Starwood 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

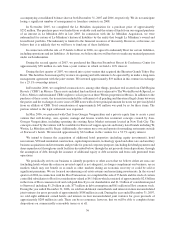

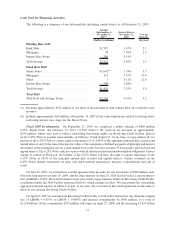

Cash Used for Financing Activities

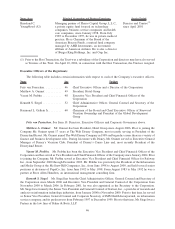

The following is a summary of our debt portfolio (including capital leases) as of December 31, 2007:

Amount

Outstanding at

December 31,

2007

(a)

Interest Rate at

December 31,

2007

Average

Maturity

(In years)(Dollars in millions)

Floating Rate Debt

Bank Debt ................................ $1,787 5.47% 2.5

Mortgages ................................ 38 7.30% 2.0

Interest Rate Swaps ......................... 300 9.14%

Total/Average ............................. $2,125 6.02% 2.5

Fixed Rate Debt

Senior Notes .............................. $1,641

(b)

7.34% 5.5

Mortgages ................................ 127 7.55% 10.4

Other .................................... 2 9.11% 22.6

Interest Rate Swaps ......................... (300) 7.88%

Total/Average ............................. $1,470 7.25% 5.9

Total Debt

Total Debt and Average Terms ................. $3,595 6.52% 4.2

(a) Excludes approximately $572 million of our share of unconsolidated joint venture debt, all of which is non-

recourse.

(b) Includes approximately $(6) million at December 31, 2007 of fair value adjustments related to existing fixed-

to-floating interest rate swaps for the Senior Notes.

Fiscal 2007 Developments. On September 13, 2007, we completed a public offering of $400 million

6.25% Senior Notes due February 15, 2013 (“6.25% Notes”). We received net proceeds of approximately

$396 million, which were used to reduce outstanding borrowings under our Revolving Credit Facility. Interest

on the 6.25% Notes is payable semi-annually on February 15 and August 15. At any time, we may redeem all or a

portion of the 6.25% Notes at a price equal to the greater of (1) 100% of the aggregate principal plus accrued and

unpaid interest and (2) the sum of the present values of the remaining scheduled payments of principal and interest

discounted at the redemption rate on a semi-annual basis at the Treasury rate plus 35 basis points, plus accrued and

unpaid interest. The 6.25% Notes rank parri passu with all other unsecured and unsubordinated obligations. Upon a

change in control of Starwood, the holders of the 6.25% Notes will have the right to require repurchase of the

6.25% Notes at 101% of the principal amount plus accrued and unpaid interest. Certain covenants in the

6.25% Notes include restrictions on liens, sale and leaseback transactions, mergers, consolidations and sale of

assets.

On June 29, 2007, we entered into a credit agreement that provides for two term loans of $500 million each.

One term loan matures on June 29, 2009, and the other matures on June 29, 2010. Each loan has a current interest

rate of LIBOR + 0.50%. Proceeds from these loans were used to repay balances under our Revolving Credit Facility

(established under the 2006 Facility referenced below), which remains in effect. We may prepay the outstanding

aggregate principal amount, in whole or in part, at any time. The covenants in this credit agreement are the same as

those in our existing Revolving Credit Facility.

On April 27, 2007 we amended our Revolving Credit Facility to both reduce the interest rate (from the original

rate of LIBOR + 0.475% to LIBOR + 0.400%) and increase commitments by $450 million, to a total of

$2.250 billion. Of this commitment, $375 million will expire on April 27, 2008, and the remaining $1.875 billion

37