Washington Post 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

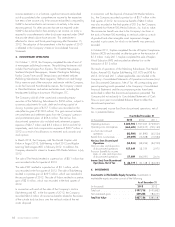

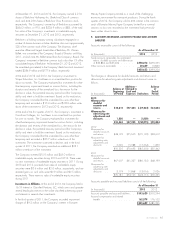

At December 31, 2013 and 2012, the Company owned 2,214

shares of Berkshire Hathaway Inc. (Berkshire) Class A common

stock and 424,250 shares of Berkshire Class B common stock,

respectively. The Company’s ownership of Berkshire accounted for

$444.2 million, or 91%, and $334.9 million, or 88%, of the total

fair value of the Company’s investments in marketable equity

securities at December 31, 2013 and 2012, respectively.

Berkshire is a holding company owning subsidiaries engaged in a

number of diverse business activities. Berkshire also owns approximately

23% of the common stock of the Company. The chairman, chief

executive officer and largest shareholder of Berkshire, Mr. Warren

Buffett, was a member of the Company’s Board of Directors until May

2011, at which time Mr. Buffett retired from the Company’s Board. The

Company’s investment in Berkshire common stock is less than 1% of the

consolidated equity of Berkshire. At December 31, 2013 and 2012,

the unrealized gain related to the Company’s Berkshire stock investment

totaled $286.9 million and $177.6 million, respectively.

At the end of 2013 and 2012, the Company’s investment in

Strayer Education, Inc. had been in an unrealized loss position for

about six months. The Company evaluated this investment for other-

than-temporary impairment based on various factors, including the

duration and severity of the unrealized loss, the reason for the

decline in value, the potential recovery period and the Company’s

ability and intent to hold the investment. Based on this evaluation,

the Company concluded that the unrealized loss was other-than-

temporary and recorded a $10.4 million and $18.0 million write-

down of the investment in 2013 and 2012, respectively.

At the end of the first quarter of 2011, the Company’s investment in

Corinthian Colleges, Inc. had been in an unrealized loss position

for over six months. The Company evaluated this investment for

other-than-temporary impairment based on various factors, including

the duration and severity of the unrealized loss, the reason for the

decline in value, the potential recovery period and the Company’s

ability and intent to hold the investment. Based on this evaluation,

the Company concluded that the unrealized loss was other-than-

temporary and recorded a $30.7 million write-down of the

investment. The investment continued to decline, and in the third

quarter of 2011, the Company recorded an additional $23.1

million write-down of the investment.

The Company invested $15.0 million and $45.0 million in

marketable equity securities during 2013 and 2012. There were

no new investments of marketable equity securities in 2011. During

2013 and 2012, proceeds from sales of marketable equity

securities were $3.6 million and $2.0 million, respectively, and net

realized gains on such sales were $0.9 million and $0.5 million,

respectively. There were no sales of marketable equity securities

during 2011.

Investments in Affiliates. At the end of 2013, the Company held a

16.5% interest in Classified Ventures, LLC, which owns and operates

several leading businesses in the online classified advertising space

and interests in several other investments.

In the third quarter of 2011, the Company recorded impairment

charges of $9.2 million on the Company’s interest in Bowater

Mersey Paper Company Limited as a result of the challenging

economic environment for newsprint producers. During the fourth

quarter of 2012, the Company sold its 49% interest in the common

stock of Bowater Mersey Paper Company Limited for a nominal

amount; no loss was recorded as the investment had previously

been written down to zero.

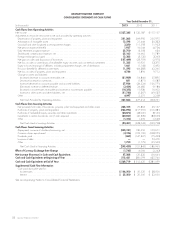

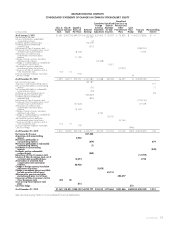

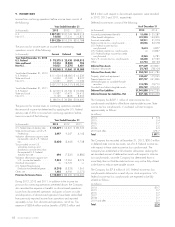

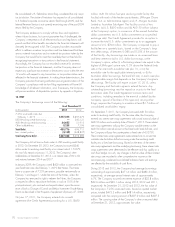

5. ACCOUNTS RECEIVABLE, ACCOUNTS PAYABLE AND ACCRUED

LIABILITIES

Accounts receivable consist of the following:

As of December 31

(in thousands) 2013 2012

Trade accounts receivable, less estimated

returns, doubtful accounts and allowances

of $33,834 and $35,462 ........... $398,014 $379,355

Other accounts receivable ............. 30,639 19,849

$428,653 $399,204

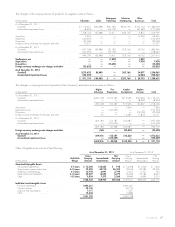

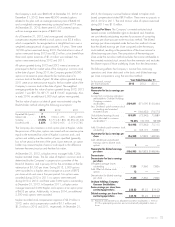

The changes in allowance for doubtful accounts and returns and

allowance for advertising rate adjustments and discounts were as

follows:

(in thousands)

Balance at

Beginning

of Period

Additions –

Charged to

Costs and

Expenses Deductions

Balance

at

End of

Period

2013

Allowance for

doubtful

accounts and

returns ...... $33,612 $57,245 $(57,023) $33,834

Allowance for

advertising rate

adjustments and

discounts ..... 1,850 — (1,850) —

$35,462 $57,245 $(58,873) $33,834

2012

Allowance for

doubtful accounts

and returns .... $48,199 $55,605 $(70,192) $33,612

Allowance for

advertising rate

adjustments and

discounts ...... 2,026 15,088 (15,264) 1,850

$50,225 $70,693 $(85,456) $35,462

2011

Allowance for

doubtful accounts

and returns .... $67,007 $61,327 $(80,135) $48,199

Allowance for

advertising rate

adjustments and

discounts ...... 3,174 11,868 (13,016) 2,026

$70,181 $73,195 $(93,151) $50,225

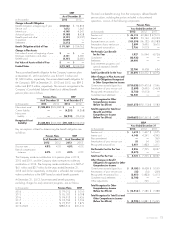

Accounts payable and accrued liabilities consist of the following:

As of December 31

(in thousands) 2013 2012

Accounts payable and accrued liabilities . . . $343,620 $310,294

Accrued compensation and related

benefits ..........................

162,079 176,102

$505,699 $486,396

2013 FORM 10-K 65