Time Magazine 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

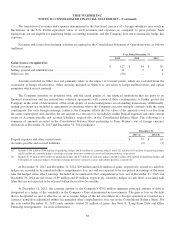

8. LONG-TERM DEBT AND OTHER FINANCING ARRANGEMENTS

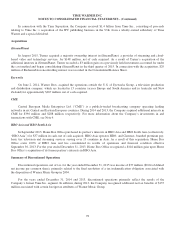

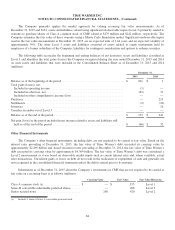

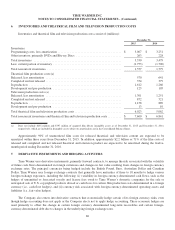

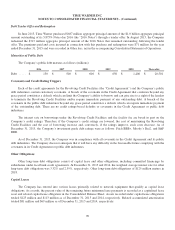

The Company’s long-term debt and other financing arrangements consist of revolving bank credit facilities, a

commercial paper program, fixed-rate public debt and other obligations. The principal amounts of long-term debt adjusted

for premiums, discounts and issuance costs consist of (millions):

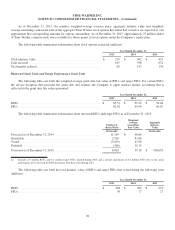

December 31,

2015 2014

Fixed-rate public debt .................................................... $ 23,572 $ 21,809

Other obligations ........................................................ 220 572

Subtotal ............................................................... 23,792 22,381

Debt due within one year .................................................. (198) (1,118)

Total long-term debt ..................................................... $ 23,594 $ 21,263

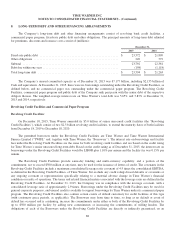

The Company’s unused committed capacity as of December 31, 2015 was $7.177 billion, including $2.155 billion of

Cash and equivalents. At December 31, 2015, there were no borrowings outstanding under the Revolving Credit Facilities, as

defined below, and no commercial paper was outstanding under the commercial paper program. The Revolving Credit

Facilities, commercial paper program and public debt of the Company rank pari passu with the senior debt of the respective

obligors thereon. The weighted-average interest rate on Time Warner’s total debt was 5.65% and 5.83% at December 31,

2015 and 2014, respectively.

Revolving Credit Facilities and Commercial Paper Program

Revolving Credit Facilities

On December 18, 2015, Time Warner amended its $5.0 billion of senior unsecured credit facilities (the “Revolving

Credit Facilities”), which consist of two $2.5 billion revolving credit facilities, to extend the maturity dates of both facilities

from December 18, 2019 to December 18, 2020.

The permitted borrowers under the Revolving Credit Facilities are Time Warner and Time Warner International

Finance Limited (“TWIFL” and, together with Time Warner, the “Borrowers”). The interest rate on borrowings and facility

fees under the Revolving Credit Facilities are the same for both revolving credit facilities and are based on the credit rating

for Time Warner’s senior unsecured long-term debt. Based on the credit rating as of December 31, 2015, the interest rate on

borrowings under the Revolving Credit Facilities would be LIBOR plus 1.10% per annum and the facility fee was 0.15% per

annum.

The Revolving Credit Facilities provide same-day funding and multi-currency capability, and a portion of the

commitment, not to exceed $500 million at any time, may be used for the issuance of letters of credit. The covenants in the

Revolving Credit Facilities include a maximum consolidated leverage ratio covenant of 4.5 times the consolidated EBITDA,

as defined in the Revolving Credit Facilities, of Time Warner, but exclude any credit ratings-based defaults or covenants or

any ongoing covenant or representations specifically relating to a material adverse change in Time Warner’s financial

condition or results of operations. The terms and related financial metrics associated with the leverage ratio are defined in the

Revolving Credit Facilities. At December 31, 2015, the Company was in compliance with the leverage covenant, with a

consolidated leverage ratio of approximately 2.9 times. Borrowings under the Revolving Credit Facilities may be used for

general corporate purposes, and unused credit is available to support borrowings by Time Warner under its commercial paper

program. The Revolving Credit Facilities also contain certain events of default customary for credit facilities of this type

(with customary grace periods, as applicable). The Borrowers may from time to time, so long as no default or event of

default has occurred and is continuing, increase the commitments under either or both of the Revolving Credit Facilities by

up to $500 million per facility by adding new commitments or increasing the commitments of willing lenders. The

obligations of each of the Borrowers under the Revolving Credit Facilities are directly or indirectly guaranteed, on an

88