Time Magazine 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

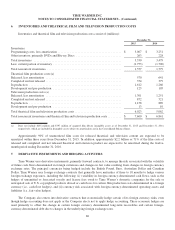

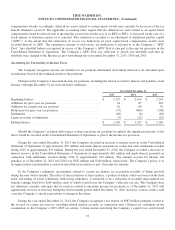

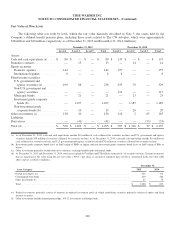

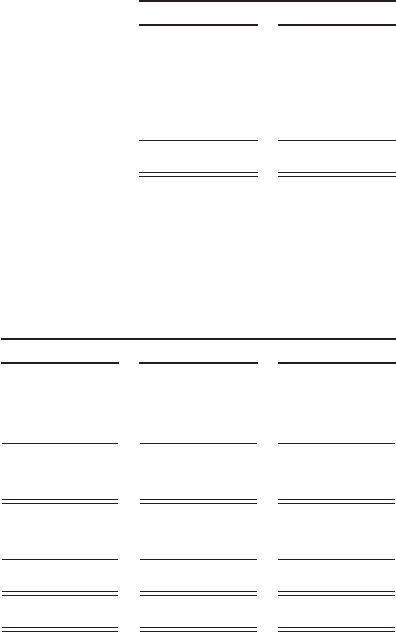

The following summary sets forth the components of Accumulated other comprehensive loss, net of tax (millions):

December 31,

2015 2014

Foreign currency translation losses ............................................. $ (583) $ (299)

Net unrealized gains on securities .............................................. 13 12

Net derivative financial instruments gains ....................................... 17 12

Net unfunded/underfunded benefit obligation .................................... (893) (889)

Accumulated other comprehensive loss, net ...................................... $ (1,446) $ (1,164)

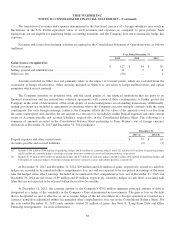

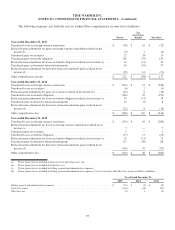

11. INCOME PER COMMON SHARE

Set forth below is a reconciliation of Basic and Diluted income per common share from continuing operations

attributable to Time Warner Inc. common shareholders (millions, except per share amounts):

Year Ended December 31,

2015 2014 2013

Income from continuing operations attributable to Time Warner Inc.

shareholders ............................................... $ 3,796 $ 3,894 $ 3,354

Income allocated to participating securities ........................ (11) (14) (16)

Income from continuing operations attributable to Time Warner Inc.

common shareholders — basic ................................ $ 3,785 $ 3,880 $ 3,338

Average basic common shares outstanding ......................... 814.9 863.3 920.0

Dilutive effect of equity awards ................................. 14.6 19.3 22.6

Average diluted common shares outstanding ....................... 829.5 882.6 942.6

Antidilutive common share equivalents excluded from computation ..... 5.0 1.0 —

Income per common share from continuing operations attributable to

Time Warner Inc. common shareholders:

Basic .................................................... $ 4.64 $ 4.49 $ 3.63

Diluted ................................................... $ 4.58 $ 4.41 $ 3.56

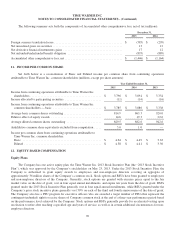

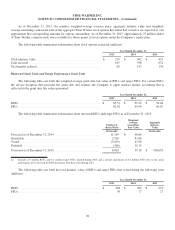

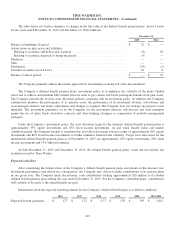

12. EQUITY-BASED COMPENSATION

Equity Plans

The Company has one active equity plan, the Time Warner Inc. 2013 Stock Incentive Plan (the “2013 Stock Incentive

Plan”), which was approved by the Company’s stockholders on May 23, 2013. Under the 2013 Stock Incentive Plan, the

Company is authorized to grant equity awards to employees and non-employee directors covering an aggregate of

approximately 36 million shares of the Company’s common stock. Stock options and RSUs have been granted to employees

and non-employee directors of the Company. Generally, stock options are granted with exercise prices equal to the fair

market value on the date of grant, vest in four equal annual installments, and expire ten years from the date of grant. RSUs

granted under the 2013 Stock Incentive Plan generally vest in four equal annual installments, while RSUs granted under the

Company’s prior stock incentive plans generally vest 50% on each of the third and fourth anniversaries of the date of grant.

The Company also has a PSU program for executive officers who are awarded a target number of PSUs that represent the

contingent (unfunded) right to receive shares of Company common stock at the end of a three-year performance period based

on the performance level achieved by the Company. Stock options and RSUs generally provide for accelerated vesting upon

an election to retire after reaching a specified age and years of service, as well as in certain additional circumstances for non-

employee directors.

96