Time Magazine 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

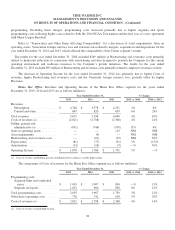

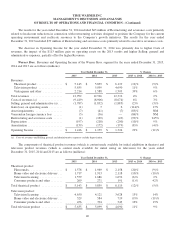

2014 vs. 2013

Refer to “Transactions and Other Items Affecting Comparability” for a discussion of Asset impairments, Gain on

operating assets, the Curtailment and external costs related to mergers, acquisitions and dispositions for the years ended

December 31, 2014 and 2013, which affected the comparability of Corporate’s results.

The results for the year ended December 31, 2014 included $31 million of Restructuring and severance costs primarily

related to headcount reductions in connection with restructuring activities designed to position the Company for the current

operating environment and reallocate resources to the Company’s growth initiatives.

Excluding the transactions noted above, Operating Loss for the year ended December 31, 2014 increased primarily due

to the absence of a benefit associated with a reduction in certain accrued employee benefit plan liabilities in 2013.

Selling, general and administrative expenses included costs related to enterprise efficiency initiatives of $43 million

and $49 million for the years ended December 31, 2014 and 2013, respectively.

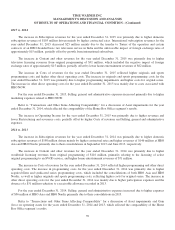

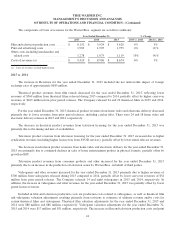

FINANCIAL CONDITION AND LIQUIDITY

Management believes that cash generated by or available to the Company should be sufficient to fund its capital and

liquidity needs for the foreseeable future, including scheduled debt repayments, quarterly dividend payments and the

purchase of common stock under the Company’s stock repurchase program. Time Warner’s sources of cash include Cash

provided by operations, Cash and equivalents on hand, available borrowing capacity under its committed credit facilities and

commercial paper program and access to capital markets. Time Warner’s unused committed capacity at December 31, 2015

was $7.177 billion, which included $2.155 billion of Cash and equivalents.

Current Financial Condition

At December 31, 2015, Time Warner had net debt of $21.637 billion ($23.792 billion of debt less $2.155 billion of

Cash and equivalents) and $23.619 billion of Shareholders’ equity, compared to net debt of $19.763 billion ($22.381 billion

of debt less $2.618 billion of Cash and equivalents) and $24.476 billion of Shareholders’ equity at December 31, 2014.

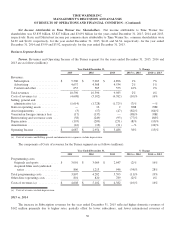

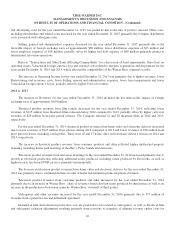

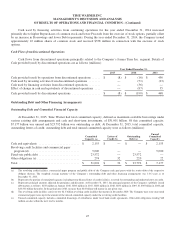

The following table shows the significant items contributing to the increase in net debt from December 31, 2014 to

December 31, 2015 (millions):

Balance at December 31, 2014............................................................. $ 19,763

Cash provided by operations from continuing operations ........................................ (3,851)

Capital expenditures ..................................................................... 423

Repurchases of common stock ............................................................. 3,632

Dividends paid to common stockholders ..................................................... 1,150

Investments and acquisitions, net of cash acquired ............................................. 713

Proceeds from the exercise of stock options .................................................. (165)

Other investment proceeds ................................................................ (141)

All other, net ........................................................................... 113

Balance at December 31, 2015............................................................. $ 21,637

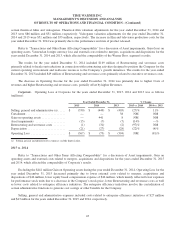

On June 13, 2014, Time Warner’s Board of Directors authorized up to $5.0 billion of share repurchases in addition to

the $5.0 billion it had previously authorized for share repurchases beginning January 1, 2014. In January 2016, Time

Warner’s Board of Directors authorized up to $5.0 billion of share repurchases beginning January 1, 2016, including the

amount remaining under the prior authorization. Purchases under the stock repurchase program may be made from time to

44