 6,639 419

Other, net ............... 1,830 2,771 1,437

Total Other Non-Operating

(Expense) Income ........ $(23,751) $ (5,456) $(55,200)

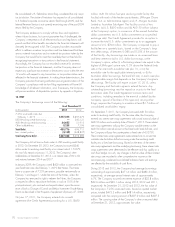

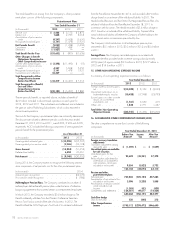

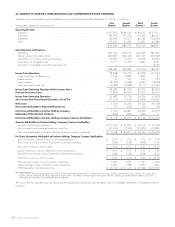

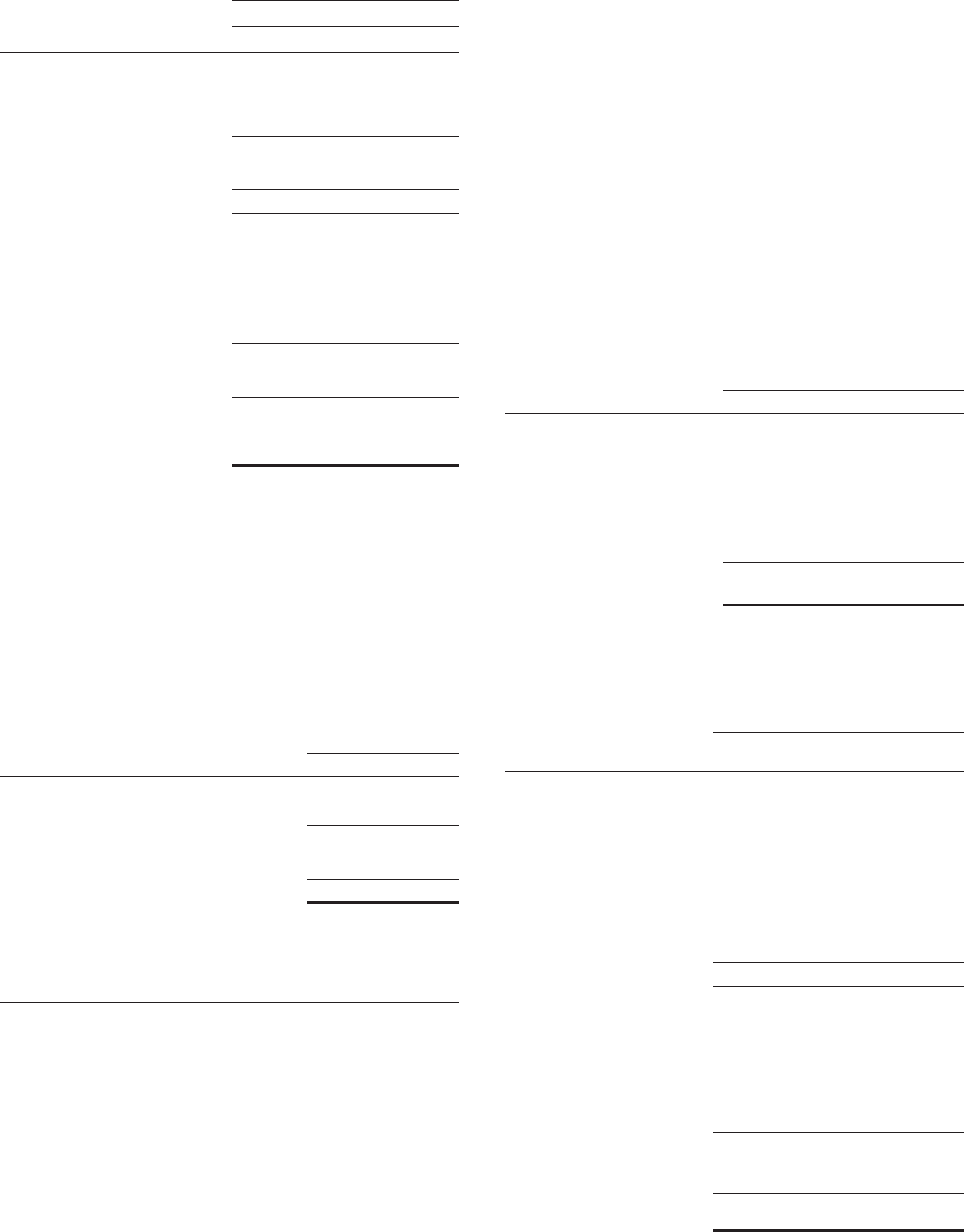

16. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

The other comprehensive income (loss) consists of the following

components:

Year Ended December 31, 2013

(in thousands) Before-Tax

Amount Income

Tax After-Tax

Amount

Foreign currency translation

adjustments

Translation adjustments arising

duringtheyear .......... $ (1,059) $ — $ (1,059)

Unrealized gains on available-

for-sale securities

Unrealized gains for the

year ................. 95,629 (38,251) 57,378

Reclassification adjustment for

write-down on available-for-

sale securities, net of gain,

includedinnetincome..... 9,554 (3,822) 5,732

105,183 (42,073) 63,110

Pension and other

postretirement plans

Actuarialgain ............ 762,806 (305,123) 457,683

Amortization of net actuarial loss

includedinnetincome..... 3,096 (1,238) 1,858

Amortization of net prior service

credit included in net

income ............... (1,383) 553 (830)

Curtailments and settlements . . . (124,051) 49,617 (74,434)

640,468 (256,191) 384,277

Cash flow hedge

Gainfortheyear .......... 520 (208) 312

Other Comprehensive

Income ............... $ 745,112 $(298,472) $446,640

78 GRAHAM HOLDINGS COMPANY