Time Magazine 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

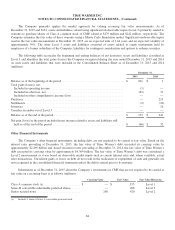

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

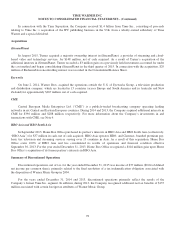

In connection with the Time Separation, the Company received $1.4 billion from Time Inc., consisting of proceeds

relating to Time Inc.’s acquisition of the IPC publishing business in the U.K. from a wholly-owned subsidiary of Time

Warner and a special dividend.

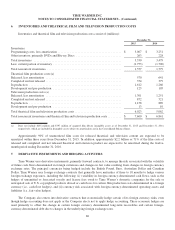

Acquisitions

iStreamPlanet

In August 2015, Turner acquired a majority ownership interest in iStreamPlanet, a provider of streaming and cloud-

based video and technology services, for $148 million, net of cash acquired. As a result of Turner’s acquisition of the

additional interests in iStreamPlanet, Turner recorded a $3 million gain on a previously held investment accounted for under

the cost method and began consolidating iStreamPlanet in the third quarter of 2015. In connection with the acquisition, $29

million of Redeemable noncontrolling interest was recorded in the Consolidated Balance Sheet.

Eyeworks

On June 2, 2014, Warner Bros. acquired the operations outside the U.S. of Eyeworks Group, a television production

and distribution company, which are located in 15 countries (across Europe and South America and in Australia and New

Zealand) for approximately $267 million, net of cash acquired.

CME

Central European Media Enterprises Ltd. (“CME”) is a publicly-traded broadcasting company operating leading

networks in six Central and Eastern European countries. During 2014 and 2013, the Company acquired additional interests in

CME for $396 million and $288 million, respectively. For more information about the Company’s investments in and

transactions with CME, see Note 4.

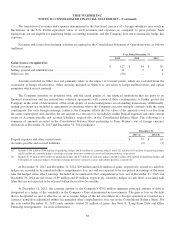

HBO Asia and HBO South Asia

In September 2013, Home Box Office purchased its partner’s interests in HBO Asia and HBO South Asia (collectively,

“HBO Asia”) for $37 million in cash, net of cash acquired. HBO Asia operates HBO- and Cinemax- branded premium pay,

basic tier television and streaming services serving over 15 countries in Asia. As a result of this acquisition, Home Box

Office owns 100% of HBO Asia and has consolidated its results of operations and financial condition effective

September 30, 2013. For the year ended December 31, 2013, Home Box Office recognized a $104 million gain upon Home

Box Office’s acquisition of its former partner’s interests in HBO Asia.

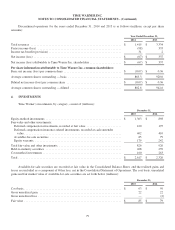

Summary of Discontinued Operations

Discontinued operations, net of tax, for the year ended December 31, 2015 was income of $37 million ($0.04 of diluted

net income per common share), primarily related to the final resolution of a tax indemnification obligation associated with

the disposition of Warner Music Group in 2004.

For the years ended December 31, 2014 and 2013, discontinued operations primarily reflect the results of the

Company’s former Time Inc. segment. In addition, during 2013, the Company recognized additional net tax benefits of $137

million associated with certain foreign tax attributes of Warner Music Group.

78