Time Magazine 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

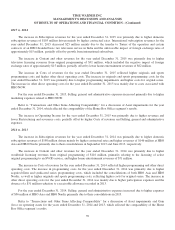

On February 10, 2015, Venezuelan government officials announced changes to Venezuela’s foreign currency exchange

system. Those changes included the elimination of the SICAD 2 exchange due to the merger of the SICAD 1 and SICAD 2

exchanges into a single SICAD exchange as well as the creation of the Simadi exchange, which is a new free market foreign

currency exchange. On their initial date of activity, the exchange rates published by the Central Bank of Venezuela were

12 VEF to each U.S. Dollar for the SICAD exchange and 170 VEF to each U.S. Dollar for the Simadi exchange. Given the

restrictions associated with the official government rate and the SICAD exchange, starting on February 10, 2015, the

Company began to use the Simadi exchange rate to remeasure its VEF-denominated transactions and balances and

recognized a pretax foreign exchange loss of $22 million in the Consolidated Statement of Operations during the year ended

December 31, 2015. As of December 31, 2014, the Company used the SICAD 2 exchange rate to remeasure its VEF-

denominated monetary assets, and, for the year ended December 31, 2014, recognized a pre-tax foreign exchange loss of

$173 million in the accompanying Consolidated Statement of Operations.

RESULTS OF OPERATIONS

Recent Accounting Guidance

See Note 1, “Description of Business, Basis of Presentation and Summary of Significant Accounting Policies,” to the

accompanying consolidated financial statements for a discussion of recent accounting guidance.

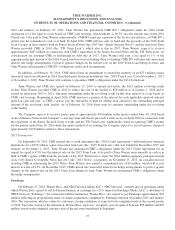

Transactions and Other Items Affecting Comparability

As more fully described herein and in the related notes to the accompanying consolidated financial statements, the

comparability of Time Warner’s results from continuing operations has been affected by transactions and certain other items

in each period as follows (millions):

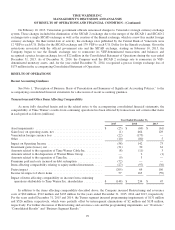

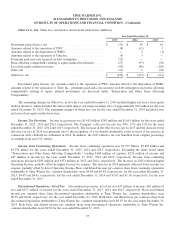

Year Ended December 31,

2015 2014 2013

Asset impairments ............................................ $ (25) $ (69) $ (61)

Gain (loss) on operating assets, net ............................... (1) 464 129

Venezuelan foreign currency loss ................................ (22) (173) —

Other ....................................................... (10) (80) 5

Impact on Operating Income .................................... (58) 142 73

Investment gains (losses), net .................................... (31) 30 61

Amounts related to the separation of Time Warner Cable Inc. .......... (8) (11) 3

Amounts related to the disposition of Warner Music Group ............ — 2 (1)

Amounts related to the separation of Time Inc. ...................... (9) 3 —

Premiums paid and costs incurred on debt redemption ................ (72) — —

Items affecting comparability relating to equity method investments ..... (27) (97) (30)

Pretax impact ................................................ (205) 69 106

Income tax impact of above items ................................ 57 165 (59)

Impact of items affecting comparability on income from continuing

operations attributable to Time Warner Inc. shareholders ............ $ (148) $ 234 $ 47

In addition to the items affecting comparability described above, the Company incurred Restructuring and severance

costs of $60 million, $512 million and $183 million for the years ended December 31, 2015, 2014 and 2013, respectively.

For the years ended December 31, 2015 and 2014, the Turner segment incurred programming impairments of $131 million

and $526 million, respectively, which were partially offset by intersegment eliminations of $2 million and $138 million,

respectively. For further discussion of Restructuring and severance costs and the programming impairments, see “Overview,”

“Consolidated Results” and “Business Segment Results.”

29