Time Magazine 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

the interest rate on the term loan, to be paid to Time Warner semi-annually in cash or in kind at CME’s option. CME used the

proceeds of the term loan to repay the $261 million aggregate principal amount of the 2015 Notes at maturity on

November 15, 2015. As consideration for assisting CME in refinancing the 2015 Notes, Time Warner also earned a

commitment fee of $9 million, which will accrue interest at a rate of 8.5%. In November 2015, CME entered into unsecured

interest rate hedge arrangements to protect against changes in the interest rate on the term loan during its term. Time Warner

has guaranteed CME’s obligations under the hedge arrangements.

Equity-Method Investments

At December 31, 2015, investments accounted for using the equity method included the Company’s investments in the

Class A common stock and Series A convertible preferred stock of CME, HBO LAG (88% owned), HYNTH and certain

other ventures that are generally 20% to 50% owned.

HBO LAG is a VIE because the Company’s ownership and voting rights in this entity are disproportionate and,

because voting control of this entity is shared equally with the other investor in HBO LAG, the Company has determined that

it is not the primary beneficiary of this VIE. As of December 31, 2015 and December 31, 2014, the Company’s aggregate

investment in HBO LAG was $558 million and $568 million, respectively, and was recorded in Investments, including

available-for-sale securities, in the Consolidated Balance Sheet. The investment in HBO LAG is intended to enable the

Company to more broadly leverage its programming and digital strategy in the territories served and to capitalize on growing

multichannel television opportunities in such territories. The Company provides programming as well as certain services,

including distribution, licensing and technological and administrative support, to HBO LAG. HBO LAG is financed through

cash flows from its operations, and the Company is not obligated to provide HBO LAG with any additional financial support.

In addition, the assets of HBO LAG are not available to settle the Company’s obligations.

HYNTH is a VIE because the equity investment at risk is not sufficient to permit HYNTH to carry on its activities

without additional subordinated financial support. The Company is not the primary beneficiary of HYNTH because it does

not have the power to direct the activities that most significantly impact the entity’s economic performance.

Cost-Method Investments

The Company’s cost-method investments include its investment in the Series B convertible redeemable preferred

shares of CME as well as its investments in entities such as non-public start-up companies and investment funds. The

Company uses available qualitative and quantitative information to evaluate all cost-method investments for impairment at

least quarterly.

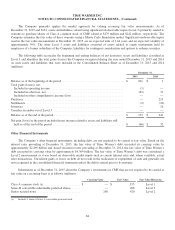

Gain on Sale of Investments

For the year ended December 31, 2015, the Company recognized net gains of $59 million, primarily related to

miscellaneous investments sold during the year. For the year ended December 31, 2014, the Company recognized net gains

of $36 million, primarily related to miscellaneous investments sold during the year. For the year ended December 31, 2013,

the Company recognized net gains of $76 million primarily related to a gain on the sale of the Company’s investment in a

theater venture in Japan. These amounts have been reflected in Other loss, net in the Consolidated Statement of Operations.

82