Starwood 2007 Annual Report Download - page 143

Download and view the complete annual report

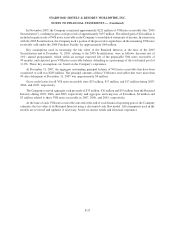

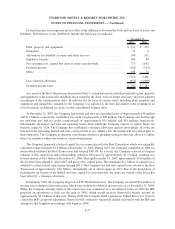

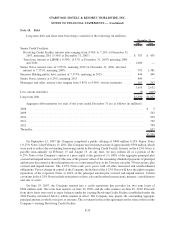

Please find page 143 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In November 2005, the Company securitized approximately $221 million of VOI notes receivable (the “2005

Securitization”), resulting in gross cash proceeds of approximately $197 million. The related gain of $24 million is

included in gain on sale of VOI notes receivable in the Company’s consolidated statements of income. In connection

with the 2005 Securitization, the Company used a portion of the proceeds to repurchase all the remaining VOI notes

receivable sold under the 2004 Purchase Facility for approximately $64 million.

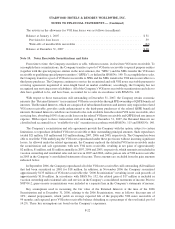

Key assumptions used in measuring the fair value of the Retained Interests at the time of the 2005

Securitization and at December 31, 2005, relating to the 2005 Securitization, were as follows: discount rate of

10%; annual prepayments, which yields an average expected life of the prepayable VOI notes receivable of

99 months; and expected gross VOI notes receivable balance defaulting as a percentage of the total initial pool of

11.0%. These key assumptions are based on the Company’s experience.

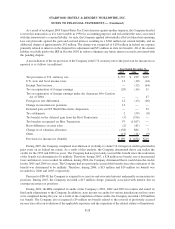

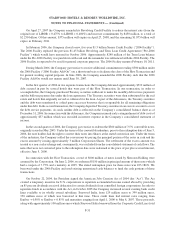

At December 31, 2007, the aggregate outstanding principal balance of VOI notes receivable that have been

securitized or sold was $285 million. The principal amounts of those VOI notes receivables that were more than

90 days delinquent at December 31, 2007 was approximately $4 million.

Gross credit losses for all VOI notes receivable were $23 million, $17 million, and $17 million during 2007,

2006, and 2005, respectively.

The Company received aggregate cash proceeds of $33 million, $36 million and $35 million from the Retained

Interests during 2007, 2006, and 2005, respectively, and aggregate servicing fees of $4 million, $4 million and

$3 million related to these VOI notes receivable in 2007, 2006, and 2005, respectively.

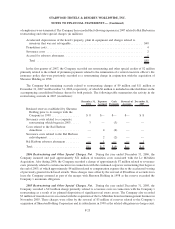

At the time of each VOI notes receivable sale and at the end of each financial reporting period, the Company

estimates the fair value of its Retained Interests using a discounted cash flow model. All assumptions used in the

models are reviewed and updated, if necessary, based on current trends and historical experience.

F-23

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)