Time Magazine 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

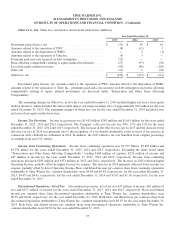

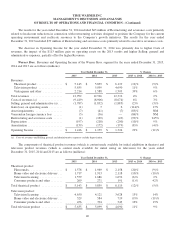

Asset Impairments

During the year ended December 31, 2015, the Company recognized asset impairments of $15 million at Corporate

primarily related to an asset held for disposal and certain internally developed software, $7 million at Warner Bros. primarily

related to certain internally developed software and $3 million at the Turner segment related to miscellaneous assets.

During the year ended December 31, 2014, the Company recognized asset impairments of $17 million at the Turner

segment related to miscellaneous assets; $4 million at the Home Box Office segment related to an international tradename;

and $41 million at the Warner Bros. segment, including $12 million related to a tradename, and the remaining amount

primarily related to various fixed assets and certain internally developed software; and $7 million at Corporate related to

certain internally developed software.

During the year ended December 31, 2013, the Company recorded noncash impairments of $47 million at the Turner

segment, of which $18 million related to certain of Turner’s international intangible assets, $18 million related to a building,

$10 million related to programming assets resulting from Turner’s decision to shut down certain of its entertainment

networks in Spain and Belgium and $1 million related to miscellaneous assets, $7 million at the Warner Bros. segment

related to miscellaneous assets and $7 million at Corporate related to certain internally developed software.

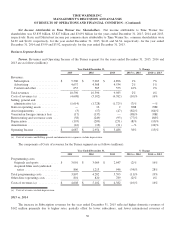

Gain (Loss) on Operating Assets, Net

For the year ended December 31, 2015, the Company recognized losses on operating assets of $1 million at the Warner

Bros. segment.

For the year ended December 31, 2014, the Company recognized net gains on operating assets of $464 million,

including $16 million of net gains at the Turner segment, consisting of a $13 million gain related to the sale of Zite, Inc., a

news content aggregation and recommendation platform, a $4 million gain related to the sale of certain fixed assets, a $3

million loss related to the shutdown of a business and a $2 million gain primarily related to the sale of a building in South

America; a $7 million gain at the Warner Bros. segment primarily related to the sale of certain fixed assets; and a $441

million gain at Corporate in connection with the sale and leaseback of the Company’s space in Time Warner Center.

For the year ended December 31, 2013, the Company recognized net gains on operating assets of $129 million,

including a $2 million gain at the Turner segment on the sale of a building, a $104 million gain at the Home Box Office

segment upon Home Box Office’s acquisition of its former partner’s interests in HBO Asia and HBO South Asia

(collectively, “HBO Asia”), a $9 million gain at the Home Box Office segment upon Home Box Office’s acquisition of its

former partner’s interest in HBO Nordic, a $6 million gain at the Warner Bros. segment related to miscellaneous operating

assets and an $8 million gain at Corporate on the disposal of certain corporate assets.

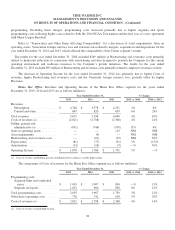

Venezuelan Foreign Currency Loss

For the year ended December 31, 2015, the Company recognized a pretax foreign exchange loss of $22 million,

consisting of $17 million at the Turner segment and $5 million at the Warner Bros. segment, related to a change in the

foreign currency exchange rate used by the Company for remeasuring its Venezuelan net monetary assets from the SICAD 2

rate to the Simadi rate. See “Recent Developments” for more information.

For the year ended December 31, 2014, the Company recognized a pretax foreign exchange loss of $173 million,

consisting of $137 million at the Turner segment and $36 million at the Warner Bros. segment, related to a change in the

foreign currency exchange rate used by the Company for remeasuring its Venezuelan net monetary assets from the official

rate to the SICAD 2 exchange rate.

30