Time Magazine 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

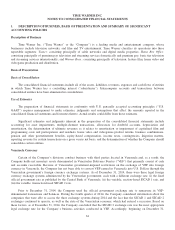

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

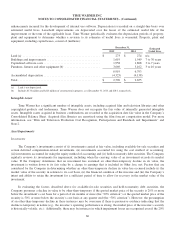

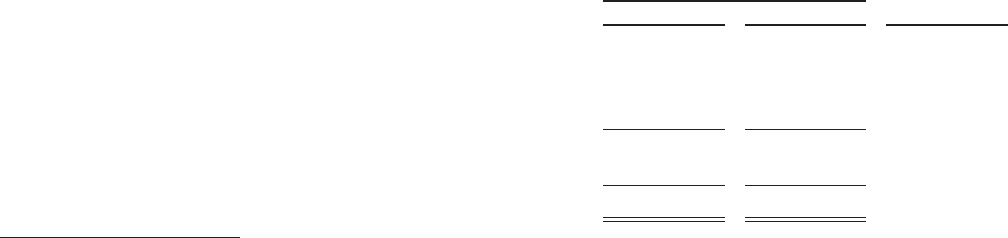

enhancements incurred for the development of internal use software. Depreciation is recorded on a straight-line basis over

estimated useful lives. Leasehold improvements are depreciated over the lesser of the estimated useful life of the

improvement or the term of the applicable lease. Time Warner periodically evaluates the depreciation periods of property,

plant and equipment to determine whether a revision to its estimates of useful lives is warranted. Property, plant and

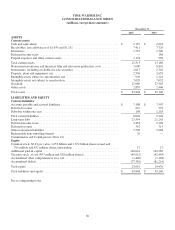

equipment, including capital leases, consist of (millions):

December 31, Estimated

Useful Lives2015 2014

Land (a) ................................................... $ 273 $ 274 n/a

Buildings and improvements ................................... 1,619 1,549 7 to 30 years

Capitalized software costs ..................................... 1,958 1,868 3 to 7 years

Furniture, fixtures and other equipment (b) ....................... 3,069 3,102 3 to 10 years

6,919 6,793

Accumulated depreciation ..................................... (4,323) (4,138)

Total ...................................................... $ 2,596 $ 2,655

(a) Land is not depreciated.

(b) Includes $174 million and $223 million of construction in progress as of December 31, 2015 and 2014, respectively.

Intangible Assets

Time Warner has a significant number of intangible assets, including acquired film and television libraries and other

copyrighted products and tradenames. Time Warner does not recognize the fair value of internally generated intangible

assets. Intangible assets acquired in business combinations are recorded at the acquisition date fair value in the Company’s

Consolidated Balance Sheet. Acquired film libraries are amortized using the film forecast computation model. For more

information, see “Film and Television Production Cost Recognition, Participations and Residuals and Impairments” and

Note 2.

Asset Impairments

Investments

The Company’s investments consist of (i) investments carried at fair value, including available-for-sale securities and

certain deferred compensation-related investments, (ii) investments accounted for using the cost method of accounting,

(iii) investments accounted for using the equity method of accounting and (iv) held-to-maturity debt securities. The Company

regularly reviews its investments for impairment, including when the carrying value of an investment exceeds its market

value. If the Company determines that an investment has sustained an other-than-temporary decline in its value, the

investment is written down to its fair value by a charge to earnings that is included in Other loss, net. Factors that are

considered by the Company in determining whether an other-than-temporary decline in value has occurred include (i) the

market value of the security in relation to its cost basis, (ii) the financial condition of the investee and (iii) the Company’s

intent and ability to retain the investment for a sufficient period of time to allow for recovery in the market value of the

investment.

In evaluating the factors described above for available-for-sale securities and held-to-maturity debt securities, the

Company presumes a decline in value to be other-than-temporary if the quoted market price of the security is 20% or more

below the investment’s cost basis for a period of six months or more (the “20% criterion”) or the quoted market price of the

security is 50% or more below the security’s cost basis at any quarter end (the “50% criterion”). However, the presumption

of an other-than-temporary decline in these instances may be overcome if there is persuasive evidence indicating that the

decline is temporary in nature (e.g., the investee’s operating performance is strong, the market price of the investee’s security

is historically volatile, etc.). Additionally, there may be instances in which impairment losses are recognized even if the 20%

66