Time Magazine 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

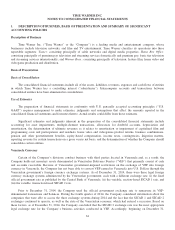

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Description of Business

Time Warner Inc. (“Time Warner” or the “Company”) is a leading media and entertainment company, whose

businesses include television networks, and film and TV entertainment. Time Warner classifies its operations into three

reportable segments: Turner: consisting principally of cable networks and digital media properties; Home Box Office:

consisting principally of premium pay television and streaming services domestically and premium pay, basic tier television

and streaming services internationally; and Warner Bros.: consisting principally of television, feature film, home video and

videogame production and distribution.

Basis of Presentation

Basis of Consolidation

The consolidated financial statements include all of the assets, liabilities, revenues, expenses and cash flows of entities

in which Time Warner has a controlling interest (“subsidiaries”). Intercompany accounts and transactions between

consolidated entities have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S.

GAAP”) requires management to make estimates, judgments and assumptions that affect the amounts reported in the

consolidated financial statements and footnotes thereto. Actual results could differ from those estimates.

Significant estimates and judgments inherent in the preparation of the consolidated financial statements include

accounting for asset impairments, multiple-element transactions, allowances for doubtful accounts, depreciation and

amortization, the determination of ultimate revenues as it relates to amortization or impairment of capitalized film and

programming costs and participations and residuals, home video and videogames product returns, business combinations,

pension and other postretirement benefits, equity-based compensation, income taxes, contingencies, litigation matters,

reporting revenue for certain transactions on a gross versus net basis, and the determination of whether the Company should

consolidate certain entities.

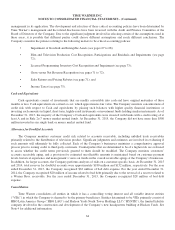

Venezuela Currency

Certain of the Company’s divisions conduct business with third parties located in Venezuela and, as a result, the

Company holds net monetary assets denominated in Venezuelan Bolivares Fuertes (“VEF”) that primarily consist of cash

and accounts receivable. Because of Venezuelan government-imposed restrictions on the exchange of VEF into foreign

currency in Venezuela, the Company has not been able to convert VEF earned in Venezuela into U.S. Dollars through the

Venezuelan government’s foreign currency exchange systems. As of December 31, 2014, there were three legal foreign

currency exchange systems administered by the Venezuelan government, each with a different exchange rate: (i) the fixed

official government rate as published by the Central Bank of Venezuela, (ii) the variable, auction-based SICAD 1 rate, and

(iii) the variable, transaction-based SICAD 2 rate.

Prior to December 31, 2014, the Company used the official government exchange rate to remeasure its VEF-

denominated transactions and balances. During the fourth quarter of 2014, the Company considered information about the

companies that were able to access the three exchange systems during 2014 and the fact that the SICAD 1 and SICAD 2

exchanges continued to operate, as well as the state of the Venezuelan economy, which had entered a recession. Based on

these factors, as of December 31, 2014, the Company concluded that the SICAD 2 exchange rate was the most appropriate

legal exchange rate for the Company’s business activities conducted in VEF. Accordingly, beginning on December 31,

61