Time Magazine 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

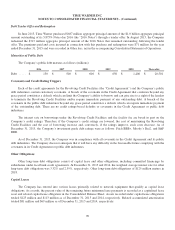

unsecured basis, by Historic TW Inc. (“Historic TW”), Home Box Office and Turner. The obligations of TWIFL under the

Revolving Credit Facilities are also guaranteed by Time Warner.

Commercial Paper Program

The Company has a commercial paper program, which was established on February 16, 2011 on a private placement

basis, under which Time Warner may issue unsecured commercial paper notes up to a maximum aggregate amount not to

exceed the unused committed capacity under the $5.0 billion Revolving Credit Facilities, which support the commercial

paper program. Proceeds from the commercial paper program may be used for general corporate purposes. The obligations of

the Company under the commercial paper program are directly or indirectly guaranteed, on an unsecured basis, by Historic

TW, Home Box Office and Turner.

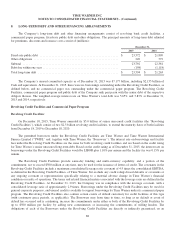

Public Debt

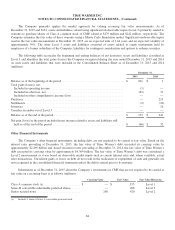

Time Warner and one of its subsidiaries have various public debt issuances outstanding. At issuance, the maturities of

these outstanding series of debt ranged from five to 40 years and the interest rates on debt with fixed interest rates ranged

from 1.95% to 9.15%. At December 31, 2015 and 2014, the weighted average interest rate on the Company’s outstanding

fixed-rate public debt was 5.67% and 5.92%, respectively. At December 31, 2015, the Company’s fixed-rate public debt had

maturities ranging from 2016 to 2045.

Debt Offerings

On June 4, 2015, Time Warner issued $2.1 billion aggregate principal amount of debt securities under a shelf

registration statement, consisting of $1.5 billion aggregate principal amount of 3.60% Notes due 2025 and $600 million

aggregate principal amount of 4.85% Debentures due 2045. The securities are guaranteed, on an unsecured basis, by Historic

TW. In addition, Turner and Home Box Office guarantee, on an unsecured basis, Historic TW’s guarantee of the

securities. The net proceeds from the offering were $2.083 billion, after deducting underwriting discounts and offering

expenses. The Company used a portion of the net proceeds from the offering to retire at maturity the $1.0 billion aggregate

principal amount outstanding of its 3.15% Notes due July 15, 2015. The remainder of the net proceeds will be used for

general corporate purposes, including share repurchases.

On July 28, 2015, Time Warner issued €700 million aggregate principal amount of 1.95% Notes due 2023 under a

shelf registration statement. The notes are guaranteed, on an unsecured basis, by Historic TW. In addition, Turner and Home

Box Office guarantee, on an unsecured basis, Historic TW’s guarantee of the notes. The net proceeds from the offering were

€693 million, after deducting underwriting discounts and offering expenses, and will be used for general corporate purposes.

In addition, the Company has designated these notes as a hedge of the variability in the Company’s Euro-denominated net

investments. See Note 7, “Derivative Instruments and Hedging Activities,” to the accompanying consolidated financial

statements for more information.

On November 20, 2015, Time Warner issued $900 million aggregate principal amount of debt securities under a shelf

registration statement, consisting of $600 million aggregate principal amount of 3.875% Notes due 2026 and $300 million

additional aggregate principal amount of 4.85% Debentures due 2045 (the “Additional Debentures”). The Additional

Debentures constitute an additional issuance of, form a single series with, and trade interchangeably with, the outstanding

4.85% Debentures due 2045 issued by Time Warner on June 4, 2015. The securities are guaranteed, on an unsecured basis,

by Historic TW. In addition, Turner and Home Box Office guarantee, on an unsecured basis, Historic TW’s guarantee of the

securities. The net proceeds from the offering were $884 million, after deducting underwriting discounts and offering

expenses, and will be used for general corporate purposes.

89