Starwood 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Executive Officers. Long-term incentive compensation for our Named Executive Officers consists primarily of

equity compensation awards granted annually under the Company’s 2004 Long-Term Incentive Plan (“LTIP”)

and secondarily of the portion of the Executive Plan and AIP awards that are deferred in the form of deferred

stock units and shares of restricted stock, respectively. Taken together, approximately 60-65% of total

compensation at target is equity-based long term incentive compensation.

In light of Mr. Heyer’s resignation in March of 2007, he received no equity awards during 2007.

In connection with his appointment as Chief Executive Officer on an interim basis, Mr. Duncan received

an award of 14,742 shares of restricted stock and 44,225 options with an exercise price of $67.835 on May 24,

2007, the date the Board approved the terms of the agreement. Following the appointment of Mr. Van Paasschen

as Chief Executive Officer, 50% of Mr. Duncan’s restricted stock and options awards vested. The remainder of

the restricted stock will vest 50% on the third anniversary of the award and 50% on the fourth anniversary of

the award. The remainder of the options will become exercisable as to one fourth of the number of shares

subject thereto on each anniversary of the date of grant. In structuring his compensation and employment

arrangements, the Compensation Committee took into account Mr. Duncan’s willingness to serve as Chief

Executive Officer on an interim basis on very little notice, the impact of traveling to the Company’s

headquarters in New York from his Chicago home, his qualifications and experience, including his prior

experience as a chief executive officer and knowledge of the Company from his service on the Board, including

as Non-executive Chairman of the Board. The Compensation Committee feels that Mr. Duncan’s employment

arrangements properly aligned his interests with that of stockholders, especially since the vast majority of his

compensation was in the form of equity awards. In addition, in agreeing to provide change in control payments

to Mr. Duncan, the Compensation Committee desired to align his interests with stockholders so that

Mr. Duncan would properly evaluate any offers that may have been received.

In order to retain Mr. Van Paasschen, the Compensation Committee awarded Mr. Van Paasschen restricted

stock units with a value on the date of grant of $1,500,000 as a sign on bonus. In addition, Mr. Van Paasschen

received an equity award with a value of $5,000,000 consisting of 75% in restricted stock and 25% in stock

options. Mr. Van Paasschen’s employment agreement, which reflects a significant emphasis on equity awards,

provides for a minimum value of equity to be granted each year, with the type of equity award (stock options or

restricted stock) to be in the same proportion as other executives of the Company. We believe an emphasis on

long term incentive compensation was particularly appropriate for the leader of a management team

committed to the creation of stockholder value. The Compensation Committee feels that the amounts awarded

to Mr. Van Paasschen were reasonable in light of his appointment as Chief Executive Officer and the value of

equity that he had built up at his previous employer.

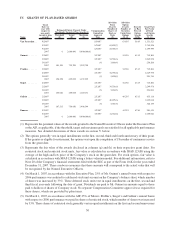

The Compensation Committee generally grants awards under the LTIP annually to all other Named

Executive Officers that are a combination of stock options and restricted stock awards. In 2007 we used a grant

approach in which the award is articulated as a dollar value. Under this approach, an overall award value, in

dollars, was determined for each executive based upon our compensation strategy and competitive market

positioning. We generally targeted the value of these awards so that total compensation at target is set at the

65th percentile of our peer group, though individual awards may have been higher or lower based on individual

performance (determined as described in the AIP assessment above). The number of restricted stock shares is

calculated by dividing 75% of the award value by the fair market value of the Company’s stock on the grant

date. The number of stock options has generally been determined by dividing the remaining 25% of the award

value by the fair market value of the company’s stock on the grant date and multiplying the result by three.

The exercise price for each stock option is equal to fair market value of the Company’s common stock on

the option grant date. See the section entitled Equity Grant Practices on page 26 below for a description of

the manner in which we determine fair market value for this purpose. Currently, most stock options vest in 25%

increments annually starting with the first anniversary from the date of grant, subject to accelerated vesting of

options granted in 2007 on the 18 month anniversary of the grant date for associates who are retirement

eligible, as defined in the LTIP (Mr. Gellein is currently retirement eligible); different rules regarding

accelerated vesting upon retirement apply to options granted prior to 2006 (see footnote 2 to the Outstanding

Equity Awards at Fiscal Year-End table on page 32). If unexercised, stock options expire 8 years from the

21