Starwood 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

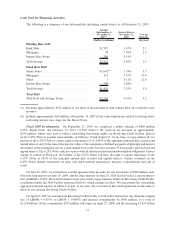

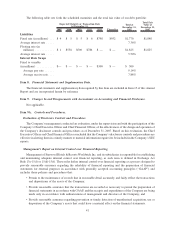

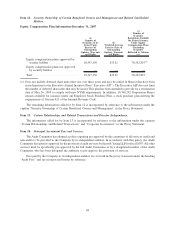

The following table sets forth the scheduled maturities and the total fair value of our debt portfolio:

2008 2009 2010 2011 2012 Thereafter

Total Fair

Value at

December 31,

2007

Total at

December 31,

2007

Expected Maturity or Transaction Date

At December 31,

Liabilities

Fixed rate (in millions) . . . $ 4 $ 5 $ 5 $ 6 $798 $952 $1,770 $1,848

Average interest rate ..... 7.36%

Floating rate (in

millions) ............ $ 1 $538 $500 $786 $ — $ — $1,825 $1,825

Average interest rate ..... 5.50%

Interest Rate Swaps

Fixed to variable

(in millions) ........... $— $ — $ — $ — $300 $ — $ 300

Average pay rate ...... 9.14%

Average receive rate.... 7.88%

Item 8. Financial Statements and Supplementary Data.

The financial statements and supplementary data required by this Item are included in Item 15 of this Annual

Report and are incorporated herein by reference

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure.

Not applicable.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

The Company’s management conducted an evaluation, under the supervision and with the participation of the

Company’s Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of

the Company’s disclosure controls and procedures as of December 31, 2007. Based on this evaluation, the Chief

Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures are

effective in alerting them in a timely manner to material information required to be included in the Company’s SEC

reports.

Management’s Report on Internal Control over Financial Reporting

Management of Starwood Hotels & Resorts Worldwide Inc. and its subsidiaries is responsible for establishing

and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act

Rule 13a-15(f) or 15(d)-15(f). Those rules define internal control over financial reporting as a process designed to

provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with generally accepted accounting principles (“GAAP”) and

includes those policies and procedures that:

• Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions

and dispositions of the assets of the Company;

• Provide reasonable assurance that the transactions are recorded as necessary to permit the preparation of

financial statements in accordance with GAAP, and the receipts and expenditures of the Company are being

made only in accordance with authorizations of management and directors of the Company; and

• Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or

disposition of the Company’s assets that could have a material effect on the financial statements.

41