Time Magazine 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

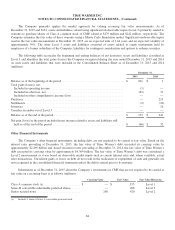

Videogame development costs are expensed as incurred before the applicable videogames reach technological

feasibility. Upon release, the capitalized videogame development costs are amortized based on the greater of the amount

computed using (i) the proportion of the videogame’s revenues recognized for such period to the videogame’s total current

and anticipated revenues or (ii) the straight-line method over the remaining economic life of the videogame. Unamortized

capitalized videogame production and development costs are stated at the lower of cost, less accumulated amortization, or net

realizable value and reported in Other assets on the Consolidated Balance Sheet. At December 31, 2015 and 2014, there were

$201 million and $277 million, respectively, of unamortized computer software costs related to videogames. Amortization of

such costs was $214 million, $115 million and $180 million for the years ended December 31, 2015, 2014 and 2013,

respectively. Included in such amortization are writedowns to net realizable value of certain videogame production costs of

$17 million, $51 million and $53 million in 2015, 2014 and 2013, respectively.

Barter Transactions

Time Warner enters into transactions that involve the exchange of advertising, in part, for other products and services,

such as a license for programming. Such transactions are recognized by the programming licensee (e.g., a television network)

as programming inventory and deferred advertising revenue at the estimated fair value when the product is available for

telecast. Barter programming inventory is amortized in the same manner as the non-barter component of the licensed

programming, and Advertising revenue is recognized when advertising spots are delivered. From the perspective of the

programming licensor (e.g., a film studio), incremental licensing revenue is recognized when the barter advertising spots are

exhibited.

Multiple-Element Transactions

In the normal course of business, the Company enters into multiple-element transactions that involve making

judgments about allocating the consideration to the various elements of the transactions. While the more common type of

multiple-element transactions encountered by the Company involve the sale or purchase of multiple products or services

(e.g., licensing multiple film titles in a single arrangement), multiple-element transactions can also involve contemporaneous

purchase and sales transactions, the settlement of an outstanding dispute contemporaneous with the purchase of a product or

service, as well as investing in an investee while at the same time entering into an operating agreement. In accounting for

multiple-element transactions, judgment must be exercised in identifying the separate elements in a bundled transaction as

well as determining the values of these elements. These judgments can impact the amount of revenues, expenses and net

income recognized over the term of the contract, as well as the period in which they are recognized.

In determining the value of the respective elements, the Company refers to quoted market prices (where available),

independent appraisals (where available), historical and comparable cash transactions or its best estimate of selling price.

Other indicators of value include the existence of price protection in the form of “most-favored-nation” clauses or similar

contractual provisions and individual elements whose values are dependent on future performance (and based on independent

factors). Further, in such transactions, evidence of value for one element of a transaction may provide support that value was

not transferred from one element in a transaction to another element in a transaction.

Accounting for Collaborative Arrangements

The Company’s collaborative arrangements primarily relate to co-financing arrangements to jointly finance and

distribute theatrical productions and an arrangement entered into with CBS Broadcasting, Inc. (“CBS”) and the NCAA that

provides Turner and CBS with exclusive television, Internet and wireless rights to the NCAA Tournament in the U.S. and its

territories and possessions from 2011 through 2024.

In most cases, the form of the co-financing arrangement is the sale of an interest in a film to an investor. Warner Bros.

generally records the amounts received for the sale of an interest as a reduction of the costs of the film, as the investor

assumes full risk for that share of the film asset acquired in these transactions. The substance of these arrangements is that

the third-party investors own an interest in the film and, therefore, in each period the Company reflects in the Consolidated

74