Time Magazine 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

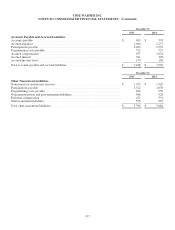

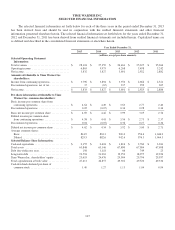

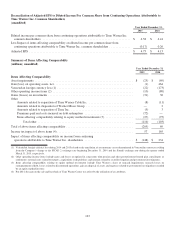

Reconciliation of Adjusted EPS to Diluted Income Per Common Share from Continuing Operations Attributable to

Time Warner Inc. Common Shareholders

(unaudited)

Year Ended December 31,

2015 2014

Diluted income per common share from continuing operations attributable to Time Warner Inc.

common shareholders .......................................................... $ 4.58 $ 4.41

Less Impact of items affecting comparability on diluted income per common share from

continuing operations attributable to Time Warner Inc. common shareholders .............. (0.17) 0.26

Adjusted EPS ................................................................... $ 4.75 $ 4.15

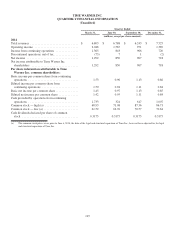

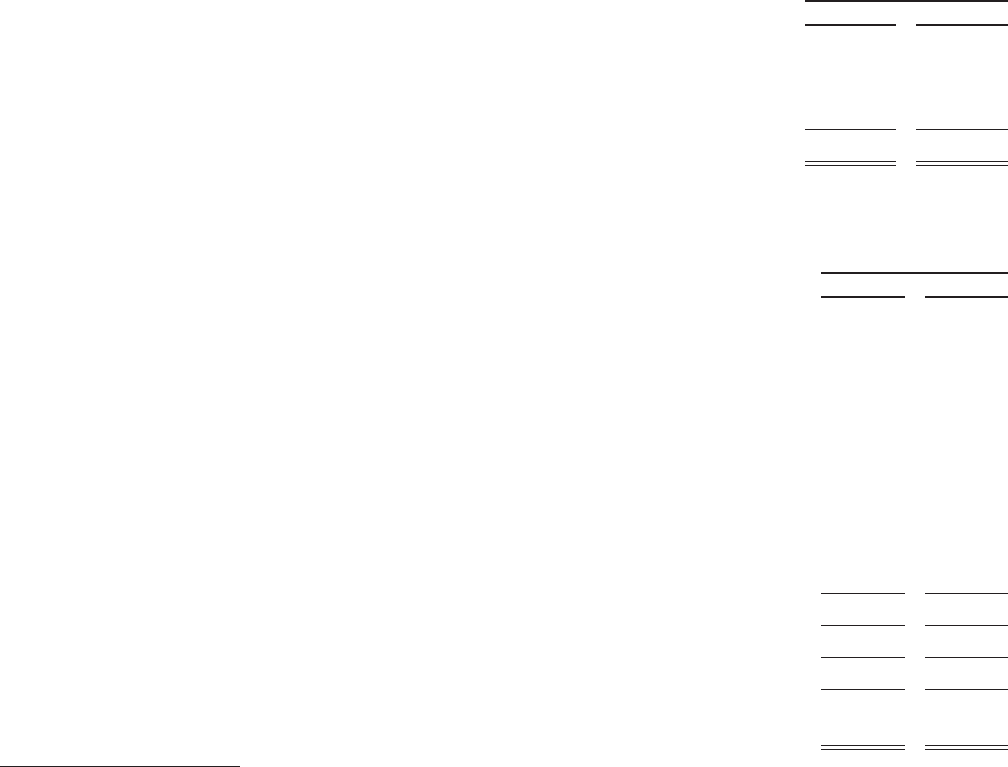

Summary of Items Affecting Comparability

(millions; unaudited)

Year Ended December 31,

2015 2014

Items Affecting Comparability

Asset impairments ................................................................. $ (25) $ (69)

Gain (loss) on operating assets, net .................................................... (1) 464

Venezuelan foreign currency loss (1) .................................................. (22) (173)

Other operating income items (2) ..................................................... (10) (80)

Gains (losses) on investments ........................................................ (31) 30

Other

Amounts related to separation of Time Warner Cable Inc. ............................. (8) (11)

Amounts related to disposition of Warner Music Group ............................... — 2

Amounts related to separation of Time Inc. ......................................... (9) 3

Premiums paid and costs incurred on debt redemption ................................ (72) —

Items affecting comparability relating to equity method investments (3) .................. (27) (97)

Total other ............................................................... (116) (103)

Total of above items affecting comparability ............................................ (205) 69

Income tax impact of above items (4) .................................................. 57 165

Impact of items affecting comparability on income from continuing

operations attributable to Time Warner Inc. shareholders ................................ $ (148) $ 234

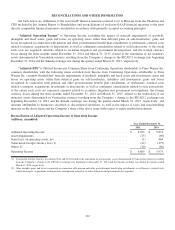

(1) Venezuelan foreign currency loss during 2014 and 2015 related to the translation of net monetary assets denominated in Venezuelan currency resulting

from the Company’s change to the SICAD 2 exchange rate beginning December 31, 2014 and the Simadi exchange rate during the quarter ended

March 31, 2015, respectively.

(2) Other operating income items include gains and losses recognized in connection with pension and other postretirement benefit plan curtailments or

settlements; external costs related to mergers, acquisitions or dispositions; and amounts related to securities litigation and government investigations.

(3) Items affecting comparability relating to equity method investments include Time Warner’s share of noncash impairments, noncash losses on

extinguishment of debt, losses related to discontinued operations, gain on disposal of assets and expenses related to government investigations recorded

by an equity method investee.

(4) For 2014, the gain on the sale and leaseback of Time Warner Center was offset by the utilization of tax attributes.

123