Time Magazine 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

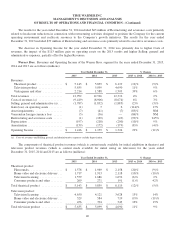

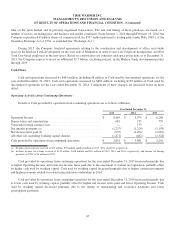

(c) The references to Note 8 and Note 16 refer to the notes to the accompanying consolidated financial statements.

(d) The Turner segment enters into contracts to license sports programming to carry on its television networks. The amounts in the table include

minimum payment obligations to sports leagues and organizations (e.g., NBA, NCAA, MLB) to air the programming over the contract period.

Included in the table is $10.7 billion payable to the NBA over the 9 years remaining on its agreements, $7.3 billion payable to the NCAA over the 9

years remaining on the agreement, which does not include amounts recoupable from CBS, and $2.0 billion payable to MLB over the 6 years

remaining on the agreement. The Turner and Home Box Office segments also enter into licensing agreements with certain production studios to

acquire the rights to air motion pictures and television series. The pricing structures in these contracts differ in that some agreements require a fixed

amount per film or television series and others are based on a percentage of the film’s box office receipts (with license fees generally capped at

specified amounts), or a combination of both. The amounts included in the table represent obligations for television series and films that had been

released theatrically as of December 31, 2015 and are calculated using the actual or estimated box office performance or fixed amounts, based on the

applicable agreement.

(e) The Company’s commitments under creative talent and employment agreements include obligations to executives, actors, producers, writers, and

other talent under contractual arrangements, including union contracts and contracts with other organizations that represent such creative talent.

(f) Other purchase obligations principally include: (1) advertising, marketing, distribution and sponsorship obligations, including minimum guaranteed

royalty and marketing payments to vendors and content providers; (2) obligations related to the Company’s postretirement and unfunded defined

benefit pension plans; (3) obligations to purchase information technology licenses and services; (4) purchases of DVD and Blu-ray Discs pursuant to

a duplication and replication agreement; (5) obligations related to payments to the NCAA for Basketball Fan Festival rights at the Turner segment;

and (6) obligations to purchase general and administrative items and services.

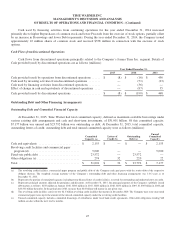

The Company’s material contractual obligations at December 31, 2015 include:

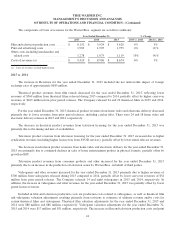

• Purchase obligations — represents an agreement to purchase goods or services that is enforceable and legally

binding on the Company and that specifies all significant terms, including: fixed or minimum quantities to be

purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction. The

purchase obligation amounts do not represent all anticipated purchases, but represent only those purchases the

Company is contractually obligated to make. The Company also purchases products and services as needed, with

no firm commitment. For this reason, the amounts presented in the table alone do not provide a reliable indication

of all of the Company’s expected future cash outflows. For purposes of identifying and accumulating purchase

obligations, all material contracts meeting the definition of a purchase obligation have been included. For those

contracts involving a fixed or minimum quantity, but with variable pricing terms, the Company has estimated the

contractual obligation based on its best estimate of the pricing that will be in effect at the time the obligation is

incurred. Additionally, the Company has included only the obligations under the contracts as they existed at

December 31, 2015, and has not assumed that the contracts will be renewed or replaced at the end of their

respective terms. If a contract includes a penalty for non-renewal, the Company has included that penalty,

assuming it will be paid in the period after the contract expires. If Time Warner can unilaterally terminate an

agreement simply by providing a certain number of days notice or by paying a termination fee, the Company has

included the amount of the termination fee or the amount that would be paid over the “notice period.” Contracts

that can be unilaterally terminated without incurring a penalty have not been included. In addition, as of

December 31, 2015, the Company expects to invest an additional $1.7 billion, excluding interest, in costs related to

the construction of its new headquarters building at Hudson Yards through 2019. Because substantially all of this

amount is based on actual costs incurred for the Company’s portion of the project and there are neither fixed nor

minimum cost provisions in the project agreements, such projected spending amounts have not been included.

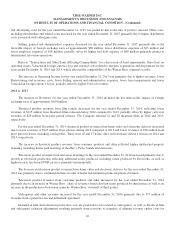

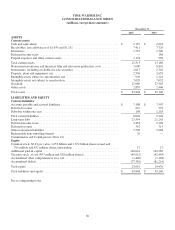

• Outstanding debt obligations — represents the principal amounts due on outstanding debt obligations as of

December 31, 2015. Amounts do not include any fair value adjustments, bond premiums, discounts, interest

payments or dividends.

• Interest — represents amounts due based on the outstanding debt balances, interest rates and maturity schedules of

the respective instruments as of December 31, 2015. The amount of interest ultimately paid on these instruments

may differ based on changes in interest rates.

• Capital lease obligations — represents the minimum lease payments under noncancelable capital leases, primarily

for certain transponder leases at the Home Box Office and Turner segments.

50