Washington Post 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

that stock awarded to a participant will be forfeited and revert to

Company ownership if the participant’s employment terminates

before the end of a specified period of service to the Company.

Some of the awards are also subject to performance and market

conditions and will be forfeited and revert to Company ownership if

the conditions are not met. At December 31, 2013, there were

471,800 shares reserved for issuance under the 2012 incentive

compensation plan. Of this number, 91,029 shares were subject to

stock awards and stock options outstanding and 380,771 shares

were available for future awards.

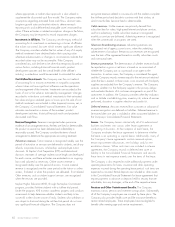

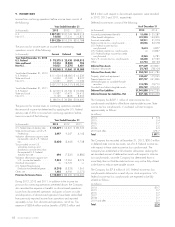

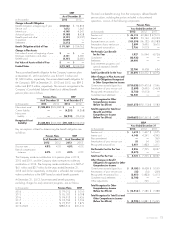

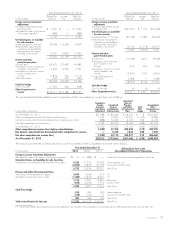

Activity related to stock awards under these incentive compensation

plans was as follows:

Year Ended December 31

2013 2012 2011

Number

of

Shares

Average

Grant-

Date

Fair

Value

Number

of

Shares

Average

Grant-

Date

Fair

Value

Number

of

Shares

Average

Grant-

Date

Fair

Value

Beginning of year,

unvested ... 207,917 $350.21 77,319 $424.45 48,359 $498.95

Awarded..... 70,165 562.29 145,348 321.56 44,030 432.09

Vested....... (71,585) 515.09 (7,134) 499.06 (13,132) 722.67

Forfeited ..... (92,018) 300.86 (7,616) 417.79 (1,938) 436.31

End of Year,

Unvested ... 114,479 424.65 207,917 350.21 77,319 424.45

In connection with the sale of the Publishing Subsidiaries, the

Company modified the terms of 86,824 share awards affecting

102 employees. The modification resulted in the acceleration of the

vesting period for 45,374 share awards, the elimination of a

market condition and vesting terms of 15,000 share awards, and

the forfeiture of 26,450 share awards; the effect of which are

reflected in the above activity. The Company also offered some

employees with 26,124 share awards the option to settle their

awards in cash resulting in a modification of these awards from

equity awards to liability awards. The Company paid employees

$13.1 million for the settlement of these liability awards. The

Company recorded incremental stock compensation expense, net of

forfeitures, amounting to $19.9 million, which is included in income

(loss) from discontinued operations, net of tax, in the consolidated

statement of operations.

For the share awards outstanding at December 31, 2013, the afore-

mentioned restriction will lapse in 2014 for 10,250 shares, in 2015

for 32,453 shares, in 2016 for 21,515 shares and in 2017 for

50,261 shares. Also, in early 2014, the Company made stock

awards of 750 shares. Stock-based compensation costs resulting from

Company stock awards were $35.2 million, $11.4 million and $8.9

million in 2013, 2012 and 2011, respectively.

As of December 31, 2013, there was $29.6 million of total unrecog-

nized compensation expense related to these awards. That cost is

expected to be recognized on a straight-line basis over a weighted

average period of 2.1 years.

Stock Options. The Company’s 2003 employee stock option plan

reserves 1,900,000 shares of the Company’s Class B common

stock for options to be granted under the plan. The purchase price

of the shares covered by an option cannot be less than the fair

value on the grant date. Options generally vest over four years and

have a maximum term of 10 years. At December 31, 2013, there

were 101,194 shares reserved for issuance under this stock option

plan, which were all subject to options outstanding.

Stock options granted under the 2012 Plan cannot be less than the

fair value on the grant date, and generally vest over four years and

have a maximum term of 10 years.

