Time Magazine 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

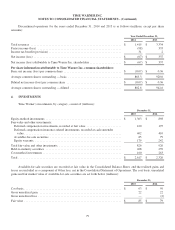

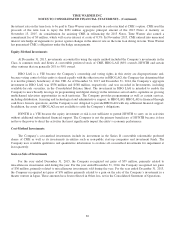

Investment Writedowns

For the years ended December 31, 2015, 2014 and 2013, the Company incurred writedowns to reduce the carrying

value of certain investments that experienced other-than-temporary impairments, as set forth below (millions):

December 31,

2015 2014 2013

Equity-method investments ........................................... $ 2 $ 21 $ 5

Cost-method investments ............................................. 6 8 5

Available-for-sale securities ........................................... 19 6 7

Total ............................................................. $ 27 $ 35 $ 17

These amounts have been reflected in Other loss, net in the Consolidated Statement of Operations.

While Time Warner has recognized all declines that are believed to be other-than-temporary as of December 31, 2015,

it is reasonably possible that individual investments in the Company’s portfolio may experience other-than-temporary

declines in value in the future if the underlying investees experience poor operating results or the U.S. or certain foreign

equity markets experience declines in value.

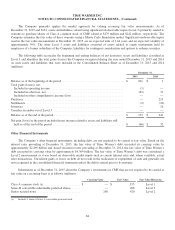

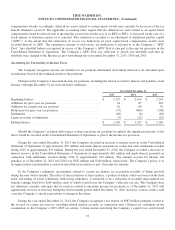

5. FAIR VALUE MEASUREMENTS

A fair value measurement is determined based on the assumptions that a market participant would use in pricing an

asset or liability. A three-tiered hierarchy draws distinctions between market participant assumptions based on (i) observable

inputs such as quoted prices in active markets (Level 1), (ii) inputs other than quoted prices in active markets that are

observable either directly or indirectly (Level 2) and (iii) unobservable inputs that require the Company to use present value

and other valuation techniques in the determination of fair value (Level 3). The following table presents information about

assets and liabilities required to be carried at fair value on a recurring basis as of December 31, 2015 and December 31, 2014,

respectively (millions):

December 31, 2015 December 31, 2014

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Assets:

Trading securities:

Diversified equity

securities (a) ...... $ 179 $ — $ — $ 179 $ 232 $ 5 $ — $ 237

Available-for-sale

securities:

Equity securities ..... 15——1519——19

Debt securities ...... — 70 — 70 — 60 — 60

Derivatives:

Foreign exchange

contracts ......... —79—79—61—61

Other .............. — — 180 180 — — 247 247

Liabilities:

Derivatives:

Foreign exchange

contracts ......... — (2) — (2) — (3) — (3)

Other .............. — — (7) (7) — — (6) (6)

Total .............. $ 194 $ 147 $ 173 $ 514 $ 251 $ 123 $ 241 $ 615

(a) Consists of investments related to deferred compensation.

83