Time Magazine 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

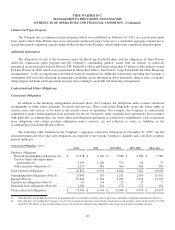

Commercial Paper Program

The Company has a commercial paper program, which was established on February 16, 2011 on a private placement

basis, under which Time Warner may issue unsecured commercial paper notes up to a maximum aggregate amount not to

exceed the unused committed capacity under the Revolving Credit Facilities, which support the commercial paper program.

Additional Information

The obligations of each of the borrowers under the Revolving Credit Facilities and the obligations of Time Warner

under the commercial paper program and the Company’s outstanding publicly issued debt are directly or indirectly

guaranteed on an unsecured basis by Historic TW, Home Box Office and Turner (other than $1 billion of debt publicly issued

by Time Warner in 2006, which is not guaranteed by Home Box Office). See Note 8, “Long-Term Debt and Other Financing

Arrangements,” to the accompanying consolidated financial statements for additional information regarding the Company’s

outstanding debt and other financing arrangements, including certain information about maturities, interest rates, covenants,

rating triggers and bank credit agreement leverage ratios relating to such debt and financing arrangements.

Contractual and Other Obligations

Contractual Obligations

In addition to the financing arrangements discussed above, the Company has obligations under certain contractual

arrangements to make future payments for goods and services. These contractual obligations secure the future rights to

various assets and services to be used in the normal course of operations. For example, the Company is contractually

committed to make certain minimum lease payments for the use of property under operating lease agreements. In accordance

with applicable accounting rules, the future rights and obligations pertaining to certain firm commitments, such as operating

lease obligations and certain purchase obligations under contracts, are not reflected as assets or liabilities in the

accompanying Consolidated Balance Sheet.

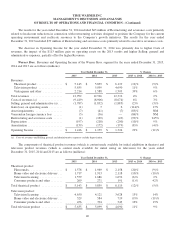

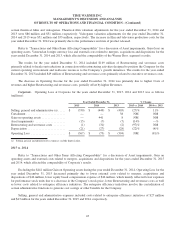

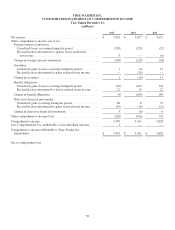

The following table summarizes the Company’s aggregate contractual obligations at December 31, 2015, and the

estimated timing and effect that such obligations are expected to have on the Company’s liquidity and cash flows in future

periods (millions):

Contractual Obligations (a)(b)(c)

Total 2016 2017-2018 2019-2020 Thereafter

Purchase obligations:

Network programming obligations (d) . . . $ 23,478 $ 3,120 $ 5,588 $ 4,984 $ 9,786

Creative talent and employment

agreements (e) .................... 2,099 1,200 732 94 73

Other purchase obligations (f) ......... 1,277 581 364 183 149

Total purchase obligations .............. 26,854 4,901 6,684 5,261 10,008

Outstanding debt obligations (Note 8) ..... 23,969 187 1,231 2,050 20,501

Interest (Note 8) ...................... 19,641 1,318 2,585 2,431 13,307

Capital lease obligations (Note 8) ......... 61 14 23 17 7

Operating lease obligations (Note 16) ..... 1,260 314 575 217 154

Total contractual obligations ............ $ 71,785 $ 6,734 $ 11,098 $ 9,976 $ 43,977

(a) The table does not include the effects of arrangements that are contingent in nature such as guarantees and other contingent commitments (Note 16).

(b) The table does not include the Company’s reserve for uncertain tax positions and related accrued interest and penalties, which at December 31, 2015

totaled $1.701 billion, as the specific timing of any cash payments relating to this obligation cannot be projected with reasonable certainty.

49