Time Magazine 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

The translation of revenues and expenses denominated in the functional currency of a foreign subsidiary may result in

fluctuations in the U.S. Dollar-equivalent value of such revenues and expenses as compared to prior periods. Such

transactions are not eligible for qualifying hedge accounting treatment, and the Company does not economically hedge this

exposure.

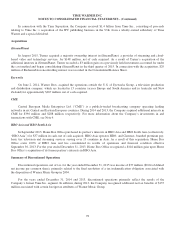

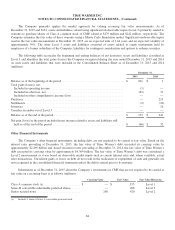

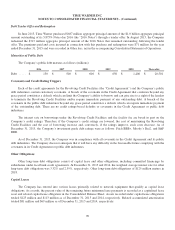

Net gains and losses from hedging activities recognized in the Consolidated Statement of Operations were as follows

(millions):

Year Ended December 31,

2015 2014 2013

Gains (losses) recognized in:

Cost of revenues ................................................. $ 127 $ 54 $ 20

Selling, general and administrative .................................. 21 5 4

Other loss, net ................................................... (26) — 1

Amounts included in Other loss, net primarily relate to the impact of forward points, which are excluded from the

assessment of hedge effectiveness. Other amounts included in Other loss, net relate to hedge ineffectiveness and option

premiums which are not material.

The Company monitors its positions with, and the credit quality of, the financial institutions that are party to its

financial transactions and has entered into collateral agreements with certain of these counterparties to further protect the

Company in the event of deterioration of the credit quality of such counterparties on outstanding transactions. Additionally,

netting provisions are included in agreements in situations where the Company executes multiple contracts with the same

counterparty. For such foreign exchange contracts, the Company offsets the fair values of the amounts owed to or due from

the same counterparty and classifies the net amount as a net asset or net liability within Prepaid expenses and other current

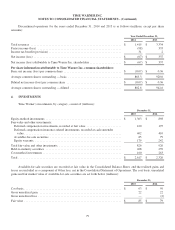

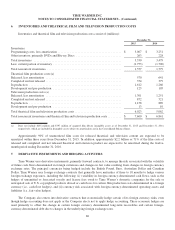

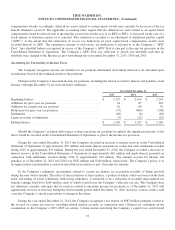

assets or Accounts payable and accrued liabilities, respectively, in the Consolidated Balance Sheet. The following is a

summary of amounts recorded in the Consolidated Balance Sheet pertaining to Time Warner’s use of foreign currency

derivatives at December 31, 2015 and December 31, 2014 (millions):

December 31,

2015 (a) 2014 (b)

Prepaid expenses and other current assets .......................................... $ 79 $ 61

Accounts payable and accrued liabilities ........................................... (2) (3)

(a) Includes $198 million ($194 million of qualifying hedges and $4 million of economic hedges) and $121 million ($116 million of qualifying hedges

and $5 million of economic hedges) of foreign exchange derivative contracts in asset and liability positions, respectively.

(b) Includes $139 million ($92 million of qualifying hedges and $47 million of economic hedges) and $81 million ($65 million of qualifying hedges and

$16 million of economic hedges) of foreign exchange derivative contracts in asset and liability positions, respectively.

At December 31, 2015 and December 31, 2014, $29 million and $20 million of gains, respectively, related to cash flow

hedges are recorded in Accumulated other comprehensive loss, net and are expected to be recognized in earnings at the same

time the hedged items affect earnings. Included in Accumulated other comprehensive loss, net at December 31, 2015 and

December 31, 2014 are net losses of $9 million and $5 million, respectively, related to hedges of cash flows associated with

films that are not expected to be released within the next twelve months.

At December 31, 2015, the carrying amount of the Company’s €700 million aggregate principal amount of debt is

designated as a hedge of the variability in the Company’s Euro-denominated net investments. The gain or loss on the debt

that is designated as, and is effective as, an economic hedge of the net investment in a foreign operation is recorded as a

currency translation adjustment within Accumulated other comprehensive loss, net in the Consolidated Balance Sheet. For

the year ended December 31, 2015, such amounts totaled $1 million of gains. See Note 8, “Long-Term Debt and Other

Financing Arrangements,” for more information.

87