Time Magazine 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION - (Continued)

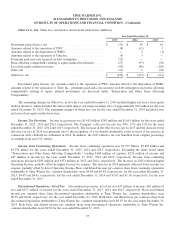

Programming Impairments

During 2015, Turner conducted a strategic evaluation of its programming, and, as a result of such evaluation, decided

to no longer air certain programming, which consisted primarily of licensed programming. In connection with that decision,

the Turner segment incurred $131 million of programming impairments, which were partially offset by $2 million of

intersegment eliminations primarily related to programming licensed by the Warner Bros. segment to the Turner

segment. Such charges have been classified as Costs of revenues in the accompanying Consolidated Statement of Operations.

iStreamPlanet

In August 2015, Turner acquired a majority ownership interest in iStreamPlanet Co., LLC (“iStreamPlanet”), a

provider of streaming and cloud-based video and technology services, for $148 million, net of cash acquired. As a result of

Turner’s acquisition of the additional interests in iStreamPlanet, Turner recorded a $3 million gain on a previously held

investment accounted for under the cost method and began consolidating iStreamPlanet in the third quarter of 2015. In

connection with the acquisition, $29 million of Redeemable noncontrolling interest was recorded in the accompanying

Consolidated Balance Sheet.

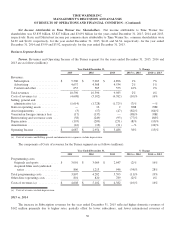

2015 Debt Offerings

During 2015, Time Warner issued $3.0 billion and €700 million aggregate principal amount of debt securities in three

separate offerings under its shelf registration statement. The Company used a portion of the net proceeds from the first

offering to retire at maturity the $1.0 billion aggregate principal amount outstanding of its 3.15% Notes due July 15, 2015.

See “Financial Condition and Liquidity –Outstanding Debt and Other Financing Arrangements” for further information.

Debt Tender Offer and Redemption

In June 2015, Time Warner purchased $687 million aggregate principal amount of the $1.0 billion aggregate principal

amount outstanding of its 5.875% Notes due 2016 (the “2016 Notes”) through a tender offer. In August 2015, the Company

redeemed the $313 million aggregate principal amount of the 2016 Notes that remained outstanding following the tender

offer. The premiums paid and costs incurred in connection with this purchase and redemption were $71 million for the year

ended December 31, 2015 and were recorded in Other loss, net in the accompanying Consolidated Statement of

Operations. See “Financial Condition and Liquidity –Outstanding Debt and Other Financing Arrangements” for further

information.

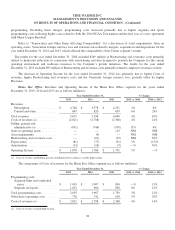

Revolving Credit Facilities Maturity Date Extension

On December 18, 2015, Time Warner amended its $5.0 billion of senior unsecured credit facilities (the “Revolving

Credit Facilities”), which consist of two $2.5 billion revolving credit facilities, to extend the maturity dates of both facilities

from December 18, 2019 to December 18, 2020. See “Financial Condition and Liquidity –Outstanding Debt and Other

Financing Arrangements” for more information.

Venezuela Currency

Certain of the Company’s divisions conduct business with third parties located in Venezuela and, as a result, the

Company holds net monetary assets denominated in Venezuelan Bolivares Fuertes (“VEF”) that primarily consist of cash

and accounts receivable. Because of Venezuelan government-imposed restrictions on the exchange of VEF into foreign

currency in Venezuela, the Company has not been able to convert VEF earned in Venezuela into U.S. Dollars through the

Venezuelan government’s foreign currency exchanges.

28