Washington Post 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of November 30, 2013, in connection with the Company’s

annual impairment testing, the Company assessed the qualitative

factors at the cable reporting unit and concluded it was not necessary

to perform the two-step goodwill impairment process. The Company

performed the two-step goodwill impairment process at the other

reporting units.

The estimated fair value of the cable reporting unit exceeded its

carrying value by a margin in excess of 100% as of November 30,

2011, the last date a quantitative review was performed. The

Company’s qualitative assessment indicated that it is not more

likely than not that the estimated fair value of the reporting unit is

less than its carrying amount, considering all factors, including the

reporting unit’s financial performance and conditions in the cable

industry. The Company’s policy requires the performance of a

quantitative impairment review of the goodwill at least once every

three years.

In connection with the Company’s reporting units where the two-

step goodwill impairment process was performed, the Company

used a discounted cash flow model, and where appropriate, a

market value approach was also utilized to supplement the dis-

counted cash flow model to determine the estimated fair value of its

reporting units. The Company made estimates and assumptions

regarding future cash flows, discount rates, long-term growth rates

and market values to determine each reporting unit’s estimated

fair value. The methodology used to estimate the fair value of the

Company’s reporting units on November 30, 2013, was con-

sistent with the one used during the 2012 annual goodwill

impairment test.

The Company made changes to certain of its assumptions utilized in

the discounted cash flow models for 2013 compared with the prior

year to take into account changes in the economic environment,

regulations and their impact on the Company’s businesses. The key

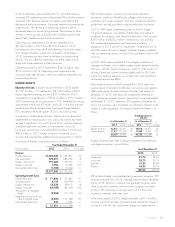

assumptions used by the Company were as follows:

• Expected cash flows underlying the Company’s business plans

for the periods 2014 through 2018 were used. The expected

cash flows took into account historical growth rates, the effect

of the changed economic outlook at some of the Company’s

businesses, industry challenges and an estimate for the possible

impact of any applicable regulations. Expected cash flows also

reflected the anticipated savings from restructuring plans at certain

education division’s reporting units, and other initiatives.

• Cash flows beyond 2018 were projected to grow at a long-term

growth rate, which the Company estimated between 1% and 3%

for each reporting unit.

• The Company used a discount rate of 11.0% to 13.5% to risk

adjust the cash flow projections in determining the estimated fair

value.

The fair value of each of the reporting units exceeded its respective

carrying value as of November 30, 2013.

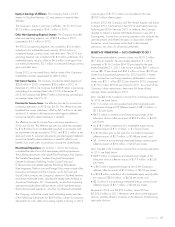

In 2012, the Company recorded a goodwill and other long-lived

asset impairment charge of $111.6 million at the KTP reporting unit.

The remaining goodwill balance at the KTP reporting unit as of

December 31, 2013, totaled $49.9 million. The estimated fair

value of the KTP reporting unit exceeded its carrying value by a

margin in excess of 50%. The estimated fair value of the

Company’s other reporting units with significant goodwill balances

also exceeded their respective carrying values by a margin in

excess of 50%. It is possible that impairment charges could occur in

the future, given the inherent variability in projecting future operating

performance.

Indefinite-Lived Intangible Assets

The Company initially assess qualitative factors to determine if it is

more likely than not that the fair value of its indefinite-lived intangible

assets is less than its carrying value. The Company compares the

fair value of the indefinite-lived intangible asset with its carrying

value if the qualitative factors indicate it is more likely than not that

the fair value of the asset is less than its carrying value or if it

decides to bypass the qualitative assessment. The Company records

an impairment loss if the carrying value of the indefinite-lived

intangible assets exceeds the fair value of the assets for the

difference in the values. The Company uses a discounted cash flow

model, and in certain cases, a market value approach is

also utilized to supplement the discounted cash flow model to

determine the estimated fair value of the indefinite-lived intangible

assets. The Company makes estimates and assumptions regarding

future cash flows, discount rates, long-term growth rates and other

market values to determine the estimated fair value of the indefinite-

lived intangible assets.

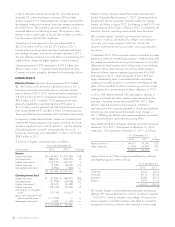

The Company’s intangible assets with an indefinite life are

principally from franchise agreements at its cable division. These

franchise agreements result from agreements the Company has with

state and local governments that allow the Company to contract and

operate a cable business within a specified geographic area. The

Company expects its cable franchise agreements to provide the

Company with substantial benefit for a period that extends beyond

the foreseeable horizon, and the Company’s cable division

historically has obtained renewals and extensions of such agree-

ments for nominal costs and without material modifications to the

agreements. The franchise agreements represent 92% of the

$541.3 million of indefinite-lived intangible assets of the Company

as of December 31, 2013. The Company grouped the recorded

values of its various cable franchise agreements into regional cable

systems or units of account.

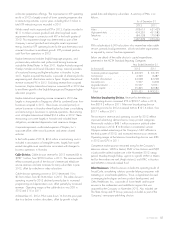

As of November 30, 2013, the Company performed a qualitative

analysis to test the franchise agreements for impairment. The esti-

mated fair value of the Company’s franchise agreements exceeded

their respective carrying values by a margin in excess of 50% as

of November 30, 2011, the last date a quantitative review was

performed. The Company’s qualitative assessment indicated that it is

not more likely than not that the estimated fair value of the franchise

rights are less than its carrying amount considering all factors,

including the review of prior year assumptions, the cable division’s

financial performance and conditions in the cable industry.

50 GRAHAM HOLDINGS COMPANY