Time Magazine 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

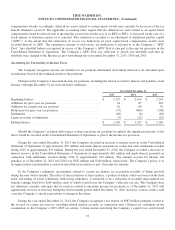

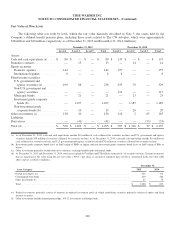

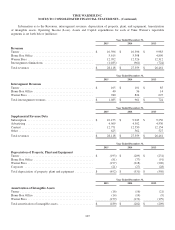

Components of Net Periodic Benefit Costs from Continuing Operations (millions)

December 31,

2015 2014 2013

Service cost (a) ...................................................... $ 4 $ 3 $ 3

Interest cost ......................................................... 83 91 79

Expected return on plan assets .......................................... (90) (95) (85)

Amortization of prior service cost ........................................ 1 1 1

Amortization of net loss ............................................... 17 14 16

Net periodic benefit costs (b) ........................................... $ 15 $ 14 $ 14

(a) Amounts relate to various international benefit plans.

(b) Excludes net periodic benefit costs/(income) related to discontinued operations of $5 million, $3 million and $(2) million during the years ended

December 31, 2015, 2014 and 2013, respectively.

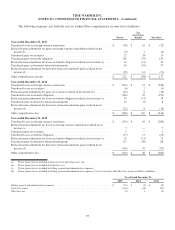

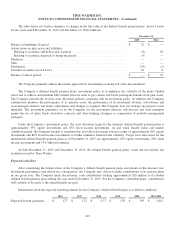

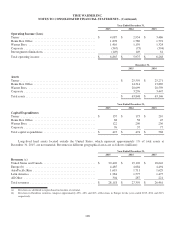

Assumptions

Weighted-average assumptions used to determine benefit obligations and net periodic benefit costs for the years ended

December 31:

Benefit Obligations Net Periodic Benefit Costs

2015 2014 2013 2015 2014 2013

Discount rate ....................... 4.59% 4.10% 4.90% 4.10% 4.89% 4.07%

Rate of compensation increase ......... 5.45% 5.34% 5.60% 5.35% 5.59% 3.98%

Expected long-term return on plan

assets ........................... n/a n/a n/a 5.84% 6.01% 5.95%

The discount rates were determined by matching the plan’s liability cash flows to rates derived from high-quality

corporate bonds available at the measurement date.

In developing the expected long-term rate of return on plan assets, the Company considered long-term historical rates

of return, the Company’s plan asset allocations as well as the opinions and outlooks of investment professionals and

consulting firms.

101