Washington Post 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

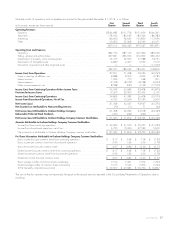

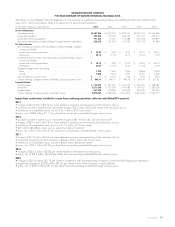

GRAHAM HOLDINGS COMPANY

FIVE-YEAR SUMMARY OF SELECTED HISTORICAL FINANCIAL DATA

See Notes to Consolidated Financial Statements for the summary of significant accounting policies and additional information relative to the

years 2011–2013 and refer to Note 3 for discussion of discontinued operations.

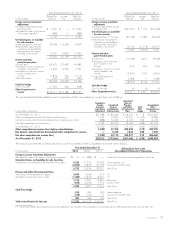

(in thousands, except per share amounts) 2013 2012 2011 2010 2009

Results of Operations

Operating revenues ................................................ $3,487,864 $3,455,570 $3,525,997 $3,935,725 $3,563,349

Income from operations ............................................. 345,565 179,180 334,118 601,577 453,010

Income from continuing operations ..................................... 191,226 72,059 151,388 354,933 263,819

Net income attributable to Graham Holdings Company common stockholders ..... 236,010 131,218 116,233 277,192 91,846

Per Share Amounts

Basic earnings per common share attributable to Graham Holdings Company

common stockholders

Income from continuing operations ................................... $ 25.83 $ 9.22 $ 19.03 $ 39.67 $ 28.15

Net income .................................................... 32.10 17.39 14.70 31.06 9.78

Diluted earnings per common share attributable to Graham Holdings Company

common stockholders

Income from continuing operations ................................... $ 25.78 $ 9.22 $ 19.03 $ 39.65 $ 28.15

Net income .................................................... 32.05 17.39 14.70 31.04 9.78

Weighted average shares outstanding:

Basic ........................................................ 7,238 7,360 7,826 8,869 9,332

Diluted ....................................................... 7,333 7,404 7,905 8,931 9,392

Cash dividends per common share .................................... $—$ 19.60 $ 9.40 $ 9.00 $ 8.60

Graham Holdings Company common stockholders’ equity per common share ..... $ 446.73 $ 348.17 $ 342.76 $ 343.47 $ 317.21

Financial Position

Working capital .................................................. $ 768,278 $ 327,476 $ 250,069 $ 353,621 $ 398,481

Total assets ...................................................... 5,811,046 5,105,069 5,016,986 5,158,367 5,186,206

Long-term debt ................................................... 447,608 453,384 452,229 396,650 396,236

Graham Holdings Company common stockholders’ equity ................... 3,300,067 2,586,028 2,601,896 2,814,364 2,939,550

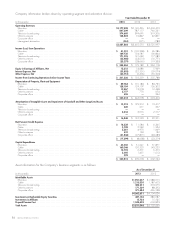

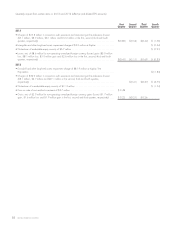

Impact from certain items included in income from continuing operations (after-tax and diluted EPS amounts):

2013

• charges of $25.3 million ($3.46 per share) related to severance and restructuring at the education division

• goodwill and other long-lived assets impairment charge of $3.2 million ($0.44 per share) at the education division

• write-down of a marketable equity security of $6.7 million ($0.91 per share)

• losses, net, of $8.6 million ($1.17 per share) from non-operating unrealized foreign currency losses

2012

• goodwill and other long-lived assets impairment charge of $81.9 million ($11.33 per share) at KTP

• charges of $32.9 million ($4.53 per share) related to severance and restructuring at the education division

• write-down of a marketable equity security of $11.2 million ($1.54 per share)

• $3.7 million ($0.48 per share) gain on sale of cost method investment

• gains, net, of $2.0 million ($0.27 per share) from non-operating unrealized foreign currency gains

2011

• charges of $17.9 million ($2.26 per share) related to severance and restructuring at the education division

• impairment charge at one of the Company’s affiliates of $5.7 million ($0.72 per share)

• write-down of a marketable equity security of $34.6 million ($4.34 per share)

• losses, net, of $2.1 million ($0.26 per share) from non-operating unrealized foreign currency losses

2010

• charges of $24.2 million ($2.83 per share) related to severance and restructuring

• gains, net, of $4.2 million ($0.47 per share) from non-operating unrealized foreign currency gains

2009

• charges of $20.6 million ($2.19 per share) in connection with the restructuring of Kaplan’s Score and Test Preparation operations

• impairment charges of $18.8 million ($2.00 per share) at two of the Company’s equity affiliates

• gains, net, of $10.3 million ($1.10 per share) from non-operating unrealized foreign currency gains

2013 FORM 10-K 89