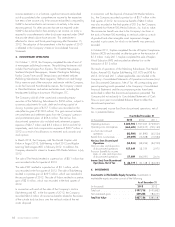

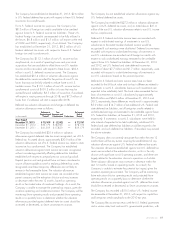

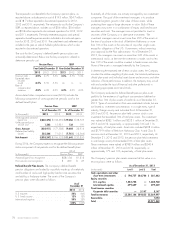

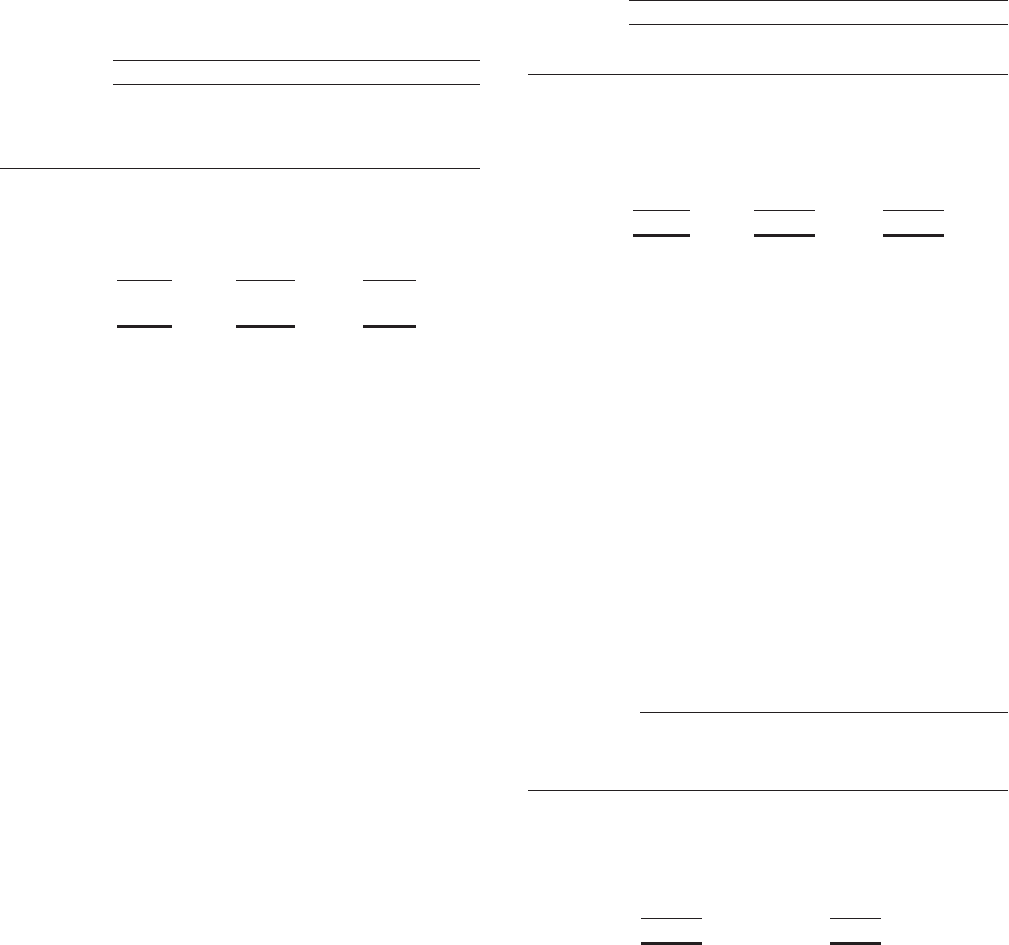

Activity related to options outstanding was as follows:

Year Ended December 31

2013 2012 2011

Number

of

Shares

Average

Option

Price

Number

of

Shares

Average

Option

Price

Number

of

Shares

Average

Option

Price

Beginning

of year .... 125,694 $478.32 129,044 $494.95 87,919 $495.05

Granted ..... 15,000 373.03 7,500 378.00 51,000 499.45

Exercised .... (14,500) 391.83 ————

Expired or

forfeited . . . (4,500) 637.53 (10,850) 605.82 (9,875) 519.04

End of Year .. 121,694 469.76 125,694 478.32 129,044 494.95

In connection with the sale of the Publishing Subsidiaries, the

Company modified the terms of 4,500 stock options affecting

six employees. The modification resulted in the acceleration of the

vesting period for 4,250 stock options and the forfeiture of

250 stock options. The Company recorded incremental stock option

expense amounting to $0.8 million, which is included in income

(loss) from discontinued operations, net of tax, in the consolidated

statement of operations.

Of the shares covered by options outstanding at the end of

2013, 73,194 are now exercisable; 21,500 will become

exercisable in 2014; 17,875 will become exercisable in 2015;

5,375 will become exercisable in 2016; and 3,750 will

become exercisable in 2017. For 2013, 2012 and 2011, the

Company recorded expense of $3.5 million, $2.9 million and

$2.7 million related to stock options, respectively. Information

related to stock options outstanding and exercisable at

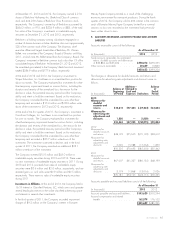

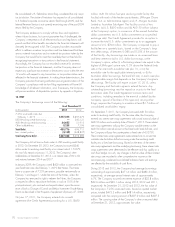

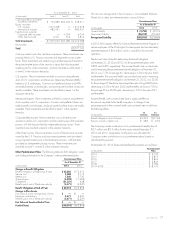

December 31, 2013, is as follows:

Options Outstanding Options Exercisable

Range of

Exercise

Prices

Shares

Outstanding

at

12/31/2013

Weighted

Average

Remaining

Contractual

Life (years)

Weighted

Average

Exercise

Price

Shares

Exercisable

at

12/31/2013

Weighted

Average

Remaining

Contractual

Life (years)

Weighted

Average

Exercise

Price

$369–396 . . . 44,000 7.6 $380.96 20,500 6.3 $384.82

419–439 . . . 17,694 5.4 421.75 17,694 5.4 421.75

503 . . . 50,000 7.2 502.58 25,000 7.2 502.58

652 . . . 2,000 4.4 651.91 2,000 4.4 651.91

730 . . . 5,000 2.9 729.67 5,000 2.9 729.67

954 . . . 3,000 1.0 953.50 3,000 1.0 953.50

121,694 6.7 469.76 73,194 5.9 488.13

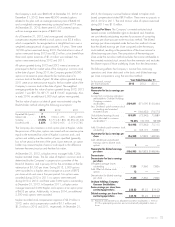

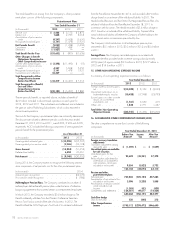

At December 31, 2013, the intrinsic value for all options outstand-

ing, exercisable and unvested was $24.8 million, $14.0 million

and $10.7 million, respectively. The intrinsic value of a stock

option is the amount by which the market value of the underlying

stock exceeds the exercise price of the option. The market value of

72 GRAHAM HOLDINGS COMPANY