Time Magazine 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

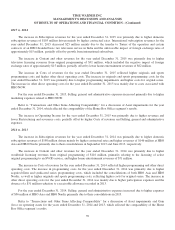

June Debt Offering

On June 4, 2015, Time Warner issued $2.1 billion aggregate principal amount of debt securities under a shelf

registration statement, consisting of $1.5 billion aggregate principal amount of 3.60% Notes due 2025 and $600 million

aggregate principal amount of 4.85% Debentures due 2045. The securities issued are guaranteed, on an unsecured basis, by

Historic TW Inc. (“Historic TW”). In addition, Turner and Home Box Office guarantee, on an unsecured basis, Historic

TW’s guarantee of the securities. The net proceeds from the offering were $2.083 billion, after deducting underwriting

discounts and offering expenses. The Company used a portion of the net proceeds from the offering to retire at maturity the

$1.0 billion aggregate principal amount outstanding of its 3.15% Notes due July 15, 2015. The remainder of the net proceeds

will be used for general corporate purposes, including share repurchases.

Debt Tender Offer and Redemption

In June 2015, Time Warner purchased $687 million aggregate principal amount of the $1.0 billion aggregate principal

amount outstanding of the 2016 Notes through a tender offer. In August 2015, the Company redeemed the $313 million

aggregate principal amount of the 2016 Notes that remained outstanding following the tender offer. The premiums paid and

costs incurred in connection with this purchase and redemption were $71 million for the year ended December 31, 2015 and

were recorded in Other loss, net in the accompanying Consolidated Statement of Operations.

July Debt Offering

On July 28, 2015, Time Warner issued €700 million aggregate principal amount of 1.95% Notes due 2023 under a

shelf registration statement. The notes are guaranteed, on an unsecured basis, by Historic TW. In addition, Turner and Home

Box Office guarantee, on an unsecured basis, Historic TW’s guarantee of the notes. The net proceeds from the offering were

€693 million, after deducting underwriting discounts and offering expenses, and will be used for general corporate purposes.

In addition, the Company has designated these notes as a hedge of the variability in the Company’s Euro-denominated net

investments. See Note 7, “Derivative Instruments and Hedging Activities,” to the accompanying consolidated financial

statements for more information.

November Debt Offering

On November 20, 2015, Time Warner issued $900 million aggregate principal amount of debt securities under a shelf

registration statement, consisting of $600 million aggregate principal amount of 3.875% Notes due 2026 and $300 million

additional aggregate principal amount of 4.85% Debentures due 2045 (the “Additional Debentures”). The Additional

Debentures constitute an additional issuance of, form a single series with, and trade interchangeably with, the outstanding

4.85% Debentures due 2045 issued by Time Warner on June 4, 2015. The securities are guaranteed, on an unsecured basis,

by Historic TW. In addition, Turner and Home Box Office guarantee, on an unsecured basis, Historic TW’s guarantee of the

securities. The net proceeds from the offering were $884 million, after deducting underwriting discounts and offering

expenses, and will be used for general corporate purposes.

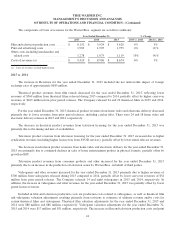

Revolving Credit Facilities

On December 18, 2015, Time Warner amended its Revolving Credit Facilities, which consist of two $2.5 billion

revolving credit facilities, to extend the maturity dates of both facilities from December 18, 2019 to December 18, 2020.

The funding commitments under the Revolving Credit Facilities are provided by a geographically diverse group of

19 major financial institutions based in countries including Canada, France, Germany, Japan, Spain, Switzerland, the

United Kingdom and the U.S. In addition, 17 of these financial institutions have been identified by international regulators as

among the 30 financial institutions that they deem to be systemically important. None of the financial institutions in the

Revolving Credit Facilities account for more than 8% of the aggregate undrawn loan commitments.

48