Time Magazine 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

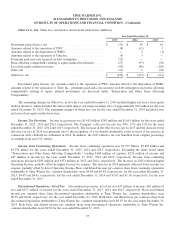

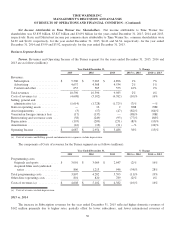

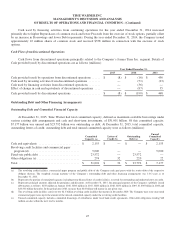

The components of Costs of revenues for the Warner Bros. segment are as follows (millions):

Year Ended December 31, % Change

2015 2014 2013 2015 vs. 2014 2014 vs. 2013

Film and television production costs ...... $ 6,152 $ 5,924 $ 5,620 4% 5%

Print and advertising costs .............. 1,989 1,907 1,935 4% (1)%

Other costs, including merchandise and

related costs ....................... 1,278 1,075 1,119 19% (4)%

Costs of revenues (a) .................. $ 9,419 $ 8,906 $ 8,674 6% 3%

(a) Costs of revenues exclude depreciation.

2015 vs. 2014

The increase in Revenues for the year ended December 31, 2015 included the net unfavorable impact of foreign

exchange rates of approximately $685 million.

Theatrical product revenues from film rentals decreased for the year ended December 31, 2015, reflecting lower

revenues of $560 million from theatrical films released during 2015 compared to 2014, partially offset by higher carryover

revenues of $169 million from prior period releases. The Company released 24 and 22 theatrical films in 2015 and 2014,

respectively.

For the year ended December 31, 2015, theatrical product revenues from home video and electronic delivery decreased

primarily due to lower revenues from prior period releases, including catalog titles. There were 24 and 18 home video and

electronic delivery releases in 2015 and 2014, respectively.

The decrease in theatrical product revenues from television licensing for the year ended December 31, 2015 was

primarily due to the timing and mix of availabilities.

Television product revenues from television licensing for the year ended December 31, 2015 increased due to higher

syndication revenues (including higher license fees from SVOD services), partially offset by lower initial telecast revenues.

The decrease in television product revenues from home video and electronic delivery for the year ended December 31,

2015 was primarily due to continued declines in sales of home entertainment product in physical formats, partially offset by

growth in EST.

Television product revenues from consumer products and other increased for the year ended December 31, 2015

primarily due to an increase in the production of television series by Warner Bros. on behalf of third parties.

Videogames and other revenues increased for the year ended December 31, 2015 primarily due to higher revenues of

$706 million from videogames released during 2015 compared to 2014, partially offset by lower carryover revenues of $54

million from prior period releases. The Company released 14 and eight videogames in 2015 and 2014, respectively. In

addition, the increase in videogames and other revenues for the year ended December 31, 2015 was partially offset by lower

patent license revenues.

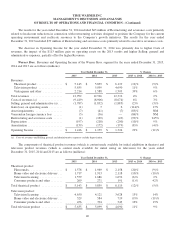

Included in film and television production costs are production costs related to videogames, as well as theatrical film

and videogame valuation adjustments resulting primarily from revisions to estimates of ultimate revenue and/or costs for

certain theatrical films and videogames. Theatrical film valuation adjustments for the year ended December 31, 2015 and

2014 were $80 million and $86 million, respectively. Videogame valuation adjustments for the year ended December 31,

2015 and 2014 were $17 million and $51 million, respectively. The increase in film and television production costs and print

41