Washington Post 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

historical experience and other assumptions believed to be

reasonable under the circumstances, the results of which form the

basis for making judgments about the carrying value of assets and

liabilities that are not readily apparent from other sources. Actual

results could differ from these estimates.

An accounting policy is considered to be critical if it is important to

the Company’s financial condition and results and if it requires

management’s most difficult, subjective and complex judgments in

its application. For a summary of all of the Company’s significant

accounting policies, see Note 2 to the Company’s Consolidated

Financial Statements.

Revenue Recognition, Trade Accounts Receivable and Allowance

for Doubtful Accounts. Education tuition revenue is recognized

ratably over the period of instruction as services are delivered to

students, net of any refunds, corporate discounts, scholarships and

employee tuition discounts.

At KTP and Kaplan International, estimates of average student

course length are developed for each course, along with estimates

for the anticipated level of student drops and refunds from test

performance guarantees, and these estimates are evaluated on an

ongoing basis and adjusted as necessary. As Kaplan’s businesses

and related course offerings have changed, including more online

programs, the complexity and significance of management’s

estimates have increased.

KHE, through the Kaplan Commitment program, provides first-time

students with a risk-free trial period. Under the program, KHE

monitors academic progress and conducts assessments to help

determine whether students are likely to be successful in their chosen

course of study. Students who withdraw or are subject to dismissal

during the risk-free trial period do not incur any significant financial

obligation. The Company does not recognize revenues related to

coursework until the students complete the risk-free period and

decide to continue with their studies, at which time the fees become

fixed or determinable.

The determination of whether revenue should be reported on a

gross or net basis is based on an assessment of whether the

Company acts as a principal or an agent in the transaction. In

certain cases, the Company is considered the agent, and the

Company records revenue equal to the net amount retained when

the fee is earned. In these cases, costs incurred with third-party

suppliers are excluded from the Company’s revenue. The Company

assesses whether it or the third-party supplier is the primary obligor

and evaluates the terms of its customer arrangements as part of this

assessment. In addition, the Company considers other key

indicators such as latitude in establishing price, inventory risk,

nature of services performed, discretion in supplier selection and

credit risk.

Accounts receivable have been reduced by an allowance for

amounts that may be uncollectible in the future. This estimated

allowance is based primarily on the aging category, historical

trends and management’s evaluation of the financial condition of

the customer.

Goodwill and Other Intangible Assets. The Company has a

significant amount of goodwill and indefinite-lived intangible assets

that are reviewed at least annually for possible impairment.

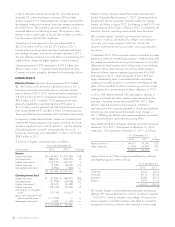

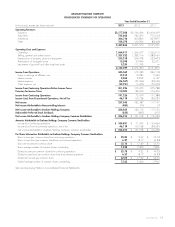

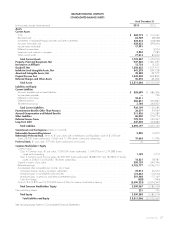

As of December 31

(in millions) 2013 2012

Goodwill and indefinite-lived intangible

assets .......................... $1,829.9 $1,857.6

Total assets ........................ $5,811.0 $5,105.1

Percentage of goodwill and indefinite-lived

intangible assets to total assets ........ 31% 36%

The Company performs its annual goodwill and intangible assets

impairment test as of November 30. Goodwill and other intangible

assets are reviewed for possible impairment between annual tests if

an event occurred or circumstances changed that would more likely

than not reduce the fair value of the reporting unit or other intangible

assets below its carrying value.

Goodwill

The Company tests its goodwill at the reporting unit level, which is

an operating segment or one level below an operating segment.

The Company initially performs an assessment of qualitative factors

to determine if it is necessary to perform the two-step goodwill

impairment test. The Company tests goodwill for impairment using

the two-step process if, based on its assessment of the qualitative

factors, it determines that it is more likely than not that the fair value

of a reporting unit is less than its carrying amount, or if it decides to

bypass the qualitative assessment. The first step of the goodwill

impairment test compares the estimated fair value of a reporting unit

with its carrying amount, including goodwill. This step is performed

to identify potential impairment, which occurs when the carrying

amount of the reporting unit exceeds its estimated fair value. The

second step of the goodwill impairment test is only performed when

there is a potential impairment and is performed to measure the

amount of impairment loss at the reporting unit. During the second

step, the Company allocates the estimated fair value of the

reporting unit to all of the assets and liabilities of the unit (including

any unrecognized intangible assets). The excess of the fair value of

the reporting unit over the amounts assigned to its assets and

liabilities is the implied fair value of goodwill. The amount of the

goodwill impairment is the difference between the carrying value of

the reporting unit’s goodwill and the implied fair value determined

during the second step.

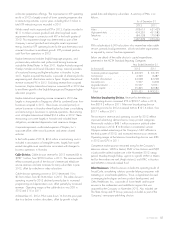

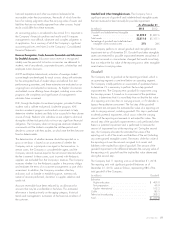

The Company had 11 reporting units as of December 31, 2013.

The reporting units with significant goodwill balances as of

December 31, 2013, were as follows, representing 98% of the

total goodwill of the Company:

(in millions) Goodwill

Education

Higher education ............................ $ 409.0

Test preparation ............................. 49.9

Kaplan international .......................... 512.2

Cable ...................................... 85.5

Television broadcasting ......................... 203.2

Total ....................................... $1,259.8

2013 FORM 10-K 49