Washington Post 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

online test preparation offerings. The improvement in KTP operating

results in 2012 is largely a result of lower operating expenses due

to restructuring activities in prior years, including $12.5 million in

total KTP restructuring costs recorded in 2011.

While overall results improved at KTP in 2012, Kaplan recorded a

$111.6 million noncash goodwill and other long-lived assets

impairment charge in connection with KTP in the fourth quarter of

2012. This impairment charge was determined as part of the

Company’s annual goodwill and intangible assets impairment

testing, based on KTP operating losses for the past three years and

a recent slowdown in enrollment growth. KTP produced positive

cash flow from operations in 2012.

Kaplan International includes English-language programs, and

postsecondary education and professional training businesses

outside the United States. In May 2011, Kaplan Australia acquired

Franklyn Scholar and Carrick Education Group, national providers

of vocational training and higher education in Australia. In June

2011, Kaplan acquired Structuralia, a provider of e-learning for the

engineering and infrastructure sector in Spain. Kaplan International

revenue increased 9% in 2012. Excluding revenue from acquired

businesses, Kaplan International revenue increased 4% in 2012 due

to enrollment growth in the English-language and Singapore higher

education programs.

Kaplan International operating income increased in 2012 due

largely to strong results in Singapore, offset by combined losses from

businesses acquired in 2011. These losses occurred primarily at

certain businesses in Australia where Kaplan has been consolidating

and restructuring its businesses to optimize operations. Restructuring

costs at Kaplan International totaled $16.4 million in 2012. These

restructuring costs were largely in Australia and included lease

obligations, accelerated depreciation and severance charges.

Corporate represents unallocated expenses of Kaplan, Inc.’s

corporate office, other minor businesses and certain shared

activities.

In the fourth quarter of 2012, $2.6 million in restructuring costs is

included in amortization of intangible assets, largely from accel-

erated intangible asset amortization associated with changes to

business operations in Australia.

Cable Division. Cable division revenue for 2012 increased 4% to

$787.1 million, from $760.2 million in 2011. The revenue results

reflect continued growth of the division’s Internet and telephone

service revenues and rate increases for many subscribers in June

2012, offset by a decline in video subscribers.

Cable division operating income in 2012 decreased 1% to

$154.6 million, from $156.8 million in 2011. The cable division’s

operating income for 2012 declined primarily due to increased

programming and depreciation costs, offset partially by increased

revenues. Operating margin at the cable division was 20% in

2012 and 21% in 2011.

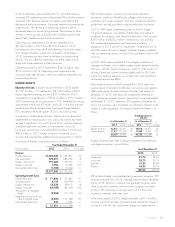

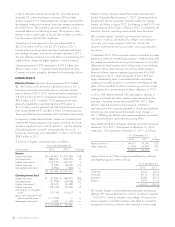

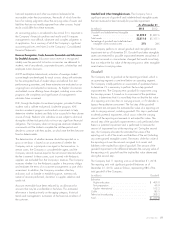

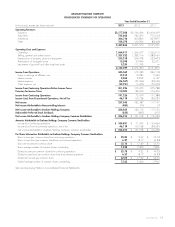

At December 31, 2012, PSUs were down 1% from the prior year

due to a decline in video subscribers, offset by growth in high-

speed data and telephony subscribers. A summary of PSUs is as

follows:

As of December 31

2012 2011

Video .......................... 593,615 621,423

High-speed data .................. 459,235 451,082

Telephony ...................... 184,528 179,989

Total ......................... 1,237,378 1,252,494

PSUs include about 6,000 subscribers who receive free video cable

service, primarily local governments, schools and other organizations

as required by various franchise agreements.

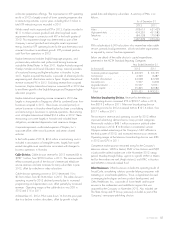

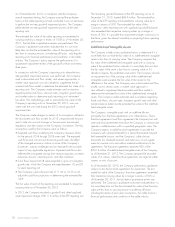

Below are details of the cable division’s capital expenditures,

presented in the NCTA Standard Reporting Categories:

Year Ended December 31

(in thousands) 2012 2011

Customer premise equipment ....... $ 43,629 $ 53,139

Commercial ................... 4,549 3,487

Scalable infrastructure ............ 24,048 34,748

Line extensions ................. 5,997 6,318

Upgrade/rebuild ............... 16,957 12,951

Support capital ................. 55,345 32,582

Total ....................... $150,525 $143,225

Television Broadcasting Division. Revenue for the television

broadcasting division increased 25% to $399.7 million in 2012,

from $319.2 million in 2011. Television broadcasting division

operating income for 2012 increased 64% to $191.6 million, from

$117.1 million in 2011.

The increase in revenue and operating income for 2012 reflects

improved advertising demand across many product categories.

These results include a $48.1 million increase in political adver-

tising revenue in 2012; $10.8 million in incremental summer

Olympics-related advertising at the Company’s NBC affiliates in

the third quarter of 2012; and increased retransmission revenues.

Operating margin at the television broadcasting division was 48%

in 2012 and 37% in 2011.

Competitive market position remained strong for the Company’s

television stations. WDIV in Detroit, KSAT in San Antonio and WJXT

in Jacksonville ranked number one in the November 2012 ratings

period, Monday through Friday, sign-on to sign-off; WPLG in Miami

tied for the number one rank (Anglo stations), and KPRC in Houston

and WKMG in Orlando ranked third.

Other Businesses. Other businesses includes the operating results of

SocialCode, a marketing solutions provider helping companies with

marketing on social-media platforms; Trove, a digital team focused

on emerging technologies and new product development; and

Celtic Healthcare, Inc., a provider of home health and hospice

services in the northeastern and mid-Atlantic regions that was

acquired by the Company in November 2012. Also included are

The Slate Group and FP Group, previously included as part of the

Company’s newspaper publishing division.

2013 FORM 10-K 45