Starwood 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.year ended December 31, 2007 included $3 million of revenues from the sale of residential units at the St. Regis in

New York compared to 2006 which included $94 million in revenues from the sale of residential units at the St.

Regis Museum Tower in San Francisco, which sold out in 2006, and at the St. Regis in New York, where only a few

residential units remained available for sale in 2007. Additionally, during the year ended December 31, 2006, we

recorded a gain of $17 million on the sale of $133 million of vacation ownership receivables. We did not sell any

such receivables in 2007 and therefore no gain was recognized.

Originated contract sales of VOI inventory, which represents vacation ownership revenues before adjustments

for percentage of completion accounting and rescission, decreased 3.8% in the year ended December 31, 2007 when

compared to the same period in 2006 as the mix of products sold during 2007 differed from that sold in 2006.

Additionally, sales and profits in Hawaii were negatively impacted by a decline in closing rates (the percentage of

tours that were converted to actual sales of vacation ownership intervals) in the second half of 2007 due to the

impending sell out of our project on Maui, partially offset by higher sales and profits at other timeshare projects.

Other revenues and expenses from managed and franchised properties increased to $1.860 billion from

$1.585 billion for the year ended December 31, 2007 and 2006, respectively, primarily due to an increase in the

number of our managed and franchised hotels. These revenues represent reimbursements of costs incurred on behalf

of managed hotel and vacation ownership properties and franchisees and relate primarily to payroll costs at

managed properties where we are the employer. Since the reimbursements are made based upon the costs incurred

with no added margin, these revenues and corresponding expenses have no effect on our operating income and our

net income.

Selling, General, Administrative and Other. Selling, general, administrative and other expenses, which

includes costs and expenses from our Bliss spas and from the sale of Bliss products, was $513 million in the year

ended December 31, 2007 when compared to $470 million in the same period in 2006. The increase was primarily

due to investments in our global development capability and costs associated with the launch of our new brands,

aloft and Element, and other brand initiatives.

Restructuring and Other Special Charges, Net. During the year ended December 31, 2007, we recorded

$53 million in net restructuring and other special charges primarily related to accelerated depreciation of property,

plant and equipment at the Sheraton Bal Harbour in Florida (“Bal Harbour”) and demolition costs associated with

our redevelopment of that hotel. Bal Harbour was closed for business on July 1, 2007, and the majority of its

employees were terminated. The hotel was demolished and we are in the process of building a St. Regis hotel along

with branded residences and fractional units.

During the year ended December 31, 2006, we recorded $20 million in net restructuring and other special

charges primarily related to transition costs associated with the acquisition of the Le Méridien brand and

management and franchise business (“the Le Méridien Acquisition”) in November 2005 and severance costs

primarily related to certain executives in connection with the continued corporate restructuring that began at the end

of 2005. These charges were offset, in part, by the reversal of accruals for a lease we assumed as part of the merger

with Sheraton Holding Corporation (“Sheraton Holding”) and its subsidiaries (formerly ITT Corporation) in 1998

as the lease matured at the end of 2006 and the accruals exceeded our maximum remaining obligation under the

lease.

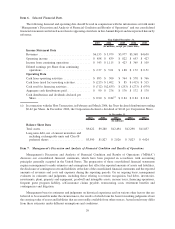

Depreciation and Amortization. Depreciation expense was $280 million during the year ended Decem-

ber 31, 2007, consistent with the corresponding period of 2006. We sold or closed 45 wholly owned hotels during

2006. However, the majority of these hotels were classified as held for sale as of December 31, 2005 and

consequently, no depreciation was recognized for either the year ended December 31, 2007 or 2006 for those hotels.

Amortization expense was $26 million in the year ended December 31, 2007, consistent with the corre-

sponding period of 2006.

Operating Income. Operating income increased 2.3% or $19 million to $858 million for the year ended

December 31, 2007 when compared to $839 million in the same period in 2006, primarily due to the increase in

management fees, franchise fees and other income, partially offset by the restructuring and other special charges

and the decline in revenues from owned, leased and consolidated joint venture hotels discussed above.

30