Time Magazine 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

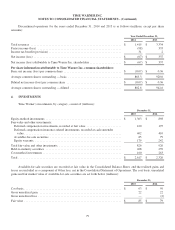

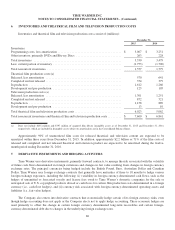

Gains and losses reclassified from Accumulated other comprehensive loss, net to Other loss, net in the Consolidated

Statement of Operations are determined based on the specific identification method.

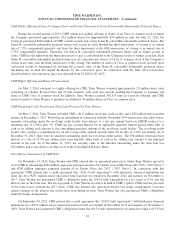

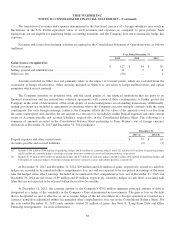

Investment in Hudson Yards Development Project

During 2015, the Company finalized agreements relating to the construction and development of office and studio

space in the Hudson Yards development on the west side of Manhattan in order to move its Corporate headquarters and New

York City-based employees to the new space. The Company will fund its proportionate share of the costs for the construction

and development through HYNTH, a limited liability company that is controlled by the developer and managed by an

affiliate of the developer. As of December 31, 2015 and 2014, the Company’s investment in HYNTH, which is accounted for

under the equity method of accounting, was approximately $438 million and $102 million, respectively, and is included in

Investments, including available-for-sale securities in the Consolidated Balance Sheet. Based on construction cost estimates

and space projections as of December 31, 2015, the Company expects to invest an additional $1.7 billion, excluding interest,

in the Hudson Yards development project through 2019.

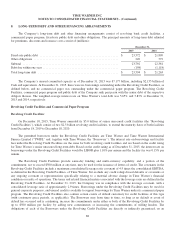

CME

As of December 31, 2015, the Company had an approximate 49.4% voting interest in CME’s common stock and an

approximate 75.7% economic interest in CME on a diluted basis.

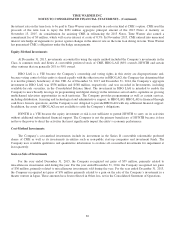

As of December 31, 2015, the Company owned 61.4 million shares of CME’s Class A common stock and 1 share of

Series A convertible preferred stock, which is convertible into 11.2 million shares of CME’s Class A common stock and

votes with the Class A common stock on an as-converted basis. The Company accounts for its investment in CME’s Class A

common stock and Series A convertible preferred stock under the equity method of accounting.

As of December 31, 2015, the Company owned all of the outstanding shares of CME’s Series B convertible

redeemable preferred shares, which are non-voting and may be converted into 99.5 million shares of CME’s Class A

common stock at the Company’s option at any time after June 25, 2016. The Company accounts for its investment in CME’s

Series B convertible redeemable preferred shares under the cost method of accounting.

As of December 31, 2015, the Company owned 3.4 million of CME’s 15% senior secured notes due 2017 (the “Senior

Secured Notes”), each consisting of a $100 principal amount plus accrued interest. The Senior Secured Notes are accounted

for at their amortized cost and classified as held-to-maturity in the Consolidated Balance Sheet. At December 31, 2015, the

carrying value of the Senior Secured Notes was $268 million.

As of December 31, 2015, the Company held 101 million warrants each to purchase one share of CME Class A

common stock. The warrants have a four-year term that expires in May 2018 and an exercise price of $1.00 per share, do not

contain any voting rights and are not exercisable until May 2016. The warrants are subject to a limited right whereby the

Company can exercise any of its warrants earlier solely to own up to 49.9% of CME’s Class A common stock. The warrants

are carried at fair value in the Consolidated Balance Sheet. The initial fair value of the warrants was recognized as a discount

to the Senior Secured Notes and the term loan provided by the Company to CME (as described below) and a deferred gain

related to the revolving credit facility provided by the Company to CME (as described below). At December 31, 2015, the

carrying value of the warrants was $179 million.

As of December 31, 2015, the Company has guaranteed an aggregate amount of €486 million of CME’s obligations (as

described below). In connection with these guarantees, the Company recognized a liability at the inception of each respective

arrangement based on the estimated fair value of the guarantee. At December 31, 2015, the carrying value of liabilities

associated with such guarantees was $66 million.

80