Time Magazine 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

time on the open market and in privately negotiated transactions. The size and timing of these purchases are based on a

number of factors, including price and business and market conditions. From January 1, 2016 through February 19, 2016, the

Company repurchased 8 million shares of common stock for $557 million pursuant to trading plans under Rule 10b5-1 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

During 2015, the Company finalized agreements relating to the construction and development of office and studio

space in the Hudson Yards development on the west side of Manhattan in order to move its Corporate headquarters and New

York City-based employees to the new space. Based on construction cost estimates and space projections as of December 31,

2015, the Company expects to invest an additional $1.7 billion, excluding interest, in the Hudson Yards development project

through 2019.

Cash Flows

Cash and equivalents decreased by $463 million, including $8 million of Cash used by discontinued operations, for the

year ended December 31, 2015. Cash and equivalents increased by $802 million, including $190 million of Cash used by

discontinued operations for the year ended December 31, 2014. Components of these changes are discussed below in more

detail.

Operating Activities from Continuing Operations

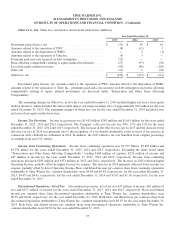

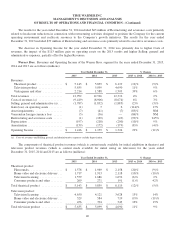

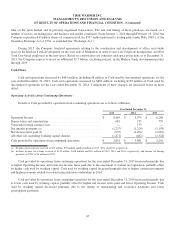

Details of Cash provided by operations from continuing operations are as follows (millions):

Year Ended December 31,

2015 2014 2013

Operating Income ........................................... $ 6,865 $ 5,975 $ 6,268

Depreciation and amortization ................................. 681 733 759

Venezuela foreign currency loss ................................ — 173 —

Net interest payments (a) ...................................... (1,227) (1,224) (1,158)

Net income taxes paid (b) ..................................... (997) (1,494) (1,087)

All other, net, including working capital changes ................... (1,471) (482) (1,524)

Cash provided by operations from continuing operations ............. $ 3,851 $ 3,681 $ 3,258

(a) Includes interest income received of $35 million, $50 million and $44 million in 2015, 2014 and 2013, respectively.

(b) Includes income tax refunds received of $142 million, $108 million and $87 million in 2015, 2014 and 2013, respectively, and income tax sharing

payments to TWC of $4 million in 2015.

Cash provided by operations from continuing operations for the year ended December 31, 2015 increased primarily due

to higher Operating Income and lower net income taxes paid due to the enactment of federal tax legislation, partially offset

by higher cash used by working capital. Cash used by working capital increased primarily due to higher content investments

and higher payments related to restructuring initiatives undertaken in 2014.

Cash provided by operations from continuing operations for the year ended December 31, 2014 increased primarily due

to lower cash used by working capital, partially offset by higher net income taxes paid and lower Operating Income. Cash

used by working capital decreased primarily due to the timing of restructuring and severance payments and lower

participation payments.

45