Time Magazine 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

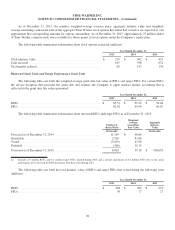

Holders of RSUs are generally entitled to receive cash dividend equivalents based on the regular quarterly cash

dividends declared and paid by the Company during the period that the RSUs are outstanding. Beginning with RSU grants

made in 2013, the dividend equivalent payment for holders of RSUs subject to a performance condition is made in cash

following the satisfaction of the performance condition. Holders of PSUs also are entitled to receive dividend equivalents

based on the regular quarterly cash dividends declared and paid by the Company during the period that the PSUs are

outstanding. The dividend equivalent payment is made in cash following the vesting of the PSUs (generally following the

end of the applicable performance period) and is based on the number of shares that vest and are paid out. Holders of stock

options do not receive dividends or dividend equivalent payments.

Upon the (i) exercise of a stock option, (ii) vesting of an RSU, (iii) vesting of a PSU or (iv) grant of restricted stock,

shares of Time Warner common stock may be issued either from authorized but unissued shares or from treasury stock.

In connection with the Time Separation and in accordance with existing antidilution provisions in the Company’s

equity plans, the number of stock options, RSUs and target PSUs outstanding at the Distribution Date and the exercise prices

of such stock options were prospectively adjusted to maintain the value of those awards subsequent to the Time Separation

(the “Adjustment”). The changes in the number of shares subject to outstanding equity awards and the exercise prices were

determined by comparing the value of such awards immediately prior to the Time Separation to the value of such awards

immediately after the Time Separation. Accordingly, the number of shares subject to each equity award outstanding as of the

Distribution Date was increased by multiplying such number of shares by a factor of approximately 1.04, while the per share

exercise price of each stock option was decreased by dividing such exercise price by a factor of approximately 1.04. The

adjustments resulted in an increase of approximately 2 million shares subject to outstanding equity awards following the

Time Separation. The adjustments to the outstanding equity awards did not result in any additional compensation expense.

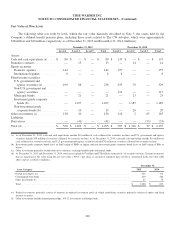

Other information pertaining to each category of equity-based compensation appears below.

Stock Options

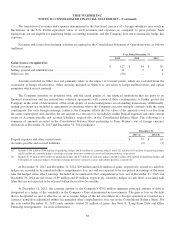

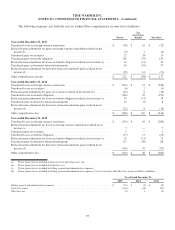

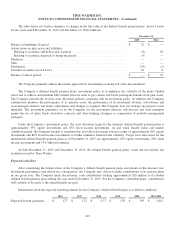

The table below summarizes the weighted-average assumptions used to value stock options at their grant date and the

weighted-average grant date fair value per share:

Year Ended December 31,

2015 2014 2013

Expected volatility ........................................... 25.0% 26.6% 29.6%

Expected term to exercise from grant date ........................ 5.80 years 5.85 years 6.27 years

Risk-free rate ............................................... 1.8% 1.9% 1.3%

Expected dividend yield ...................................... 1.7% 1.7% 2.1%

Weighted average grant date fair value per option .................. $ 18.16 $ 16.94 $ 13.48

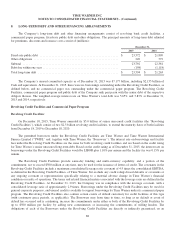

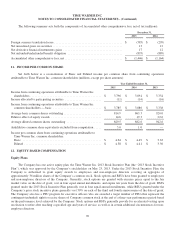

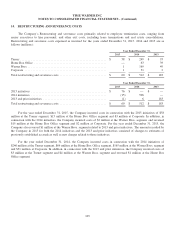

The following table summarizes information about stock options outstanding as of December 31, 2015:

Number

of Options

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(thousands) (in years) (thousands)

Outstanding as of December 31, 2014 ............. 29,821 $ 36.27

Granted ..................................... 3,379 83.31

Exercised .................................... (5,240) 31.27

Forfeited or expired ............................ (218) 32.73

Outstanding as of December 31, 2015 ............. 27,742 42.98 4.86 $ 702,685

Exercisable as of December 31, 2015 .............. 20,576 32.62 3.60 $ 668,932

97