Washington Post 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

income statement or in a footnote, significant amounts reclassified

out of accumulated other comprehensive income by the respective

line items of net income only if the amount reclassified is required by

GAAP to be reclassified to net income in its entirety in the same

reporting period. For other amounts that are not required under

GAAP to be reclassified in their entirety to net income, an entity is

required to cross-reference to other disclosures required under GAAP

that provide details about those amounts. This amendment is

effective for interim and fiscal years beginning after December 15,

2012. The adoption of the amendment in the first quarter of 2013

is reflected in the Company’s Notes to Consolidated Financial

Statements.

3. DISCONTINUED OPERATIONS

On October 1, 2013, the Company completed the sale of most of

its newspaper publishing businesses. The publishing businesses sold

include The Washington Post, Express, The Gazette Newspapers,

Southern Maryland Newspapers, Greater Washington Publishing,

Fairfax County Times and El Tiempo Latino and related websites

(Publishing Subsidiaries). Slate magazine, TheRoot.com and Foreign

Policy were not part of the transaction and remain with the Company,

as do the Trove and SocialCode businesses, the Company’s interest

in Classified Ventures and certain real estate assets, including the

headquarters building in downtown Washington, DC.

The Company sold all of the issued and outstanding equity

securities of the Publishing Subsidiaries for $250 million, subject to

customary adjustments for cash, debt and working capital at

closing. A pre-tax gain of $157.5 million was recorded on the

sale (after-tax gain of $100.0 million). This gain amount includes

net curtailment and settlement gains from the Company’s pension

and postretirement plans of $56.6 million. The net loss from

discontinued operations also included early retirement program

expense of $22.7 million and $8.5 million in 2013 and 2012,

respectively, and stock compensation expense of $20.7 million in

2013 as a result of modifications to restricted stock awards and

stock options.

In March 2013, the Company sold The Herald. Kaplan sold

Kidum in August 2012, EduNeering in April 2012 and Kaplan

Learning Technologies (KLT) in February 2012. In addition, the

Company divested its interest in Avenue100 Media Solutions in July

2012.

The sale of The Herald resulted in a pre-tax loss of $0.1 million that

was recorded in the first quarter of 2013.

The sale of KLT resulted in a pre-tax loss of $3.1 million, which

was recorded in the first quarter of 2012. The sale of EduNeering

resulted in a pre-tax gain of $29.5 million, which was recorded in

the second quarter of 2012. The sale of Kidum resulted in a pre-tax

gain of $3.6 million, which was recorded in the third quarter of

2012.

In connection with each of the sales of the Company’s stock in

EduNeering and KLT, in the first quarter of 2012, the Company

recorded $23.2 million of income tax benefits related to the excess

of the outside stock tax basis over the net book value of the net

assets disposed.

In connection with the disposal of Avenue100 Media Solutions,

Inc., the Company recorded a pre-tax loss of $5.7 million in the

third quarter of 2012. An income tax benefit of $44.5 million

was also recorded in the third quarter of 2012 as the Company

determined that Avenue100 Media Solutions, Inc. had no value.

The income tax benefit was due to the Company’s tax basis in

the stock of Avenue100 exceeding its net book value as a result

of goodwill and other intangible asset impairment charges

recorded in prior years, for which no tax benefit was previously

recorded.

In October 2011, Kaplan completed the sale of Kaplan Compliance

Solutions (KCS) and recorded an after-tax gain on the transaction of

$1.5 million. In July 2011, Kaplan completed the sale of Kaplan

Virtual Education (KVE) and recorded an after-tax loss on the

transaction of $1.2 million.

The results of operations of the Publishing Subsidiaries, The Herald,

Kidum, Avenue100, Kaplan EduNeering, KLT, KCS and KVE for

2013, 2012 and 2011, where applicable, are included in the

Company’s Consolidated Statements of Operations as Income (Loss)

from Discontinued Operations, Net of Tax. All corresponding prior

period operating results presented in the Company’s Consolidated

Financial Statements and the accompanying notes have been

reclassified to reflect the discontinued operations presented. The

Company did not reclassify its Consolidated Statements of Cash

Flows or prior year Consolidated Balance Sheet to reflect the

discontinued operations.

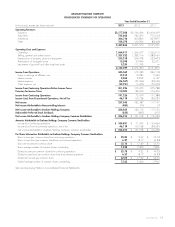

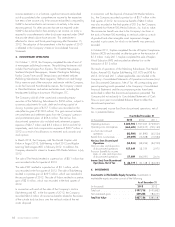

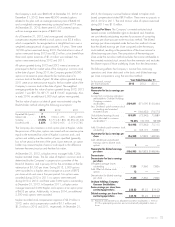

The summarized income (loss) from discontinued operations, net of

tax, is presented below:

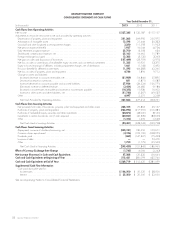

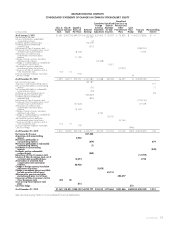

Year Ended December 31

(in thousands) 2013 2012 2011

Operating revenues ......... $ 382,705 $ 597,425 $ 723,605

Operating costs and expenses . .

(465,605) (639,315) (769,129)

Loss from discontinued

operations .............. (82,900) (41,890) (45,524)

Benefit from income taxes ..... (29,059) (13,668) (10,934)

Net Loss from Discontinued

Operations ............. (53,841) (28,222) (34,590)

Gain on sales and disposition

of discontinued operations . . 157,449 23,759 2,975

Provision (benefit) for income

taxes on sales and disposition

of discontinued operations . . 57,489 (64,591) 2,616

Income (Loss) from Discontinued

Operations, Net of Tax .....

$ 46,119 $ 60,128 $ (34,231)

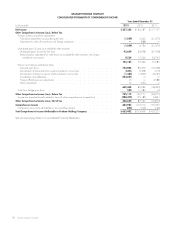

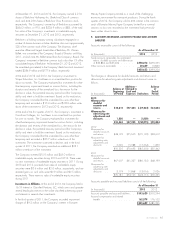

4. INVESTMENTS

Investments in Marketable Equity Securities. Investments in

marketable equity securities consist of the following:

As of December 31

(in thousands) 2013 2012

Total cost .......................... $197,718 $195,832

Net unrealized gains ................. 289,438 184,255

Total Fair Value ..................... $487,156 $380,087

64 GRAHAM HOLDINGS COMPANY