Starwood 2007 Annual Report Download - page 129

Download and view the complete annual report

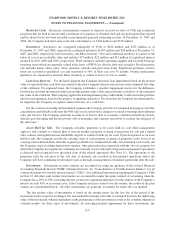

Please find page 129 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Restricted Cash. Restricted cash primarily consists of deposits received on sales of VOIs and residential

properties that are held in escrow until a certificate of occupancy is obtained, the legal rescission period has expired

and the deed of trust has been recorded in governmental property ownership records. At December 31, 2007 and

2006, the Company had short-term restricted cash balances of $196 million and $329 million.

Inventories. Inventories are comprised principally of VOIs of $620 million and $472 million as of

December 31, 2007 and 2006, respectively, residential inventory of $33 million and $38 million at December 31,

2007 and 2006, respectively, hotel inventory and Bliss inventory. VOI and residential inventory is carried at the

lower of cost or net realizable value and includes $37 million, $22 million and $15 million of capitalized interest

incurred in 2007, 2006 and 2005, respectively. Hotel inventory includes operating supplies and food and beverage

inventory items which are generally valued at the lower of FIFO cost (first-in, first-out) or market. Hotel inventory

also includes linens, china, glass, silver, uniforms, utensils and guest room items. Significant purchases of these

items are recorded at purchased cost and amortized to 50% of their cost over 36 months. Normal replacement

purchases are expensed as incurred. Bliss inventory is valued at lower of cost or market.

Loan Loss Reserves. For the hotel segment, the Company measures loan impairment based on the present

value of expected future cash flows discounted at the loan’s original effective interest rate or the estimated fair value

of the collateral. For impaired loans, the Company establishes a specific impairment reserve for the difference

between the recorded investment in the loan and the present value of the expected future cash flows or the estimated

fair value of the collateral. The Company applies the loan impairment policy individually to all loans in the portfolio

and does not aggregate loans for the purpose of applying such policy. For loans that the Company has determined to

be impaired, the Company recognizes interest income on a cash basis.

For the vacation ownership and residential segment, the Company provides for estimated mortgages receivable

cancellations and defaults at the time the VOI sales are recorded with a charge to vacation ownership and residential

sales and services. The Company performs an analysis of factors such as economic condition and industry trends,

defaults, past due aging and historical write-offs of mortgages and contracts receivable to evaluate the adequacy of

the allowance.

Assets Held for Sale. The Company considers properties to be assets held for sale when management

approves and commits to a formal plan to actively market a property or group of properties for sale and a signed

sales contract and significant non-refundable deposit or contract break-up fee exist. Upon designation as an asset

held for sale, the Company records the carrying value of each property or group of properties at the lower of its

carrying value which includes allocable segment goodwill or its estimated fair value, less estimated costs to sell, and

the Company stops recording depreciation expense. Any gain realized in connection with the sale of a property for

which the Company has significant continuing involvement (such as through a long-term management agreement)

is deferred and recognized over the initial term of the related agreement (See Note 11). The operations of the

properties held for sale prior to the sale date, if material, are recorded in discontinued operations unless the

Company will have continuing involvement (such as through a management or franchise agreement) after the sale.

Investments. Investments in joint ventures are accounted for using the guidance of the revised Financial

Accounting Standards Board (“FASB”) Interpretation No. 46, “Consolidation of Variable Interest Entities,” for all

ventures deemed to be variable interest entities (“VIEs”). See additional information regarding the Company’s VIEs

in Note 22. All other joint venture investments are accounted for under the equity method of accounting when the

Company has a 20% to 50% ownership interest or exercises significant influence over the venture. If the Company’s

interest exceeds 50% or in certain cases, if the Company exercises control over the venture, the results of the joint

venture are consolidated herein. All other investments are generally accounted for under the cost method.

The fair market value of investments is based on the market prices for the last day of the period if the

investment trades on quoted exchanges. For non-traded investments, fair value is estimated based on the underlying

value of the investment, which is dependent on the performance of the investment as well as the volatility inherent in

external markets for these types of investments. In assessing potential impairment for these investments, the

F-9

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)