Starwood 2007 Annual Report Download - page 102

Download and view the complete annual report

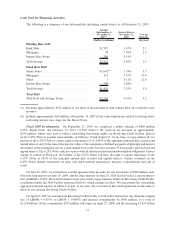

Please find page 102 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.will expire in February 2011. On May 1, 2007 we borrowed on our Revolving Credit Facility to finance the

redemption of $700 million of the 7.375% Senior Notes.

Fiscal 2006 Developments. On March 15, 2006, we completed the redemption of the remaining 25,000

outstanding Class B EPS for approximately $1 million in cash. On April 10, 2006, in connection with the Host

Transaction, we redeemed all of the Class A EPS and Realty Partnership units for approximately $34 million in

cash. In the year ended December 31, 2006, we redeemed approximately 926,000 SLC Operating Limited

Partnership units for approximately $56 million in cash.

In February 2006, we closed a five-year $1.5 billion Senior Credit Facility (“2006 Facility”). The 2006 Facility

replaced the previous $1.45 billion Revolving and Term Loan Credit Agreement (“Pre-2006 Facility”) which would

have matured in October 2006. Approximately $240 million of the Term Loan balance under the Pre-2006 Facility

was paid down with cash and the remainder was refinanced with the 2006 Facility. The 2006 Facility is expected to

be used for general corporate purposes. The 2006 Facility matures February 10, 2011 and had an original interest

rate of LIBOR + 0.475%. We currently expect to be in compliance with all covenants of the 2006 Facility.

During March 2006, we gave notice to receive additional commitments totaling $300 million under our 2006

Facility (“2006 Facility Add-On”) on a short-term basis to facilitate the close of the Host Transaction and for

general working capital purposes. In June 2006, we amended the 2006 Facility such that the 2006 Facility Add-On

would not mature until June 30, 2007.

In the first quarter of 2006 in two separate transactions we defeased approximately $510 million of debt

secured in part by several hotels that were part of the Host Transaction. In one transaction, in order to accomplish

this, we purchased Treasury securities sufficient to make the monthly debt service payments and the balloon

payment due under the loan agreement. The Treasury securities were then substituted for the real estate and hotels

that originally served as collateral for the loan. As part of the defeasance, the Treasury securities and the debt were

transferred to a third party successor borrower that is responsible for all remaining obligations under this debt. In the

second transaction, we deposited Treasury securities in an escrow account to cover the debt service payments. As

such, neither debt is reflected on our consolidated balance sheet as of December 31, 2006. In connection with the

defeasance, we incurred early extinguishment of debt costs of approximately $37 million which was recorded in

interest expense in our consolidated statement of income.

In the second quarter of 2006, we gave notice to redeem the $360 million of 3.5% convertible notes, originally

issued in May 2003. Under the terms of the convertible indenture, prior to the redemption date of June 5, 2006, the

note holders had the right to convert their notes into Shares at the stated conversion rate. Under the terms of the

indenture, we settled the conversions by paying the principal portion of the notes in cash and the excess amount by

issuing approximately 3 million Corporation Shares. The notes that were not converted prior to the redemption date

were redeemed at the price of par plus accrued interest, effective June 5, 2006.

In connection with the Host Transaction, a total of $600 million of notes issued by Sheraton Holding were

assumed by the Corporation. On June 2, 2006, we redeemed $150 million in principal amount of these notes which

had a coupon of 7.75% and a maturity in 2025. The stated redemption price for these notes was 103.186%. We

borrowed under the 2006 Facility and used existing unrestricted cash balances to fund the cash portions of these

transactions.

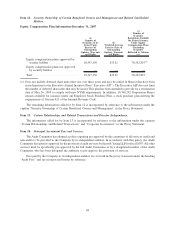

Other. Based upon the current level of operations, management believes that our cash flow from operations

and asset sales, together with our significant cash balances (approximately $366 million at December 31, 2007,

including $204 million of short-term and long-term restricted cash), available borrowings under the Revolving

Credit Facility (approximately $1.330 billion at December 31, 2007), available borrowing capacity from inter-

national revolving lines of credit (approximately $37 million at December 31, 2007), and capacity for additional

borrowings will be adequate to meet anticipated requirements for scheduled maturities, dividends, working capital,

capital expenditures, marketing and advertising program expenditures, other discretionary investments, interest and

scheduled principal payments and share repurchases for the foreseeable future. However, there can be no assurance

that we will be able to refinance our indebtedness as it becomes due and, if refinanced, on favorable terms. In

addition, there can be no assurance that our continuing business will generate cash flow at or above historical levels,

38