Time Magazine 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

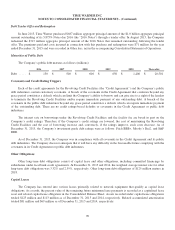

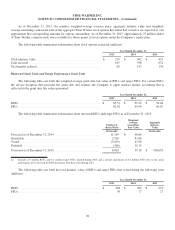

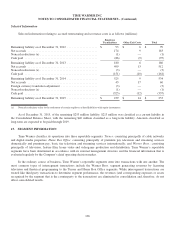

Equity-Based Compensation Expense

The impact on Operating income for equity-based compensation awards is as follows (millions):

Year Ended December 31,

2015 2014 2013

Stock options ............................................... $ 39 $ 26 $ 33

RSUs and PSUs ............................................. 143 193 205

Total impact on operating income ............................... $ 182 $ 219 $ 238

Tax benefit recognized ....................................... $ 64 $ 76 $ 78

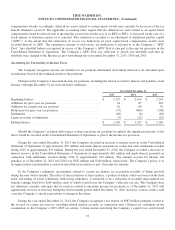

Total unrecognized compensation cost related to unvested Time Warner stock option awards as of December 31, 2015,

without taking into account expected forfeitures, is $67 million and is expected to be recognized over a weighted-average

period between 1 and 2 years. Total unrecognized compensation cost related to unvested RSUs and target PSUs as of

December 31, 2015, without taking into account expected forfeitures, is $177 million and is expected to be recognized over a

weighted-average period between 1 and 2 years.

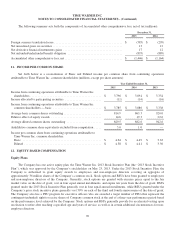

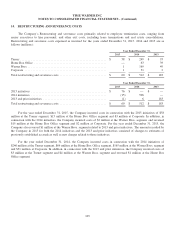

13. BENEFIT PLANS

Retirement Plan Amendments

Effective after June 30, 2010, the Company’s domestic defined benefit pension plans were closed to new hires and

employees with less than one year of service, and participating employees stopped accruing additional years of service for

purposes of determining the benefits provided by the plans (though crediting years of service for purposes of vesting and

eligibility for early retirement benefits continues). Effective December 31, 2013, pay increases are no longer taken into

consideration when determining a participating employee’s benefits under the plans.

In July 2013, the Company’s Board of Directors approved amendments to the Time Warner Group Health

Plan. Pursuant to the amendments, (i) subsidized medical benefits provided to eligible retired employees (and their eligible

dependents) were discontinued for all future retirees who were employed on December 31, 2013 and who would not meet the

eligibility criteria by December 31, 2015 and (ii) effective January 1, 2014, post-65 retiree medical coverage was

discontinued and eligible retirees (and their eligible dependents) were moved to coverage provided in the individual health

insurance market.

99