Time Magazine 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

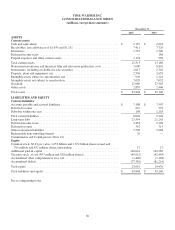

Investing Activities from Continuing Operations

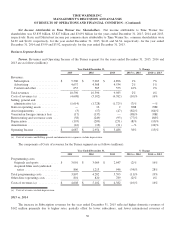

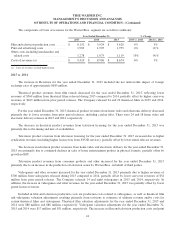

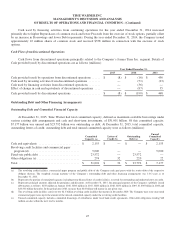

Details of Cash provided (used) by investing activities from continuing operations are as follows (millions):

Year Ended December 31,

2015 2014 2013

Investments in available-for-sale securities ........................ $ (41) $ (30) $ (27)

Investments and acquisitions, net of cash acquired:

Hudson Yards ............................................. (304) (102) —

iStreamPlanet ............................................. (148) — —

CME .................................................... — (396) (288)

Eyeworks ................................................ — (267) —

All other ................................................. (220) (185) (207)

Capital expenditures ........................................ (423) (474) (568)

Proceeds from available-for-sale securities ........................ 2 25 33

Proceeds from Time Inc. in the Time Separation .................... — 1,400 —

Proceeds from the sale of Time Warner Center ..................... — 1,264 —

Other investment proceeds ..................................... 141 148 170

Cash provided (used) by investing activities ....................... $ (993) $ 1,383 $ (887)

The change in Cash provided (used) by investing activities from continuing operations for the years ended December

31, 2015 and 2014 was primarily due to proceeds received in 2014 in connection with the Time Separation and from the sale

of space in Time Warner Center. The remaining change in Cash provided (used) by investing activities from continuing

operations for the years ended December 31, 2015 and 2014 was primarily due to the change in investment and acquisition

spending.

Financing Activities from Continuing Operations

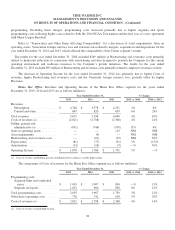

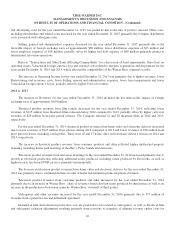

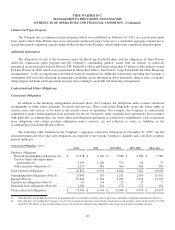

Details of Cash used by financing activities from continuing operations are as follows (millions):

Year Ended December 31,

2015 2014 2013

Borrowings ................................................. $ 3,768 $ 2,409 $ 1,028

Debt repayments ............................................. (2,344) (72) (762)

Proceeds from the exercise of stock options ....................... 165 338 674

Excess tax benefit from equity instruments ........................ 151 179 179

Principal payments on capital leases ............................. (11) (11) (9)

Repurchases of common stock .................................. (3,632) (5,504) (3,708)

Dividends paid .............................................. (1,150) (1,109) (1,074)

Other financing activities ...................................... (260) (173) (111)

Cash used by financing activities ................................ $ (3,313) $ (3,943) $ (3,783)

Cash used by financing activities from continuing operations for the year ended December 31, 2015 decreased

primarily due to a decrease in Repurchases of common stock and an increase in Borrowings, partially offset by an increase in

Debt repayments. During the year ended December 31, 2015, the Company issued approximately 5 million shares of

common stock and received $165 million in connection with the exercise of stock options. At December 31, 2015,

substantially all of the approximately 21 million exercisable stock options outstanding on such date had exercise prices below

the closing price of the Company’s common stock on the New York Stock Exchange.

46